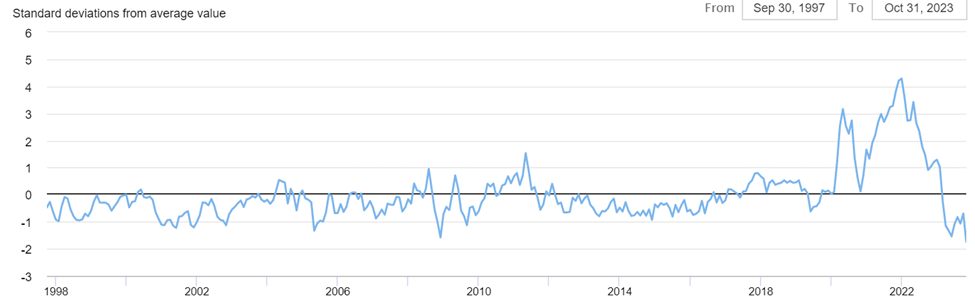

One prominent measure of global supply chain flow finds the least friction in a quarter-century. Please see the chart below. Average viscosity is represented by zero. In October the measure was 1.74 standard deviations below average.

According to the authors of the Global Supply Chain Pressure Index at the Federal Reserve Bank of New York:

The GSCPI integrates a number of commonly used metrics with the aim of providing a comprehensive summary of potential supply chain disruptions. Global transportation costs are measured by employing data from the Baltic Dry Index (BDI) and the Harpex index, as well as airfreight cost indices from the U.S. Bureau of Labor Statistics. The GSCPI also uses several supply chain-related components from Purchasing Managers’ Index (PMI) surveys, focusing on manufacturing firms across seven interconnected economies: China, the euro area, Japan, South Korea, Taiwan, the United Kingdom, and the United States.

Bloomberg explains, “The gauge has clocked nine straight months of negative readings. The cost of moving goods by rail, truck, sea and air has declined from record highs set during the pandemic.”

Good news for many is not good news for all. Maersk has announced significant layoffs. Looking at the October US freight market, Zach Strickland at FreightWaves observed: “After a year of loose conditions, transportation providers are running through cash reserves built up from the freight boom and starting to fall out of the market. Operating authorities for interstate carriers of property have fallen 6% since last July according to Carrier Details’ analysis of the FMCSA data. The capacity ceiling is falling and will eventually run into demand and lead to increasing service disruptions.” (More and more.)

From August 2020 to August 2022 the US freight market substantially increased capacity to fulfill demand shifts and increased demand overall. Since August 2022 demand has softened. For two years content was chasing very tight spaces. Now space is chasing content. Demand is still decent or better. Shipments have not fallen off the cliff. But we no longer need all the freight capacity that was needed one year ago.

Global Supply Chain Pressure Index (GSCPI)