The Midcontinent Independent System Operator (MISO) is the regional reliability organization for electric utilities serving more than 40 million people in the central United States. Yesterday MISO released a “Maximum Generation Emergency Alert effective from 08/24/2023 12:00 EST until 08/24/2023 22:00 EST…” [See several updates below]

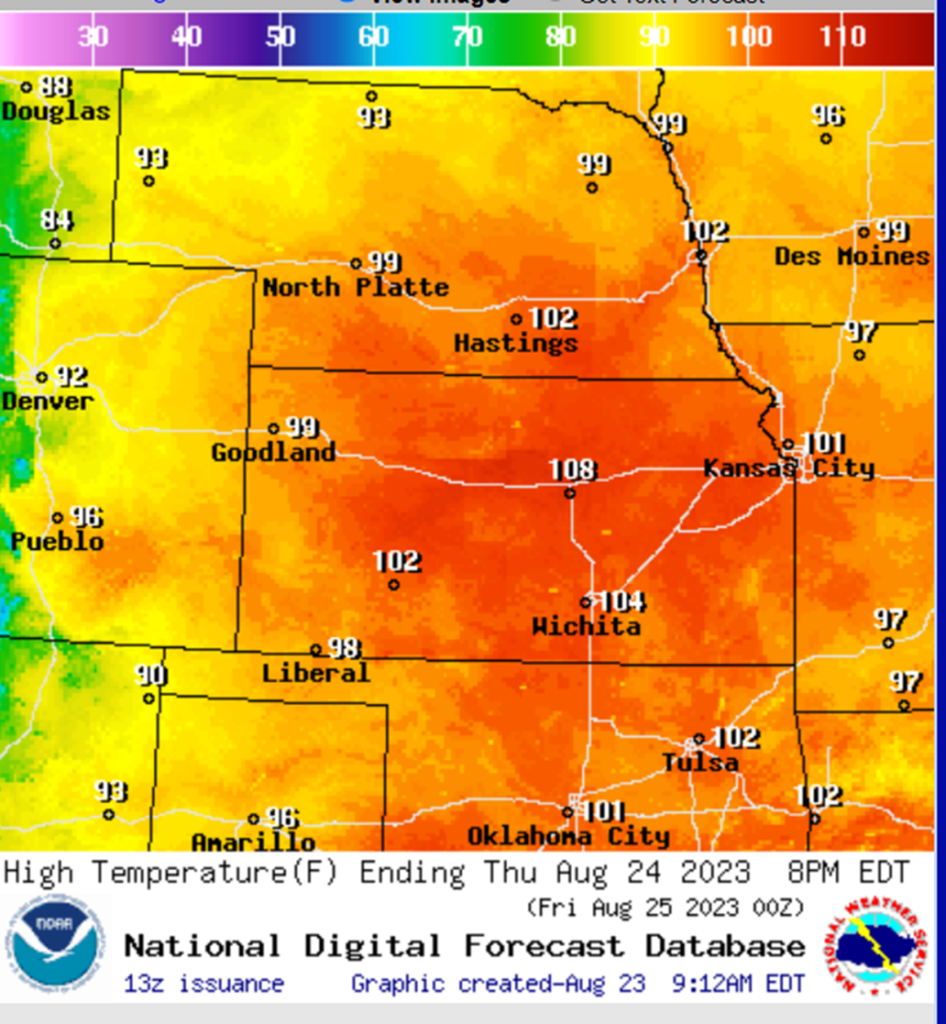

S&P Global reports, “Sweltering heat continues to push up power prices in the Central US, where the Southwest Power Pool set a peakload record of 56.18 GW Aug. 21 and the Midcontinent Independent System Operator was forecasting a record-smashing 130 GW of demand Aug. 24. In preparation for the soaring demand, MISO notified all local utilities in its footprint to prepare every available resource to serve the projected load, the grid operator said in a statement late Aug. 21. “We anticipate challenging operating conditions throughout the entire week, and we will need every available resource at some point,” Jessica Lucas, MISO executive director for system operations, said in the statement. (Below see SPG chart of MISO data.)

