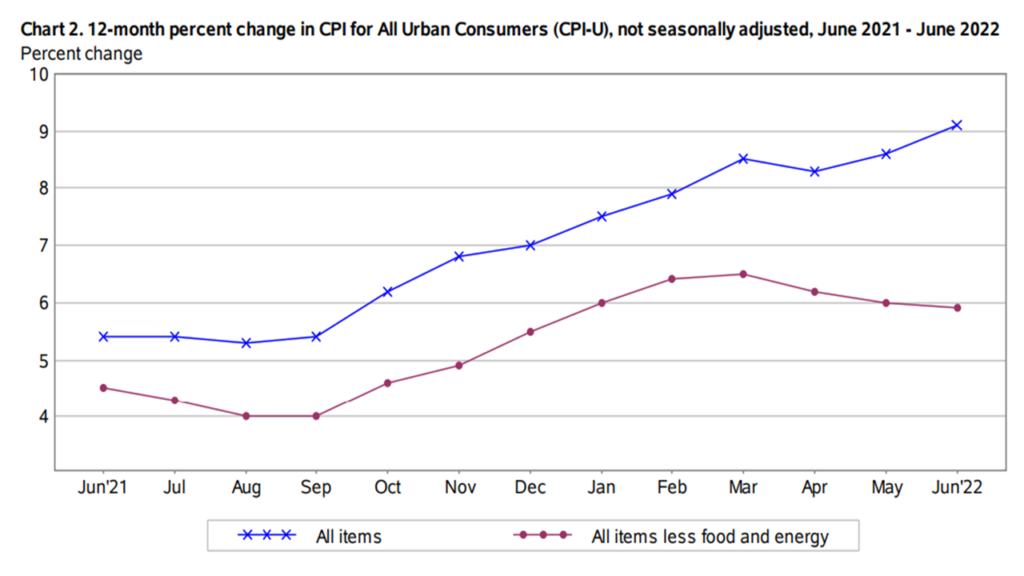

Above are the headline numbers for June CPI: Overall up 9.1 percent, core (less energy and food) up 5.9 percent over the last twelve months. This is a couple of decimal points higher than expected… and expectations were plenty high. Still, given prices at the pump for most of June, not a huge surprise. Rents are also rising fast. The slight, continuing decline in core inflation is more interesting to me.

Food price hikes pale next to fuel, but so did the faces of many June grocery shoppers. Most US consumers under age-60 have never experienced this size and rate of food price increases. We also know that, partly as a result of prices, inflation-adjusted grocery expenditures have been falling all this year. I have predicted real food-at-home expenditures still have a ways to fall until intersecting with pre-pandemic trends. (More on food price trends.) Given June’s velocity of food price increases, I will be surprised if demand destruction has paused. This also tracks what I hear informally from retailers and distributors. While total revenues are still going up, actual volume of groceries shipped is declining. This dynamic has started to show up in a reduced incidence of stock-outs.

Reduced demand is reducing friction in food supply chains.

+++

Here’s this morning’s full statement on food from the Bureau of Labor Statistics:

The food index increased 1.0 percent in June following a 1.2-percent increase the prior month. The index for food at home also rose 1.0 percent in June, the sixth consecutive increase of at least 1.0 percent in that index. Five of the six major grocery store food group indexes rose in June. The index for other food at home rose 1.8 percent, with sharp increases in the indexes for butter and for sugar and sweets. The index for cereals and bakery products increased 2.1 percent in June, with the index for flour rising 5.3 percent. The dairy and related products index rose 1.7 percent over the month, following a 2.9-percent increase in May. The fruits and vegetables index increased 0.7 percent in June after rising 0.6 percent in May. The index for nonalcoholic beverages rose 0.8 percent over the month. The only major grocery group index to decline in June was the index for meats, poultry, fish, and eggs which fell 0.4 percent over the month as the indexes for beef and pork declined.

The food away from home index rose 0.9 percent in June after rising 0.7 percent in May. The index for full service meals rose 0.8 percent over the month. The index for limited service meals increased 0.7 percent in June, as it did in May.

The food at home index rose 12.2 percent over the last 12 months, the largest 12-month increase since the period ending April 1979. All six major grocery store food group indexes increased over the span, with five of the six rising more than 10 percent. The index for other food at home increased the most, rising 14.4 percent, with the index for butter and margarine increasing 26.3 percent. The remaining groups saw increases ranging from 8.1 percent (fruits and vegetables) to 13.8 percent (cereals and bakery products).

The index for food away from home rose 7.7 percent over the last year, the largest 12-month change since the period ending November 1981. The index for full service meals rose 8.9 percent over the last 12 months, and the index for limited service meals rose 7.4 percent over the last year.