How long Friday’s shutdown of the Colonial Pipeline persists is the critical issue. Most news reports indicate this infrastructure carries “roughly 45% of gasoline and diesel fuel consumed on the East Coast.” This is accurate, but significantly understates market dependence between Atlanta and Washington DC. In many local markets dependence for some fuel categories is closer to (even more than) seventy percent.

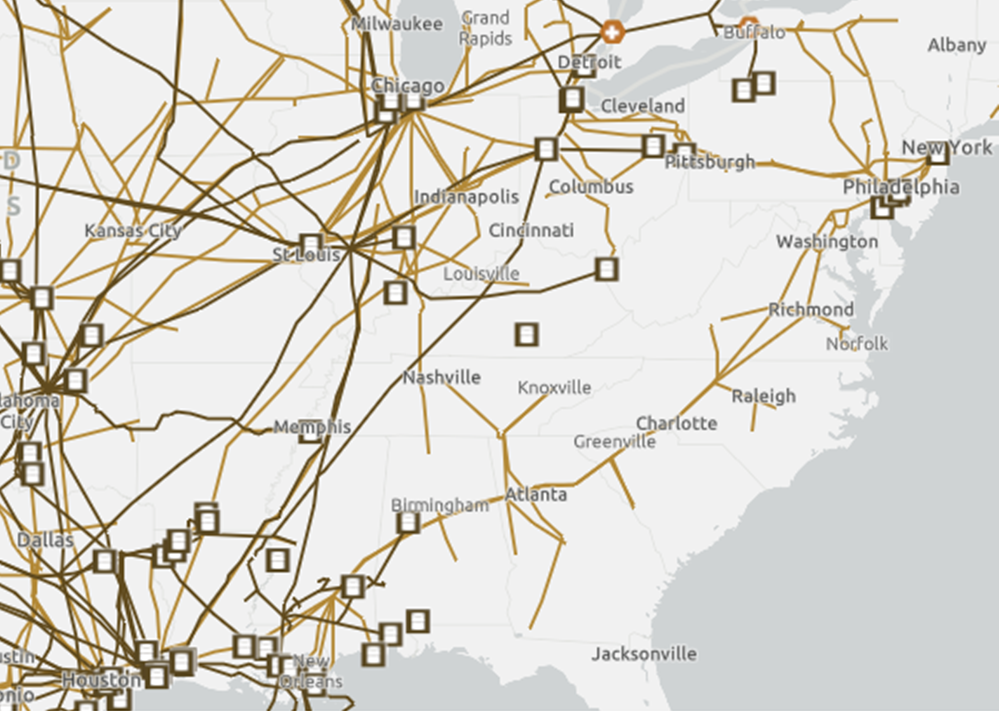

Alternative sources and routes are not readily available. The smaller Plantation Pipeline parallels Colonial, but has recently been running at capacity. Northeast refinery capacity cannot replace lost connections to Gulf Coast refining. Importing refined product into the ports of Baltimore, Philadelphia, and New York could help fill-the-gap, especially on the northern edges of Colonial’s distribution area. But this will not happen overnight. As the map below indicates, local refinery capacity (black boxes) is non-existent between Philadelphia and Birmingham.

Even if North Atlantic and Midwest refinery capacity is ginned-up, transportation and delivery capacity from fuel racks to retail was already estimated as being at least one-quarter below pre-pandemic levels. The US currently has a nationwide shortage of drivers appropriately trained and licensed to handle hazardous materials (e.g., gasoline and diesel).

At most Colonial discharge locations and at wholesale racks that depend on Colonial there is stored inventory. In most years, this inventory would be approaching maximum in preparation for Memorial Day and the summer driving season. I don’t know (yet) if this is true today, but until I see it disproved, it is a reasonable bet. So, the driver shortage is actually a more immediate constraint on flow than a short-term cut-off of supply. [UPDATE: As of the end of April Central Atlantic gasoline stocks were slightly above the same level for the same week in April 2019. Lower Atlantic stocks were slightly lower than in 2019. A quick conversation with one distribution insider suggests that delivery delays caused by the driver shortage have modestly increased the buffer supply available.]

But if mid-May consumer demand is not fulfilled in a timely way (for whatever reason) and this prompts widespread anxiety buying , the interplay between Colonial’s shutdown and the lack of drivers for fuel tankers could create a treacherous and time-extended demand-supply disequilibrium between, say, the Potomac and Chattahoochee watersheds.

Below, petroleum pipelines and refineries (US Energy Information Administration)