if the center does not hold

DISRUPTION emerges from particulars of time and space. The character of disruption reflects innate complexity and unpredictable convergence of multiple variables.

As Depression-era customers pulled products at Piggly Wiggly, the opening on the shelf signaled the clerk to restock. The opening in the stock-room signaled the need to re-order. Demand signaled supply. Toyota adapted the concept to build cars. In each case, movement in space determines the moment in time that re-supply is signaled. In each case, space is organized to reduce time expended in responding to demand.

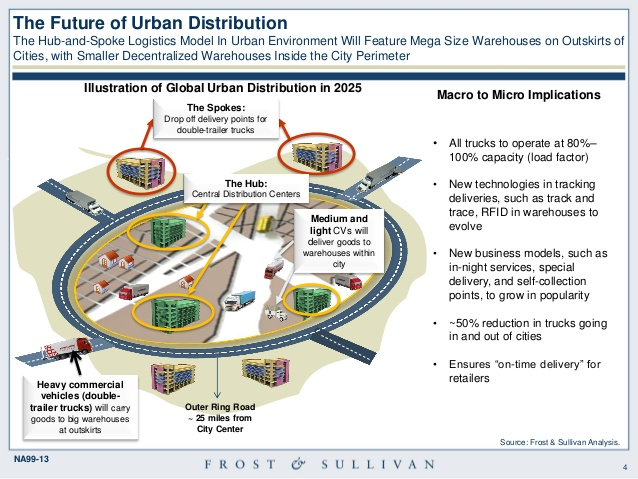

Hub-and-spoke supply networks adapt Just-in-Time processes from the shop and factory floor to whole regions. The bar-code scanned at the check-out (or a sensor on the store shelf) sends signals upstream toward sources. Supply is pulled toward demand with as few “touches” as possible between source of supply and source of demand.

Networks are expressions of connectedness and compactness. Supply and demand networks consist of points/vertices/nodes that are connected by paths/edges/links between which signals and supplies are sent. The more compact – structurally and linguistically similar – the nodes, the smoother the transmission of signals and supplies through the network. Bar-codes and other smart labels are a wonderfully adept universal language of contemporary commerce.

In the process of increasing both connectedness and compactness, hub-and-spoke networks tend toward becoming scale-free networks. A frequent advantage of scale-free networks is the potential speed with which new information (bits or bytes) can be accurately shared across the network. The fewer (and shorter) hops between supply nodes and demand nodes, the clearer the signal.

But strength is often the public face of hidden weakness. The same innate efficiencies that spread good can also spread bad.

Complex systems are connected, emergent, self-organized networks. The network model is rather flexible – nodes represent anything of interest and links represent any form of coupling or connectivity… Complex systems evolve—they change over time. In most cases, one or more properties of a complex system emerge out of randomness or disorder as the system responds to transformative forces. Efficiency and optimal restructuring is perhaps the most common form of transformative force…

In many cases, self-organization increases system risk by reducing resiliency as SOC [Self-Organized Criticality] transforms a system from a non-critical to a critical state. For economic and NIMBY reasons, network systems form hubs, betweeners, and critical nodes and links…

Why? Random systems lack organizational structure—the parts of the system are linked together haphazardly. Organized systems exhibit less disorder, meaning there is a distinct pattern in the way the parts are linked together. For example, a scale-free network containing a highly linked hub and many sparsely linked nodes is more organized than a random network. The U.S. telecommunications system has structure because of its telecom hotel hubs. The electric power grid has a few nodes with high betweeness, hence more structure than a random grid. When a highly organized system reaches its critical point, insignificant incidents become significant because they can collapse the entire system…

As self-organization increases, typically in the form of larger hubs or nodes with high betweeness properties, the complex system also become more vulnerable to targeted attacks and normal accidents. The extreme case of self-organization is SOC—a state in which small changes are likely to create large effects.

The grocery market in the United States is huge, hyper-competitive, and dynamic. Before 1988 Walmart did not stock groceries. Since 1988 Walmart has become the single largest source of groceries in the United States. According to Progressive Grocer the company currently accounts for over 4000 retail grocery outlets and roughly one-quarter of all US grocery purchases. Walmart has arguably claimed this role by applying the supply chain expertise it developed with non-groceries to an industry that had not adapted to the potential of pull instead of push.