The emerging situation is of particular concern given the forward-looking assessment of MISO’s capacity in this year’s NERC Summer Reliability Assessment, “Demand forecasts and preliminary resource data indicate that MISO is at risk of operating reserve shortfalls during periods of high demand or low resource output. MISO’s resources are projected to be lower than in the summer of 2022 while net internal demand has also decreased. Firm transmission imports for this summer have significantly increased; this has resulted in a higher Anticipated Reserve Margin (ARM) of 23% (on an installed capacity basis) compared to 21% last summer…”

The prior paragraph is purposeful in highlighting ambivalence — both strengths and weaknesses. Bottom line: capacity is lower than last year and tomorrow’s demand is expected to spike. Our situation on Thursday night may mostly depend on some consumer restraint in the face of brutal temperatures and how the wind blows. The Summer Reliability Assessment for MISO also notes, “Performance of wind generators during periods of high electricity demand is a key factor in determining whether system operators need to employ operating mitigations, such as maximum-generation declarations and energy emergencies. MISO has over 30,300 MW of installed wind capacity; however, the historically-based on-peak capacity contribution is 5,488 MW.”

The MISO demand/supply dashboard can be accessed here.

+++

August 24 Update: The following alert was distributed 8:16 Central Time this morning: “MISO is escalating the Maximum Generation Alert to a Maximum Generation Emergency Event Step 2a effective from 12:00 until 22:00 EST today for the MISO Balancing Authority Area. The reason for the Event is because of Forced Generation Outages, Above Normal Temps, Higher than Forecasted Load.” According to Reuters, “MISO projected it would have 125,907 MW of supplies available with 120,656 MW from internal resources and 5,251 MW of imports. That would not be enough to meet the grid’s forecast peak of 127,692 MW, which would top the system’s all-time high of 127,100 MW in July 2011.” Reuters and others are also reporting that the Texas grid is facing similar shortfalls today (more).

Later: At 2:00 Central Time on Thursday some personal observations: MISO’s solar and fossil-fuel generators are achieving forecasts. MISO’s wind generation has been less than forecast most of today. For example, the day-ahead forecast for 1:00 Central anticipated 4294MW being generated, instead 3134.33MW was being generated. At 2:00 the deficit had grown to just over 1500MW. Imports seem to be arriving as anticipated. This is, however, a wide-area challenge encompassing at least the Southwest Power Pool, ERCOT, and MISO. Will exports from other regions be sufficient to fill gaps across such a wide area? Behavior of the national grid can be monitored on the EIA website.

