Here is a long excerpt from yesterday’s EIA Petroleum Status Report for last week.

U.S. crude oil refinery inputs averaged 16.6 million barrels per day during the week ending December 2, 2022 which was 53,000 barrels per day less than the previous week’s average. Refineries operated at 95.5% of their operable capacity last week. Gasoline production decreased last week, averaging 9.1 million barrels per day. Distillate fuel production increased last week, still averaging 5.3 million barrels per day. U.S. crude oil imports averaged 6.0 million barrels per day last week, decreased by 24,000 barrels per day from the previous week. Over the past four weeks, crude oil imports averaged about 6.2 million barrels per day, 4.1% less than the same four-week period last year. Total motor gasoline imports (including both finished gasoline and gasoline blending components) last week averaged 519,000 barrels per day, and distillate fuel imports averaged 372,000 barrels per day.

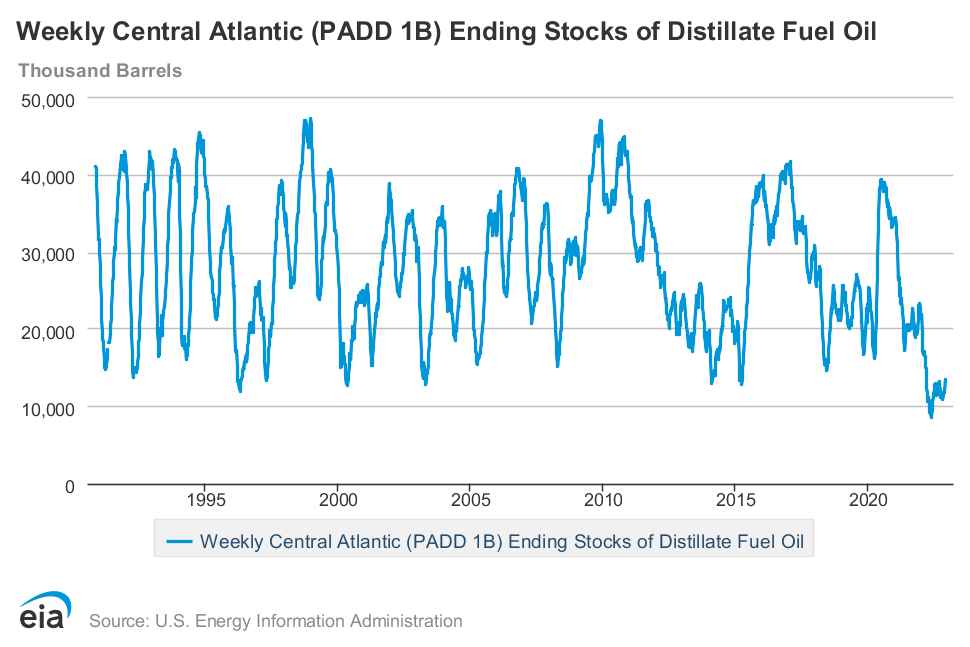

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) decreased by 5.2 million barrels from the previous week. At 413.9 million barrels, U.S. crude oil inventories are about 9% below the five year average for this time of year. Total motor gasoline inventories increased by 5.3 million barrels from last week and are about 3% below the five year average for this time of year. Finished gasoline inventories decreased, while blending components inventories increased last week. Distillate fuel inventories increased by 6.2 million barrels last week and are about 9% below the five year average for this time of year. Propane/propylene inventories decreased by 1.0 million barrels from last week and are 14% above the five year average for this time of year. Total commercial petroleum inventories increased by 5.9 million barrels last week. Total products supplied over the last four-week period averaged 20.1 million barrels a day, down by 3.8% from the same period last year. Over the past four weeks, motor gasoline product supplied averaged 8.4 million barrels a day, down by 7.1% from the same period last year. Distillate fuel product supplied averaged 3.7 million barrels a day over the past four weeks, down by 9.8% from the same period last year. Jet fuel product supplied was up 7.5% compared with the same four-week period last year.

Given distance from sources and constrained channels between demand and supply, I give particular attention to diesel stocks for New England and the mid-Atlantic (PADD 1A and 1B). For all of PADD 1 (Atlantic Coast) inventories are back inside the five year range. The mid-Atlantic is a bit better off than New England (see chart below). Demand and prices have fallen (more). As long as channels are not seriously disrupted (e.g., Colonial Pipeline) and production persists (for how long at over 90 percent?), this will do. Our blood pressure is uncomfortably high, but we can keep trucking…