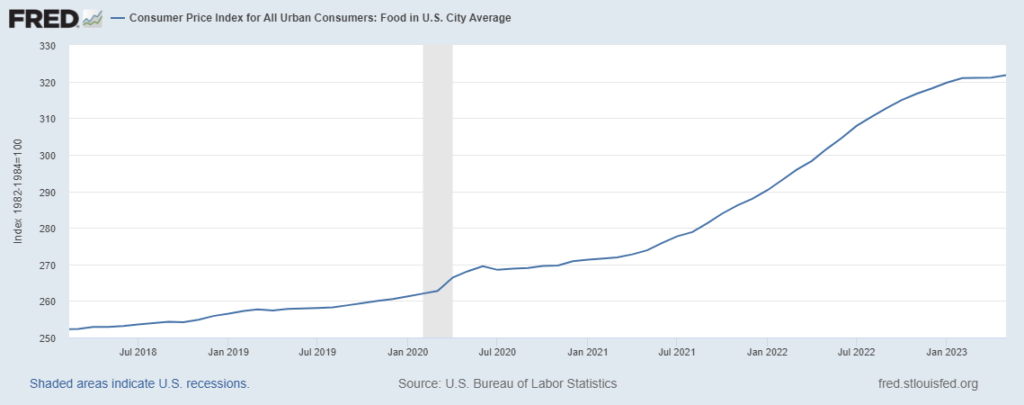

In May the Consumer Price Index for food continued flat (see chart below) showing little change since February. The overall CPI headline number “rose 0.1 percent in May on a seasonally adjusted basis, after increasing 0.4 percent in April… Over the last 12 months, the all items index increased 4.0 percent before seasonal adjustment,” according to the US Bureau of Labor Statistics. While core inflation remains above policy-making targets, the direction of travel is widely considered encouraging. According to Bloomberg, “At 4%, year-over-year inflation is now at its lowest level since March 2021.” What I read into these statistical bytes is that many Americans have reduced expenditures on what they physically bite off at most meals. Please see more below the chart.

+++

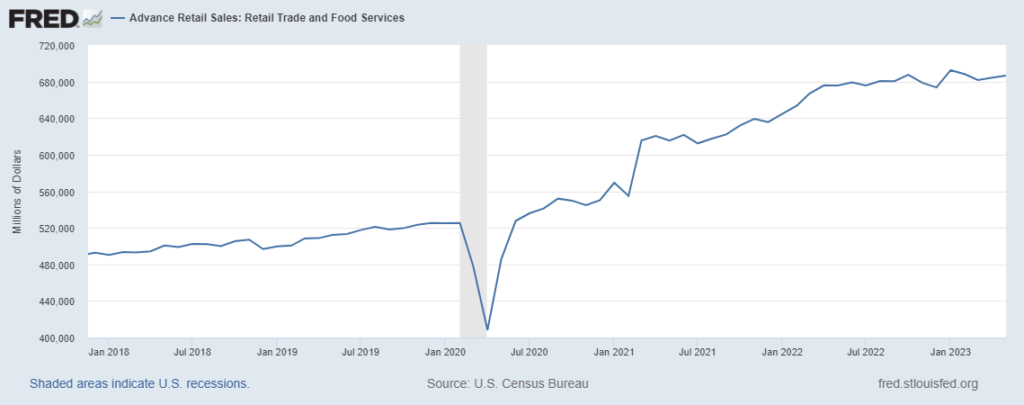

June 15 Update: May retail sales (not inflation-adjusted) were up slightly, please see chart below. This includes food sales, but I am going to call food sales flat. Grocery store sales, adjusted for selling days and season, are reported as $73,731 million for March, $73,634 million for April, and $73,792 million for May. Food-Away-From-Home sales have also been stable for the last 90-plus days, moving between $87,392 million and $87,997 million. I know this is getting redundant, but it is worth noting how far above pre-pandemic trends these levels of retail sales remain… for essentially the same size population (more).

June 19 Update: According to Bloomberg’s Business Week, “… household spending on “food away from home” surpassed spending on “food at home” for the first time in 2015, and after falling back in 2020, it’s now back on top by a bigger margin than ever…“Food away from home” accounted for 53.2% of US household food spending in 2022, the USDA estimates, up from 48.3% in 2020 and 43% in 1997.”