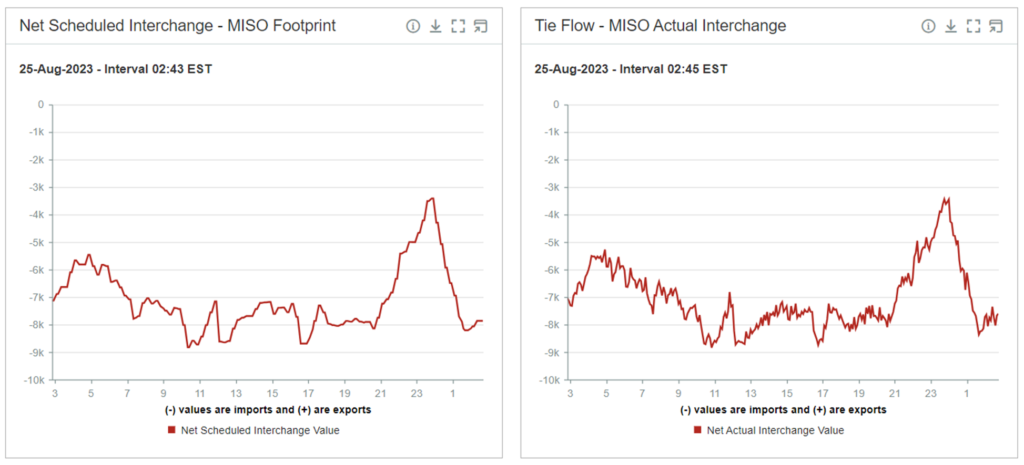

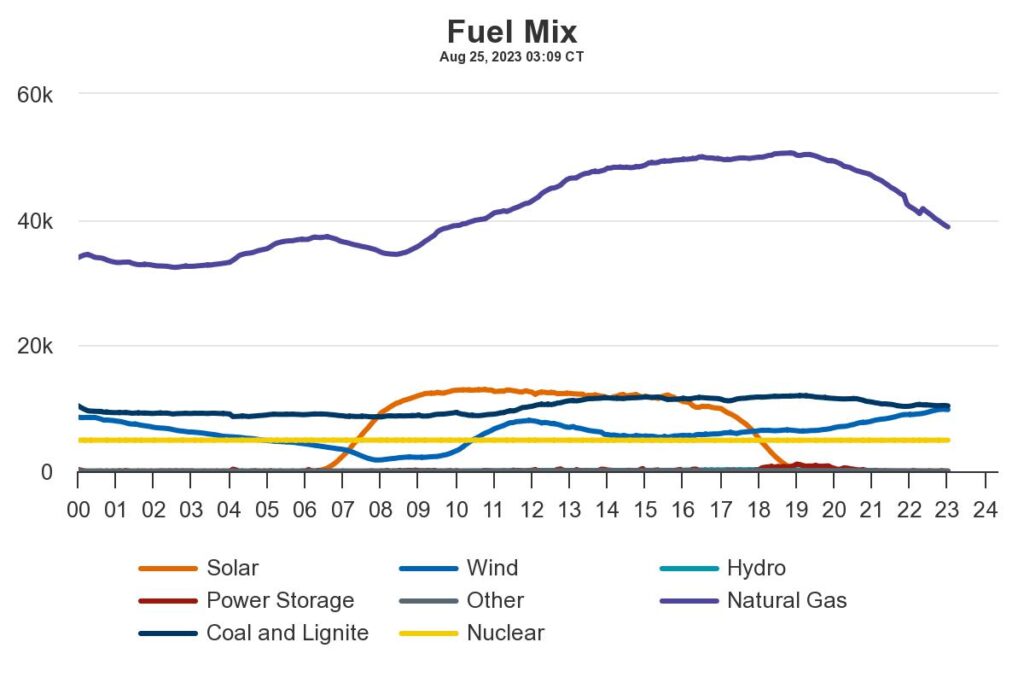

August 25 Early Morning Update: The mid-continent’s grid did not fail on Thursday. Both MISO and ERCOT avoided rolling blackouts and other extreme measures, but barely. Good news does not attract the attention that would have been given the opposite. I will be looking for more detailed assessments from domain specialists. Bloomberg is crediting a pop-up thunderstorm for cooling demand in Houston. Right now, it seems to me that in combination with other measures, it was possible to import more power from other regions when it was needed most. The chart immediately below is most of yesterday’s import pattern for MISO. At about 4:45 PM local time (16:45 on chart) imports peaked (or on this chart bottomed-out) at slightly more than 8745MW, even more than scheduled, much more than expected on Thursday morning. I won’t have access to data for another 24 hours or so, but I bet PJM was exporting lots of megawatts to MISO. In the case of ERCOT (Texas), they were importing too, but I am as intrigued with the release of “stored power”(see second chart below). Just before 8PM local this was contributing 1132MW… just as solar power was fading and evening demand was peaking. Related to this report? I’m not sure. Almost certainly related to this report.

