The USDA report attempts to focus on several systemic vulnerabilities related to supply networks for food. Six priorities are identified for sustained attention, mostly through federal policy, regulation, and government investment: 1) Concentration and Consolidation in Agri-Food Production, Manufacturing, and Distribution, 2) Labor Needs, 3) Ecological and Climate Risks to Crops, 4) Livestock and Poultry Disease Threats, 5)Transportation Bottlenecks, and 6) Trade Disruptions.

While labeled a vulnerability analysis, I perceive at least three of the six priorities are oriented to rather specific threats… and potential bad actors are implied in all six. This threat-oriented perspective is even more prominent as each priority is analyzed and recommendations are offered.

There is modest attention to demand. To the extent demand factors are included in the analysis they are addressed as market distortions caused by the purchasing power of a few domestic processors, distributors, and retailers or any impediment to international agricultural sales. I am surprised by lack of attention to SNAP, WIC and other USDA program beneficiaries as sources of demand. Consumer behavior — especially new trends in food consumption — are not addressed.

This is a very upstream angle on food flows. For example, following is a quote from pages 14-15 of the 47 page report. Midstream and downstream structures and behaviors are assessed principally in terms of accommodating current upstream characteristics. Given this angle, the assessments outlined are valid. A wider angle of engagement — especially of nodes, channels, and functions between upstream and downstream — would unveil additional opportunities for achieving resilience.

Consolidation and concentration related vulnerabilities threatening specialty crops supply chains include:

• Erosion of traditional wholesalers toward direct marketing contracts between growers and retail chains due to increased centralization of food procurement systems.

• Increasing concentration in food retailing, especially among the largest grocery retailers.

• Consolidated distribution infrastructure in freight rail and ocean shipping, all of which are required consistently and timely due to the perishable nature of specialty crops.

There are also non-competition related factors in the specialty crops sector, particularly significant due to crop perishability and reliance on local growing conditions, that pose additional risks especially when paired with these consolidation and concentration issues. These factors include:

• Access to a workforce, which is typically seasonal in nature and shifts geographically over time.

• Climate change and the increased frequency of extreme weather events such as frosts in Florida and the recent mega-drought in the western U.S. pose significant threats, which are exacerbated when market players are concentrated or consolidated geographically or within a subsector… [more examples are included]

• Market and trade shocks which may impose barriers on imports or reduce opportunities for exports, such as when countries impose trade restrictions in response to domestic food price inflation or enter into trade agreements that exclude the United States.

Every report like this has to choose its angle(s) (and exclude others). Within the aperture selected, I don’t disagree — and often enthusiastically agree — with the USDA report’s findings. The problems identified are real. Implementation of the report’s recommendations would mitigate several threats to the US food system.

This is not, however, an assessment of the US food system’s supply chain resilience.

The Executive Order that prompted this assessment includes, “The Secretary of Agriculture, in consultation with the heads of appropriate agencies, shall submit a report on supply chains for the production of agricultural commodities and food products.” [My italics.] This is what the report has done, this is the origin of the upstream angle. Given this point of origin and explicit target, it is possible to appreciate how much attention to midstream and downstream factors have been creatively included in the report.

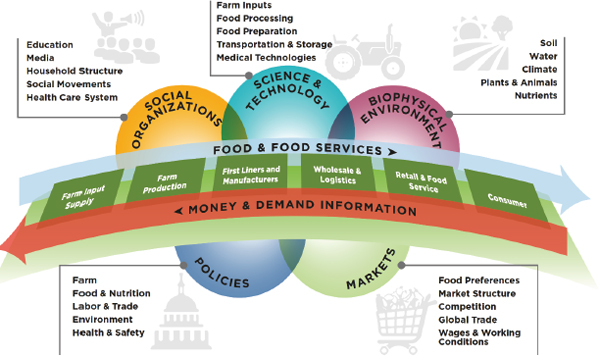

Below is a visualization of the demand and supply network for food developed as part of “A Framework for Assessing Effects of the Food System” (National Academies of Sciences, 2015). In many ways the USDA report is, intentionally, limited to that green box labeled “Farm Production.” More is needed.

Demand for food is in considerable turmoil. Climate change is imposing significant structural shifts on global demand (and supply) for food. Consumer needs and expectations outside the United States have important implications for US agricultural production, processing, pricing, and more. The pandemic has accelerated dramatic shifts in US demand for food and, at least temporarily, reversed some important patterns of US food consumption. Upstream, midstream, and downstream players are competing, collaborating, and creating to adapt to these changes in demand. These adaptations are usually pragmatic, even opportunistic. Some enhance resilience. Some diminish resilience. The Department of Agriculture was not asked to consider these factors in this report.

There are other factors that need to be considered and strategically triaged, if we want to enhance the resilience of the US food system.