While many long-time grocery leaders faltered and failed as Walmart transformed their commercial ecology, Kroger has survived and even thrived. It remains the largest US “traditional” grocery chain and it has added non-traditional products such as pharmacy, dry-cleaning, cafes, wine-bars, and fuel. JP Morgan-Chase predicts that by 2017 Kroger will surpass Whole Foods as the largest retailer of natural and organic foods. Progressive Grocer reports that in 2014 Kroger’s 2600-plus store network generated $108 billion in grocery sales. This is about $180 billion less than Walmart, but as of June 2015 Kroger had achieved 46 consecutive quarters of growing same-store sales.

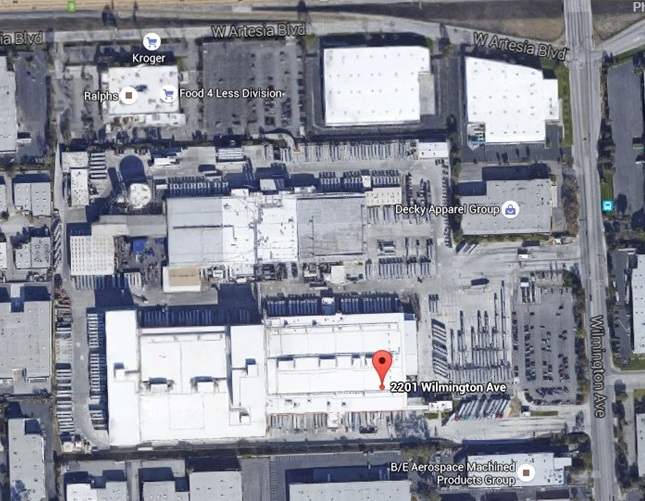

In 1998 Kroger became the owner of Ralphs and Food4Less, two prominent Southern California grocery chains. The company has continued to lead with these local identities. According to The Shelby Report, in May 2015 Kroger operated 368 stores – compared to 130 Walmart SuperCenters – and served roughly 18.5 percent of this $43.88 billion grocery market extending from Santa Barbara to Las Vegas to San Diego. Walmart is the fourth largest retailer in this region with about 10.6 percent marketshare. In 2007 Ralphs opened the first new full-service grocery store in downtown LA built since the 1960s. It is now the highest grossing store in the division. Ralphs partners with Instacart for mobile shopping and delivery. Customers can shop Ralphs online and are promised delivery in two hours for $3.99 or in one hour for four dollars more. Kroger has matched pull with pull, and is raising the bet with differentiated merchandising.

This enormous Southern California capacity – generating over $8 billion in 2014 sales – is focused on three distribution centers, two creameries, one bakery, and one meat plant. There are other sources of capacity, other places from which supply is pulled. But the network – as a network – depends on these few dense nodes.

One of the top five grocery operations in Southern California has its key distribution center less than ten miles from the San Andreas Fault. None of Kroger’s capacity is quite so close, but all of its key nodes are located in areas liable to intense earthquake effects. It’s hard to find a place between the ocean and the mountains that is not.

What happens to the grocery network on which millions depend as the efficiency of hub-and-spoke encounters the energy of a magnitude 7.0 earthquake or worse?

On March 11, 2011 a magnitude 9.0 undersea earthquake spawned a tsunami, pulverizing the Northeast coast of Japan and doing damage far inland. The ocean-facing Fukushima Nuclear Power Station was especially hard-hit. More than 15,000 died. Over 200,000 were left homeless. In the immediate aftermath of the event 4.4 million survivors were without electric power and over 1.5 million lost access to public water systems. A winter blizzard shortly followed. The large impact zone – similar to the distance between Los Angeles to San Francisco – is mostly non-urban, but encompassed roughly nine million persons.

The usual suppliers of food to the region were entirely side-lined for several days. Initially, several roads and bridges required repair. Some delay in regular supply chain operations also resulted from disruptions in fuel supply. The earthquake-related loss of a key refining node reduced Japanese national fuel capacity by roughly twenty-five percent. The mantra was often heard (in Japanese): “No Roads, No Gasoline, No Delivery.”

