just-in-time

DISRUPTION emerges from particulars of time and space. The character of disruption reflects innate complexity and unpredictable convergence of multiple variables.

Just-in-Time is a means of measurement. It measures current or very recent reality. The measurements can inform a wide range of choices.

Some see Just-in-Time as righteous: lean, learning, self-correcting, flexible. Others see pride that goeth before destruction: tenuous, anemic, over-engineered, and vulnerable to collapse at the worst moment.

Digital expression of demand has revolutionized the time (and space) of the music industry. For music Just-in-Time has become immediate (and ubiquitous). Amazon, Zara, and many others are working to do the same for a wide array of products: books to high-fashion to food.

Just-in-Time emerged in the early post-World War II years from studies by Japan’s Toyota Corporation to improve production efficiency. During a 1956 trip to the United States, a Toyota production engineer, Taiichi Ohno, was especially impressed by his encounter with the American self-service grocer Piggly Wiggly.

Unlike most other grocers – and every automobile manufacturer — of the time, Piggly Wiggly placed essentially all of its inventory directly on the shop floor, allowing consumers to pull whatever they needed. Restocking reflected what had been sold, no more and no less. Ohno perceived that as these pull signals travel toward sources of supply they can facilitate a tight focus on what is being consumed: what is really needed. This can – if recognized – be used to eliminate waste and costs related to Just-in-Case hoarding of resources and over-production.

Organizing production to reflect consumer “pull”, rather than the “push” of historical patterns or guesses about the future was a revolutionary shift. Especially when the signals are treated as measures and the measures are consistently applied to manage production (and distribution and more), a very different relationship emerges between sources of demand and sources of supply.

In Ohno’s judgment, Just-in-Time shifts an organization’s mindset from a worried (and wasteful) strategy of risk-avoidance to a confident, empirical strategy of creating abundance. He wrote, “All we are doing is looking at the time line, from the moment the customer gives us an order to the point when we collect the cash. And we are reducing the time line by reducing the non-value adding wastes.”

If the Toyota team had visited the same Piggly Wiggly just a few years later the lean supply chain that inspired them would have been a bit fatter. If they had visited almost any supermarket other than a Piggly Wiggly they would have seen considerable fat. By the 1960s US supermarkets were competing on product diversity, proliferation of services, and volume. The unprecedented affluence of American society in the Sixties did not encourage much attention to lean opportunities. The focus was on more, not less.

As a result, Just-in-Time did not claim a leading role in US supermarkets or any other US sector. Instead the self-service, lean supply chain “supermarket” format was translated to the Japanese factory floor. Over the 1960s and Seventies this strategy incrementally, but radically transformed Japanese automobile manufacturing. By the early 1980s Just-in-Time and related practices created a comparative advantage for Japanese auto companies that seriously threatened US auto companies and the competitive capacity of other long-time US manufacturing leaders. In 1982 the average Japanese automobile worker was more than twice as productive as his US peer and to many consumers the quality difference seemed even greater.

This threat re-shored Just-in-Time to the United States. In the subsequent three-plus decades Just-in-Time and other components of continuous-improvement have become common denominators of global competition. Economic value is increasingly generated by eliminating deviation from demand signals, reducing variation in quality, cutting costs, and compressing time from emergence of demand to fulfillment of demand. As Ohno observed, it is more and more about “reducing the time-line.”

For many tech-oriented products, the time-line practically re-starts every two years or so as product capacity doubles and costs decline (consistent with Moore’s Law, if it persists). In 2009, nearly 70 percent of the mobile phone market was dominated by Nokia. Over the next three years this highly capable market leader lost 90 percent of its global share to Apple and Android. Who’s the next giant killer?

In 2007 Greek Yogurt made up no more than one percent of national consumption of yogurt. By 2013 over forty percent of sales were for Greek Yogurt. (Total US yogurt sales are over $7.6 billion per year.) Several analysts credit a creative brand strategy delivered via social media. Chobani, the Greek yogurt pioneer, was only an ambitious start-up in 2007. By 2012 it had 600,000 Facebook Friends plus equally impressive numbers on most online channels. Who or what is the next giant?

Since 2009 rapid global adoption of smartphones with their real-time, all-the-time capacity for comparison, socialization, communication, and financial transactions has had an enormous impact on whole categories of non-tech products. Mobile purchasing, especially among the rising generation, is transforming behavior patterns that have characterized commerce since the rise of mass consumption. Brand loyalty seems to have meaning only as long as the brand is also the source of innovation that satiates or stimulates consumer cravings. New demand patterns are creating new supply requirements.

Mobile online retail payment volume has more than tripled since 2013 and is expected to triple again over the next four years. According to Javelin research, mobile online retail commerce will hit $94 billion by the close of 2015. And for the first time, just over half of all online retail purchases involve bits instead of bytes.

