A few factors worth considering: During December the planet’s largest national economy was experiencing a strong labor market with higher wages during an extended holiday season featuring gift-giving, family reunions, and general partying. Weather was certainly variable, but nothing that would seriously constrain overall demand pulling supply (or push toward demand). Without knowing much more, I might guess that demand for food — especially eating-out — would be comparatively higher than just before or after.

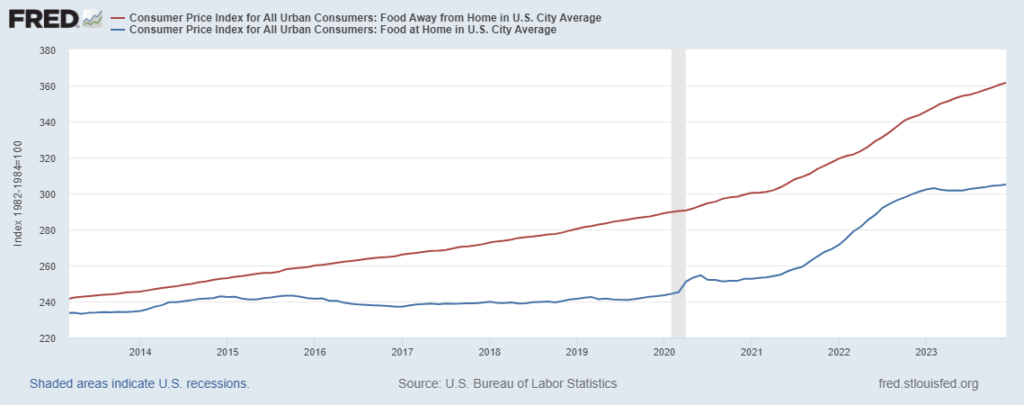

Today’s Consumer Price Index for food-at-home and food-away-from home does not directly measure demand or supply. But the CPI does presume to demonstrate — or at least provide a credible indicator of — comparative price behavior. (See chart below.) The Bureau of Labor Statistics finds that during December the price of eating-out increased 0.3 percent from November and over the last twelve months has increased 5.2 percent. I am guessing, not claiming, that service sector wages could be implicated.

Meanwhile at the grocery store (and similar) the MOM change was 0.1 percent and 1.3 percent over the last twelve months. The supply of high volume, high velocity finished foods is, this seems to suggest, pretty much consistent with demand. The supply of more customized, thereby lower volume, lower velocity food ready-to-eat — prepared and served by others rather than self-prepared — is less well-matched with December demand and, probably, charging more to cover the wages needed to close the supply gap with demand.

People worried about inflation are less happy with these outcomes than those who want healthy supply chains for all sorts of foods and eating experiences. Especially in the food-at-home network these are great results compared with the imbalance between demand and supply — and therefore the food inflation rate — during the second half of 2021 and all of 2022.