To the extent that demand pulls, sizes, and organizes supply — and in most advanced economies, this is mostly the case — then consumption can be said to fuel supply. According to the Bureau of Economic Analysis:

Personal income increased $77.8 billion (0.3 percent at a monthly rate) in September. Disposable personal income (DPI)—personal income less personal current taxes— increased $56.1 billion (0.3 percent). Personal outlays—the sum of personal consumption expenditures (PCE), personal interest payments, and personal current transfer payments—increased $175.1 billion (0.9 percent) and consumer spending increased $138.7 billion (0.7 percent). Personal saving was $687.7 billion and the personal saving rate—personal saving as a percentage of disposable personal income—was 3.4 percent in September.

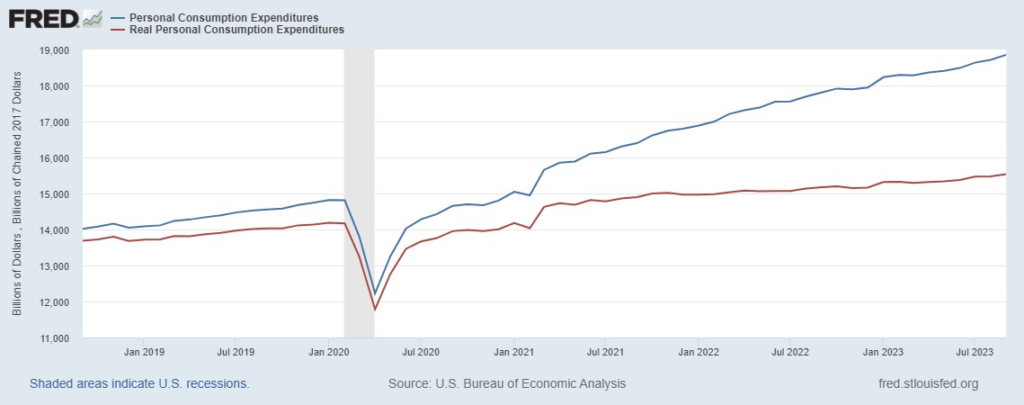

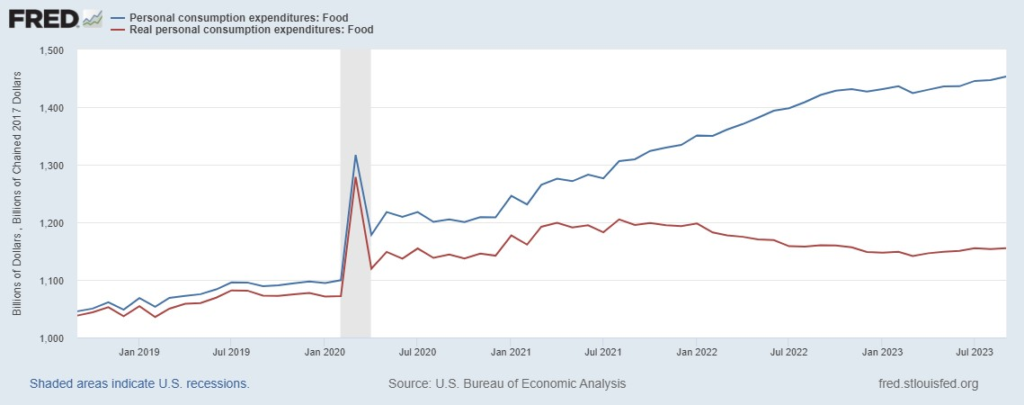

The first chart below displays a five year trend for overall nominal PCE and Real PCE. The second chart is focused on nominal and real expenditures on food-at-home. It is meaningful to me that in September 2023 US consumers spent 1154.9 billion inflation-adjusted dollars on food compared to 1160.1 billion inflation-adjusted dollars in September 2022. This suggests more careful shopping by millions.

Still, on the whole Americans continue to spend more. In September expenditures on cars, pharmaceuticals, and travel showed particular strength (more). Personal outlays grew at a rate more than double personal income. Bloomberg quotes two economists who say, “Consumers continued to live beyond their means in September, with personal spending growth far outstripping income gains … We think that dynamic cannot persist much longer.” I wonder about the implications of potentially very different expenditure patterns by the top two income quintiles compared to the bottom three quintiles.

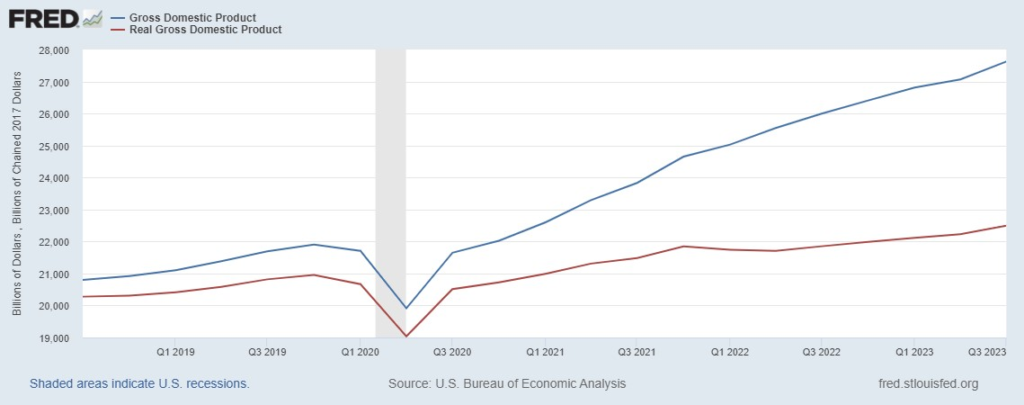

In any case, this year the overall US economy has continued to show rather amazing strength (see third chart below and more). Wages are increasing. Over 9.6 million jobs are currently “open“. Given recent demand — and the prospects of similar demand — I expect the current level of supply activity to persist at least through the end of the year.