But even after roads were reopened and fuel was secured, the government excluded private parties from the impact zone. A military and police perimeter was established, inside of which the government attempted to create entirely new supply networks.

Outside the immediate impact zone – especially in Tokyo – the food supply chain was hit hard by hoarding. An analysis of retail pull-signals and inventory records conducted in the two years after the event found, “Although sufficient supplies of food, fuel, and emergency goods to meet demand in normal time were available, store shelves were left empty due to panic buying and hoarding of certain foods and other basic supplies in the wake of the earthquake. Empty shelves, in turn, gave rise to a vicious cycle of consumers scrambling to stockpile such goods.” Even while millions with real need for food could not send their pull-signals, those who had no new need amplified their signaling. The supply network responded, but the bull-whip cut deep.

Yet even with the surging demand of real-need and feared-need, supply capacity mostly met or exceeded demand. The source network persisted. A post-event analysis found that only yogurt and fermented soybeans (natto), among 214 products examined, experienced sustained shortages.

But the distribution challenge was enormous. Capacity proved sufficient. Deploying actual capability was very complicated. Dealing with hoarding was tough. Responding to the active suppression of the supply network was even more difficult.

According to the Foreign Agricultural Service at the United States embassy in Tokyo:

- As of March 15: “Major supermarkets such as AEON and Ito-Yokado cannot deliver to their stores in the emergency area at this time. They are sending noodles, water [to the government] for relief supplies and trying to keep up with stocks of water, cup noodles and batteries at their stores in the affected area, but are having difficulty. Kokubu, a major food wholesaler, says that it’s hard to tell at this moment when infrastructure will recover. At present, the guesstimate is at least one week from today (March 15) to restart distribution of foods. The wholesaler’s 25 storage facilities in the effective region, Tohoku Region, are not operative due to power black-outs… hospitals are not receiving enough food to feed their patient populations.”

- As of March 16: “Seven-Eleven Japan, the biggest convenience store (13,000 outlets), improves its supply ability better day by day. 7-11 Japan is able to shift its distribution system and is able to adapt the Kanto logistic network to serve the Tohoku region, and then use other plants west of Tokyo to serve Tokyo. As of March 14, both Lawson and 7-11 Japan resumed business in more than a half of shop operations in Tohoku region. Lawson resumed operation of 450 outlets out of a total of 810 in Tohoku region. 7-11 also resumed sales at a 450 outlets out of a total of 920 in the region… Major food wholesalers, Kokubu, Ryoshoku and Nippon Access, have received double the orders from retailers. Wholesalers are maintaining ordinary operations at their warehouses in the Tokyo region. According to the Asahi Shinbum on March 15, sales results of the major retailers jumped dramatically in last two days. Purchases of bottled water vaulted to 10 times, Natto 3 times bigger, Tofu 1.7 times more, milk 1.5 bigger. Sales of chicken rose 9 times more than the sales of same period of last year, canned food 3 times bigger, rice 1.6 times more… Rice, toilet paper and other daily necessities are growing scarce at stores, not only in the quake hit Tohoku region, but also in the Tokyo metropolitan area. But manufacturers across a wide array of industries say they have sufficient capacity to meet the demand. The temporary shortage at retailers is likely caused by such factors as turmoil in logistics networks and anxious consumers stocking up on various goods. Retailers and manufacturers are working to fill store shelves depleted in quake-hit regions and the Tokyo area by using distribution networks and production bases in unscathed in Western parts of the nation.”

- As of March 17: “Out of 170 outlets of York Benimaru, one of the largest retail grocery chains in Tohoku area, 77 outlets are closed.”