Mobile purchasing is pulling entire supply chains to behave with the accessibility, speed, and efficiency that Piggly Wiggly inspired at Toyota, including US grocery stores. In 2013 roughly $6.5 billion was spent online for groceries. This is only one percent of the US grocery market. But several sources are predicting a compound annual growth rate for online purchases seven times that of off-line grocery sales.

Meanwhile the fastest-growing offline grocers are much leaner in terms of product variety and merchandising costs. Trader Joe’s, one of the twenty largest US grocery chains, is essentially a twenty-first century update of the original Piggy Wiggly: A pure pull-play for high demand products offered at attractive price points delivered by one of the most efficient supply chains on the planet. Aldi, a close cousin, plans to expand its US store network from 1400 to 2000 locations by 2018. Organized to maximize supply chain efficiency, Aldi has recently been growing at 15 to 20 percent per year in an otherwise flat – arguably over-saturated – US grocery market. Several traditional supermarkets are experimenting with smaller format stores and much leaner supply chains.

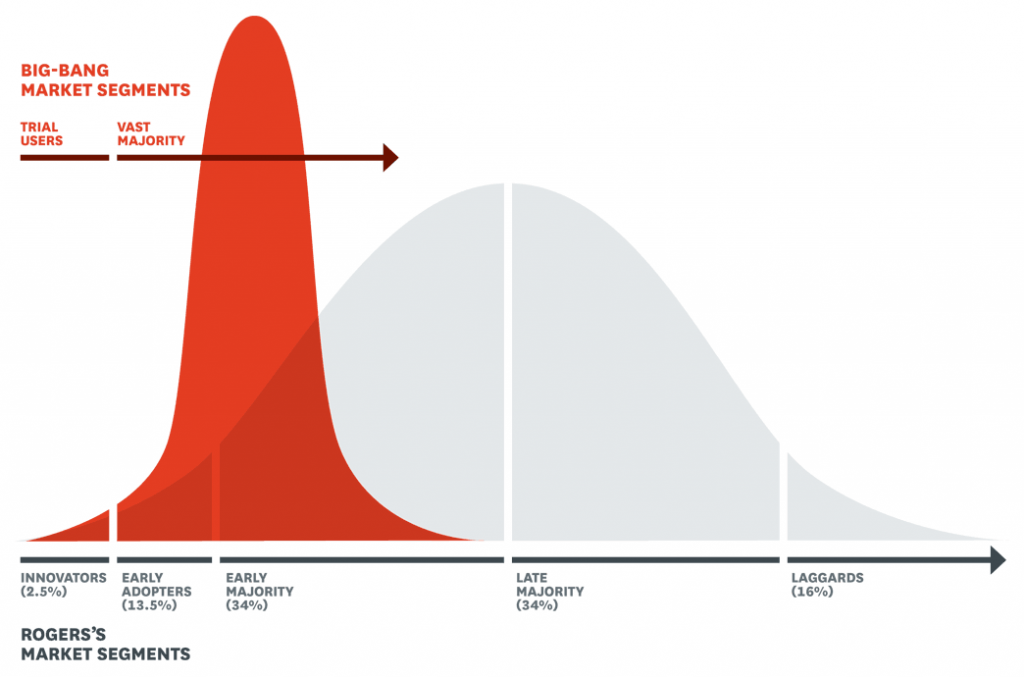

Consumers are now capable of communicating preferences with a speed and clarity never before possible. The pull signals we send are multiplying; as is our expectation of the speed by which demand will be supplied. Innovative products often emerge quickly (or not at all), surge sharply, and fade fast.

Sridhar Ramaswamy, a Senior Vice President with Google, writes:

Consumer behavior has changed forever. Today’s battle for hearts, minds, and dollars is won (or lost) in micro-moments—intent-driven moments of decision-making and preference-shaping that occur throughout the entire consumer journey… —the I want-to-know moments, I want-to-go moments, I want-to-do moments, and I want-to-buy moments—that really matter. We call these “micro-moments,” and they’re game changers for both consumers and brands.

It took Taiichi Ohno and his colleagues a bit more than three years to triple Toyota’s productivity levels (per worker) to equal the productivity of Ford Motor Company. Over the next two decades Ford’s productivity (and other US manufacturers) remained essentially the same, while Toyota’s continued to improve. Eventually four Toyota vehicles were produced by the same number of Ford workers that produced one vehicle. It was a Just-in-Time revolution measured in years.

Today Just-in-Time may be measured in moments.

Piggly Wiggly Patent, October 9, 1917

Manufacturing Innovation: Lessons from the Japanese Auto Industry, Sloan Review (MIT), Fall 1988.

Big Bang Disruption: Strategy in the Age of Devastating Innovation, Larry Downes and Paul Nunes, 2014

Go, make money… There are many events in the womb of time which will be delivered. Traverse, go, provide thy money.

Iago to Roderigo, Act I, Scene 3, Othello by William Shakespeare

Just-in-Time was written by Philip J. Palin, September 2015