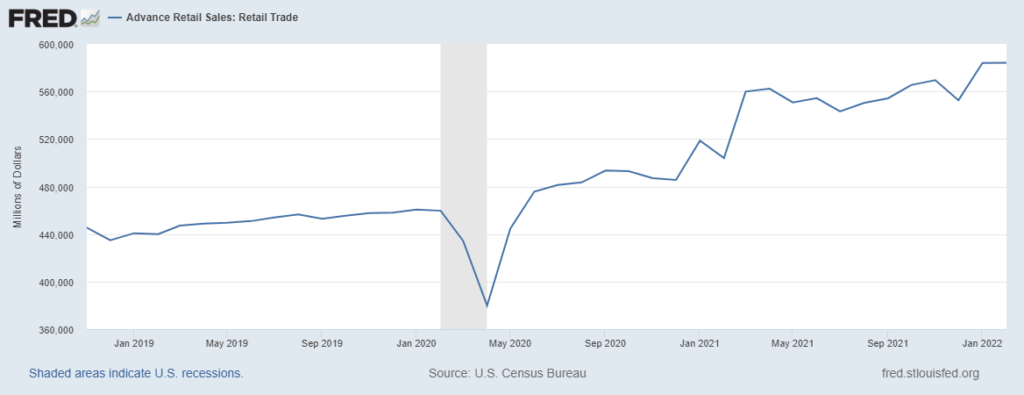

February retail sales were the highest on record, one-fifth above February 2020. See first chart below.

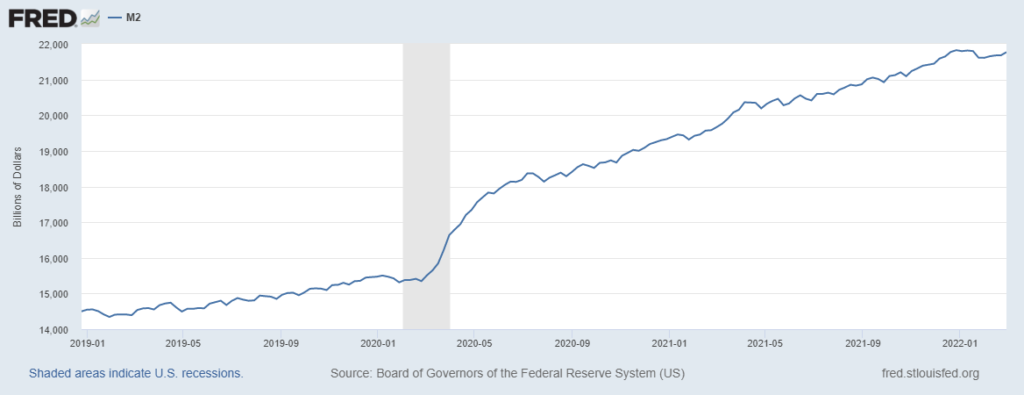

Despite — because of? — this robust spending, American consumers continue to have significant cash reserves. The M2 money supply in February is very close to late December’s record-setting high. The USA currently has about one-third more cash on hand than pre-pandemic. See second chart below.

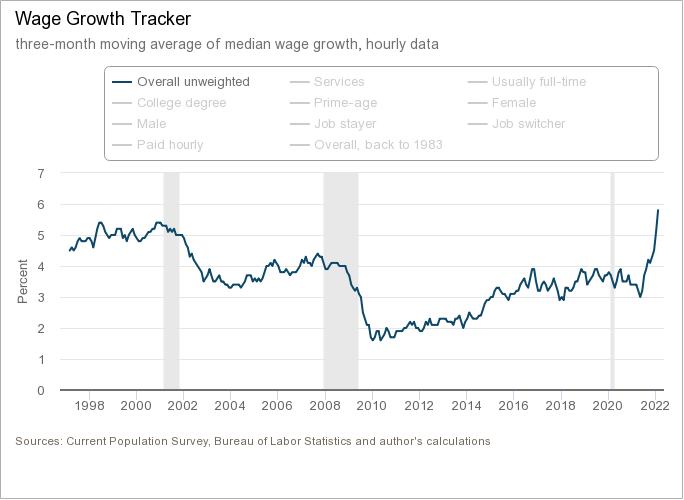

Mostly this is due to reduced-spending during the pandemic and “Economic Impact Payments“. The Personal Saving Rate was much higher than usual from March 2020 until September 2021. Wage growth has also been strong, especially since May 2021. See third chart below.

As a result — regardless of supply chain “shortages” and inflation — many Americans continue to pull very hard on supply. Inventories remain tight. Individual products and even entire categories can mysteriously ebb and as suddenly flow again.

This level of demand — and potential demand — is unusual (perhaps not seen since the late 1940s). Current demand is motivating maximum throughput of current production and distribution capacity. But the structure of this demand and prospects for its continuity are uncertain or, at least, product or category or sector specific. Investment in additional production and distribution capacity is strong, but uneven — depending on perceived longevity of current demand.

To resume reliable flows requires reclaiming an improved equilibrium of demand and supply. There is evidence that disequilibrium is not getting worse. There is not — yet — persuasive evidence of equilibrium emerging any time soon.