Below is the August 24 Fuel Mix for ERCOT (Electric Reliability Council of Texas)

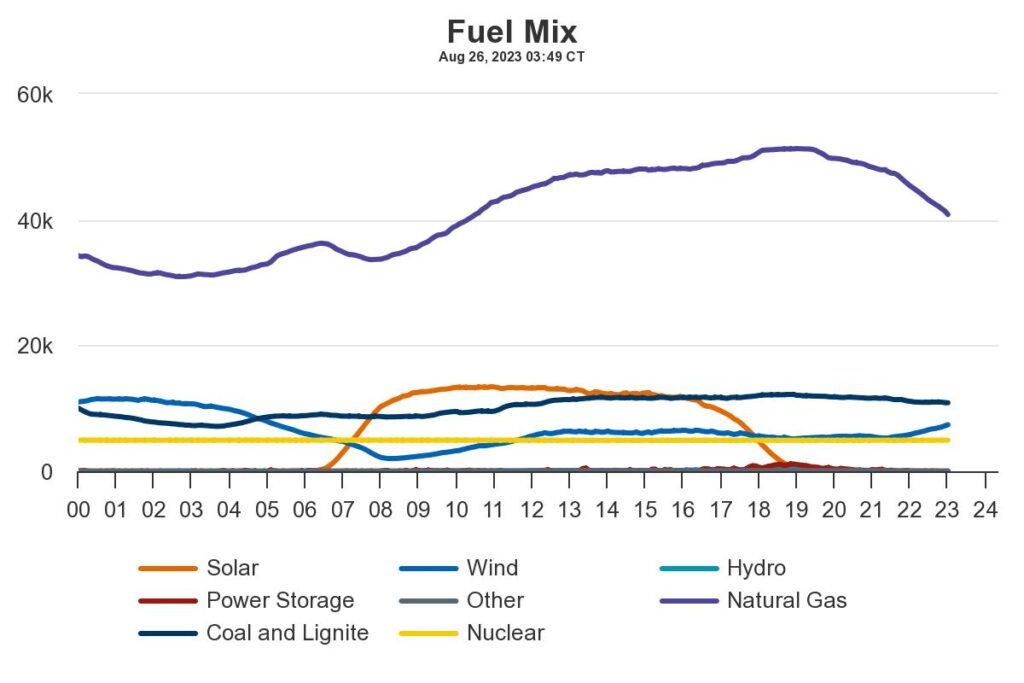

August 25 Afternoon Update: Bloomberg reports, “A punishing heat wave will test power supplies in Texas for a second day as triple-digit temperatures continue to drive up electricity consumption. The state’s grid operator expects to have almost 80 gigawatts of capacity available at about 8 p.m. local time, after solar farms start shutting off, based on hourly forecasts. Demand will be within about 1 gigawatt of that total. Five-minute forecasts show demand exceeding supply around that time…”

August 26 Update: It was once again very close, but the Texas grid made it through another sundown. Here’s more from the Dallas NBC affiliate. Below are the Friday, August 25 supply slopes. Excessive heat is forecast to continue through this weekend. MISO has also declared a Hot Weather Alert through Sunday.

August 27 Update: The Texas grid continues to operate along the cusp. Reuters is reporting renewed conservation requests by ERCOT. The warnings and earnest requests are prudent. Repeated skin-of-the-teeth avoidance of blackouts does tend to reduce attention and related conservation behavior…

September 2 Update: S&P Global has published an important, helpful review of ERCOT performance over the month of August. The report includes the following:

ERCOT President and CEO Pablo Vegas said Texas power consumers’ response to requests to conserve energy enabled the grid to avoid declaring Energy Emergency Alerts so far this summer, despite setting 10 peakload records, most recently 85.4 GW on Aug. 10. In comparison with summer 2022’s all-time peak of 80.1 GW, the increase has been more than 5 GW, Vegas said, about 7% growth year on year, compared with nationwide annual load growth averaging about 1% since the early 2000s. Texas’ energy demand reflects the growing Texas population and economy, which bring with them “demands on infrastructure in highways, schools and energy,” Vegas said. “I don’t think anybody expects the growth to slow down meaningfully…”

An August 31 report in the Texas Tribune mostly agrees with Vargas and raises the threat of conservation fatigue. “Repetitive power conservation appeals by the state’s grid operator face a challenge: Texans becoming less responsive to calls. Past conservation requests have helped reduce 100,000 homes worth of power demand on the grid.”