Same statistical report, three different headlines:

From CNBC — Key Fed inflation gauge rose 2.8% annually in February, as expected

From The Hill — Inflation ticker higher in February as consumer spending soared

From FXStreet — Price pressures seen broadly unchanged

Bloomberg summarized: “Inflation-adjusted consumer spending advanced 0.4%, above all estimates after a larger drop in the prior month, according to the report from the Bureau of Economic Analysis. Real disposable income, the main supporter of spending, edged lower for the first time since September.”

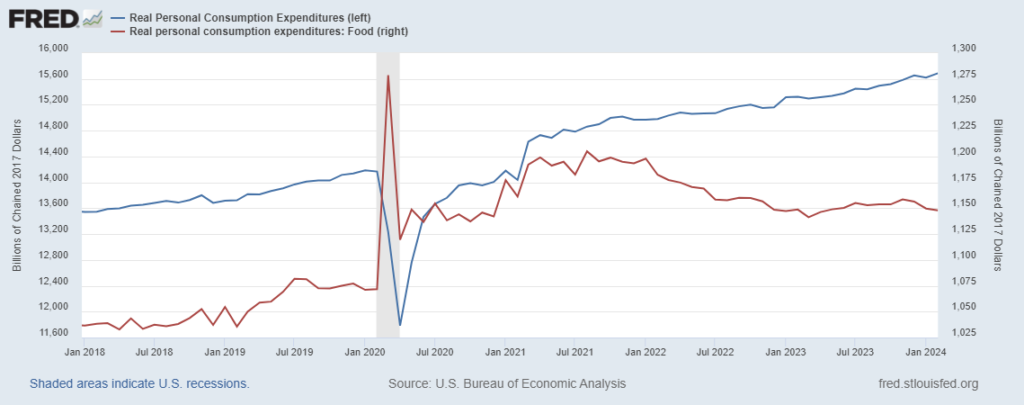

I like the PCE report because it includes inflation-adjusted estimates of spending. Below is a chart showing how — when adjusted for inflation — US personal consumption continues to climb pretty consistently at a level well-above pre-pandemic patterns. Meanwhile spending on food has fallen significantly since early 2021, yet food-at-home spending remains at least five percent higher than pre-pandemic. Food-Away-From-Home consumption has been even stronger.

Earlier this week the Wall Street Journal reported, “Shoppers are stretched, but discretionary spending isn’t abating as quickly as some finance chiefs and economists expected—a phenomenon economists and finance chiefs have coined “revenge” and even “doom” spending. And it has CFOs across industries—from travel to clothing, restaurants and consumer packaged goods—working to figure out what the impact is on balance sheets. Americans—for now—remain resilient and are holding on to some nice-to-have experiences and habits, and are willing to even spend on small and large extravagances…”

The FreightWaves March Market Update strikes me as consistent with February’s personal consumption findings: “There are no signs of a strong shift in market conditions at this point. The trucking market is crawling along a floor but still appears to have seen the toughest part of the cycle. Transportation service providers are now in a waiting game, while shippers need to remain vigilant. April is typically a slower month, and the market appears to be only slightly responsive to the typical March seasonality. May will house the next see-where-we-are mile marker for the market as summer shipping kicks off and Memorial Day provides the first major holiday. The outlook until then is for more of the same for dry van, with the flatbed market being the one to watch for the most volatility and refrigeration still being exposed to a potentially disruptive harvest period.”

Spending is not hot and may even be cooling, but it is — so far — certainly persistent. This is preserving and extending current supply chain capacity.