Freight is where, when, and how push meets pull. Demand prompts supply, freight fulfills demand. Air cargo, maritime (riverine and ocean-going), train, truckload, LTL, refrigerated, van, flatbed, package delivery, and even more reflect diverse modes, intermodal possibilities, and diverse, responsive spot and contract markets. Freight is most of how volumes achieve velocity.

The many parts of the freight sector are highly interdependent, but most deliveries finally depend on some sort of truck and trucker on the road able to refuel (here and here).

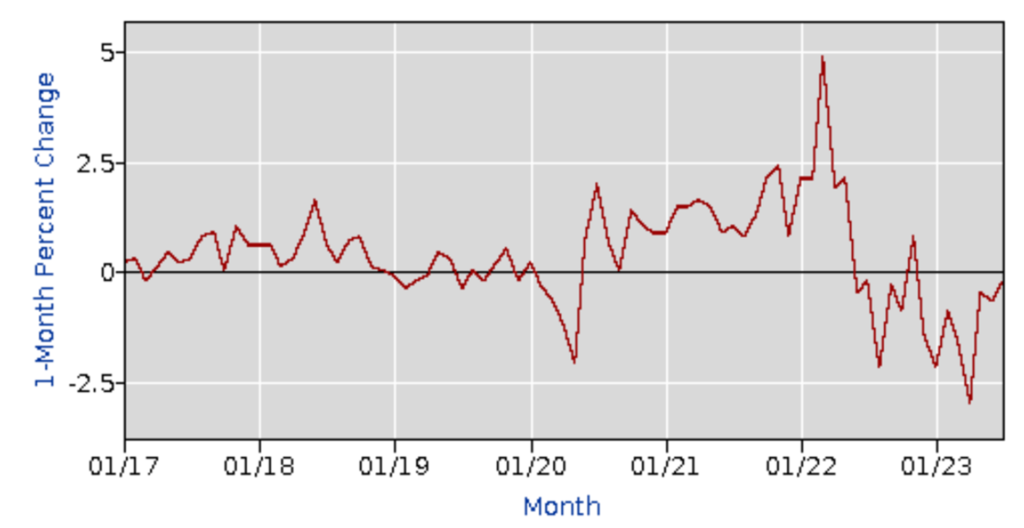

The chart below suggests the steep peaks, deep valleys, and recurring volatility of the US trucking market. The red line is basically volume (compared to a 1990 baseline). The blue line is the Producer Price Index (PPI) for the trucking sector, measuring price changes freight carriers command or suffer. When demand for stuff is strong and stresses capacity (e.g., first half of 2022), prices will trend higher. When freight demand falls, especially if capacity hangs on (e.g., since at least last summer), prices will be softer… in this case, compared to a 1992 base-line (more and more).

There are plenty of other freight indicators: FreightWaves SONAR, DAT Trendlines, Bank of America Truckload Demand Indicator, U.S. Bank Freight Payments Index, ATA Truck Tonnage Index — each offering different angles more or less current. Diesel prices are absolutely worth tracking. Most of these smoke signals now agree — some more, some less enthusiastically — with Brooke Sutherland at Bloomberg “The free-falling freight market may finally be finding a bottom. Shippers shouldn’t count on a return to the go-go days of Covid, but resilient US consumers offer a way out of the morass…”

Volumes are more or less fine, not great but no where near the deepest valleys of 2020 or even 2017. Price-drops may have stopped (at least slowed) while still above pre-pandemic levels, even after adjusting for inflation (see second chart below). The recent loss or downsizing of some trucking firms, such as Yellow, can be good news for those still hauling.

Freight movement is analogous to human blood pressure, not too high and not too low is best for the whole supply chain. I’m sure truckers hope our current pace and related pressure builds a bit, there is existing capacity to do more. But current flow volumes and velocity are inside healthy ranges.

One Month Percent Change: PPI Transportation Services-truck transportation of freight, not seasonally adjusted

Bureau of Labor Statistics, Data extracted on: August 17, 2023 (5:59:47 AM)