- As of March 18: “Consumer hoarding behavior, rolling blackouts, and the lack of fuel continue to wreak havoc on Japan’s food supply system. In response to nation-wide retail level food shortages the Japanese government has made strong overtures to the Japanese people to be judicious in their food purchases… Local retail stores in Tokyo, away from the affected areas, are constantly busy restocking shelves while worried consumers continue to purchase items just in case another disaster occurs. The items that stores can’t keep pace of are bottled water, rice, eggs, bread and bread products. Milk purchases are limited to one carton per customer. As already reported, deliveries are slow because truckers can’t get sufficient fuel due to high levels of consumer gas purchases and the compromised fuel transportation infrastructure. With regard to gas supplies, prices are going up quickly throughout the nation. Regular gasoline has gone up from about 140 yen ($1.75) per liter to 158 yen ($1.97) per liter, and most stations are limiting customers to 20 liters or 3000 yen per visit.”

- As of March 22: “Some semblance of normalcy is returning in the Tokyo area. Supermarkets that were having difficulties restocking their shelves are now finding it easier, but shelves are still lacking the usual colorful packages, lined neatly in a row. This differs by region and town, and even sometimes by store. Rice was almost gone from one store in the Akasaka area, while another store, about a block away had ample stocks. There seems to be a lull at different locations and at different times. This will most likely continue because trucks still cannot get sufficient gas to make deliveries.”

- As of March 24: “NTV reported at 10:13 that there continues to be a serious shortage of food in Ishinomaki, Miyagi, where nearly 80,000 people are dependent on food distribution. The network said that only 110,000 loaves of bread and 60,000 “onigiri” rice balls were delivered to shelters there on Thursday. According to the network, one shelter in the city could only serve one loaf of bread and one onigiri per person for Thursday night and Friday morning.” On March 24 transportation restrictions into the Tohoku region were lifted. Despite continuing fuel shortages, this allowed private trucking to freely operate across most of the Tohoku region.

- As of March 28: “On Friday we reported that AEON stores have reopened stores in the affected area. Today, Reuters reported that Wal-Mart will re-open 12 of its Seiyu stores in Japan which were affected by the earthquake, and is hoping to open the remaining 12 impacted stores as soon as possible. Wal-Mart has 371 stores and 43 deli outlets in Japan, of which 24 were affected by the March 11 earthquake and tsunami.” Supply capacity and capability were restored to most areas once restrictions on trucking were lifted.

- As of March 31: “A growing number of Japanese food makers and retailers are turning to emergency imports to cope with shortages caused by the recent disaster. Aeon Co. has announced plans to import large amounts of food and sundries, purchasing 1,500 tons of onions and 500 tons of carrots from Australia, among other items. Several firms announced to import bottled water from South Korea, Canada, and other countries… Dairy products are still in short supply in eastern Japan as scarce packaging materials such as paper cartons hinder production. Yogurt output, for example, cannot keep up with demand due to rolling blackouts, and supplying products from western Japan is not practical because milk is highly perishable.

In March 2011 the grocery supply chain in Japan demonstrated considerable resilience. It did not collapse under the pressure of extraordinary and extended hoarding in one of the densest urban areas on the planet. Once roads were passable and the perimeter was lifted the network responded creatively and even courageously to the needs of survivors across Tohoku.

But Tohoku is not Tokyo. As the FAS reports indicate, Tohoku benefited from its proximity to the powerful food networks serving Tokyo, all of which had escaped significant physical damage. The hubs continued to hum. The comparatively modest needs of non-urban Tohoku could be absorbed by the gigantic capacity of the Kanto network (Greater Tokyo, population over 42 million) with help from the nearly as robust Kansai network (Greater Osaka, population over 22 million). If the tsunami had rushed into Tokyo Bay?

If an earthquake and tsunami devastated San Barbara, it would benefit by its proximity to Los Angeles. But what if the hardest hit unfolds between the Salton Sea and Hungry Valley? How many hubs have to fall before the Southern California network itself is flat on its back?

Bak’s Sandpile by Ted G. Lewis

The Run on Daily Foods and Goods by M. Horia and K. Iwamoto

The Tohoku disasters: Chief lessons concerning the post disaster humanitarian logistics response and policy implications byJosé Holguín-Veras, Eiichi Taniguchi, Miguel Jaller, Felipe Aros-Vera, Frederico Ferreira, Russell G. Thompson

The photograph below is by Jean Chung, taken near Kesennuma, Japan on March 22, 2011.

If the Center does not Hold was written by Philip J. Palin, September 2015