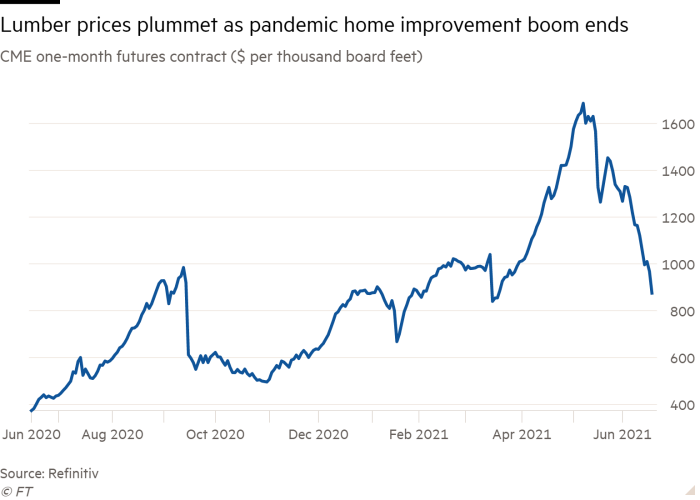

Supply of lumber has increased. Even more important, demand has decreased. Increasing prices have, as usual, diminished demand. Alternative spending opportunities displaced lumber.

On June 16 Jerome Powell, Chairman of the Federal Reserve Board of Governors, said, “Inflation has come in above expectations over the last few months. But if you look behind the headline numbers, you’ll see that the incoming data are, are consistent with the view that prices—that prices that are driving that higher inflation are from categories that are being directly affected by the recovery from the pandemic and the reopening of the economy. So, for example, the experience with, with lumber prices is, is illustrative of this. The thought is that prices like that that have moved up really quickly because of the shortages and bottlenecks and the like, they should stop going up, and at some point, they, they, in some cases, should actually go down.”

In the month since, this lumber market pattern has persisted and similar behavior has been seen in other product categories. Will demand spikes continue to be concentrated in specific categories? Will category-specific price increases successfully redistribute demand and restore supply equilibrium? Or will widening lags between demand and supply morph into generalized and stubborn inflationary pressures?

According to the US Department of Labor, “In June, the Consumer Price Index for All Urban Consumers rose 0.9 percent on a seasonally adjusted basis; rising 5.4 percent over the last 12 months, not seasonally adjusted. The index for all items less food and energy increased 0.9 percent in June (SA); up 4.5 percent over the year.” (More)

Food and energy prices are typically footnoted in the CPI due to their volatility. But recently food and energy have not been alone in attracting manic demand — and resulting supply gyrations. More from the CPI:

The index for used cars and trucks rose sharply for the third consecutive month, increasing 10.5 percent in June. This was the largest monthly increase ever reported for the used cars and trucks index, which was first published in January 1953… The lodging away from home index increased 7.0 percent in June. The index for new vehicles rose 2.0 percent in June, that index’s largest 1-month increase since May 1981. The motor vehicle insurance index increased 1.2 percent over the month. The index for airline fares rose 2.7 percent in June after increasing 7.0 percent the previous month.

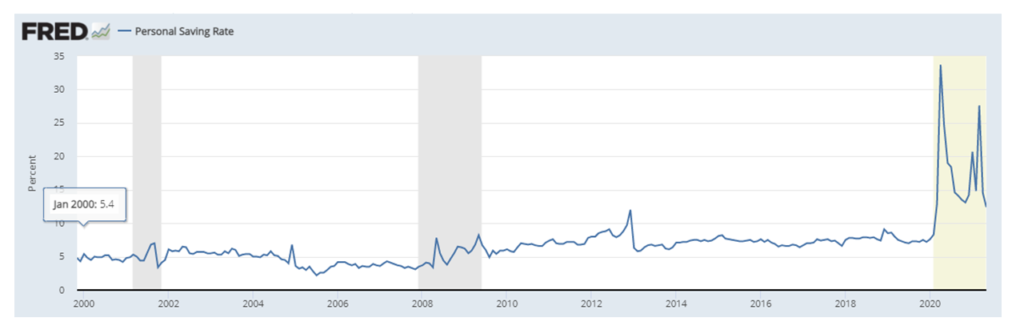

According to the Bureau of Economic Analysis, Real Disposable Personal Income was just over $15 trillion in January 2020. By May 2021 DPI had increased by about $1 trillion. Household debt is higher than ever, but high-interest credit card debt has been slashed. The US Personal Savings Rate remains remarkably elevated, as shown below.

There is pent-up demand, especially for products and services constrained by pandemic slow-downs and shut-downs. There is plenty of cash available to express “effectual demand“. In some categories, spending has surged and/or returned more quickly than sources of supply had anticipated. In some categories — such as restaurant meals, automobiles, and airline seats — there are structural challenges that continue to constrain supply below seasonal 2019 levels.

Demand is pulling and has the potential to pull harder. Supply is pushing toward demand, but suppliers are keen to avoid long-term capacity-building costs (capacity that is unlikely to be needed by early 2022). As a result, supplies can increase more gradually than demand. This incremental gap can suddenly deepen when demand surges all at once on a narrow target. These gaps and resulting market fluctuations are likely to persist through Christmas this year.

After Christmas? Others have some projections. But I will wait to see what can be seen as of late September… I already have a sense of trying to fly too high.

+++

Starting at noon today Chairman Powell will give testimony to the House Committee on Financial Services. Both a live webcast and an archive copy should be available. JULY 15 UPDATE: The Fed Chairman is watching carefully, but still perceives most of today’s sharp price increases are the outcome of temporary imbalances between demand and supply. If so, as demand moderates and supply chains optimize , prices should stabilize. Here’s the WSJ report.