The Census Bureau’s report on Advance Monthly Sales for Retail and Food Services for December showed a decline in spending from November. Friday’s related headlines were uniformly gloomy, please see here, here, and here.

CNN’s headline announced, “Warning Sign for the Economy: Consumers are Getting Grumpy.” Evidence referenced, “Americans shopped less in December, causing the first drop in retail sales since the summer. Sales dropped 1.9% compared with November, adjusted for seasonal swings.”

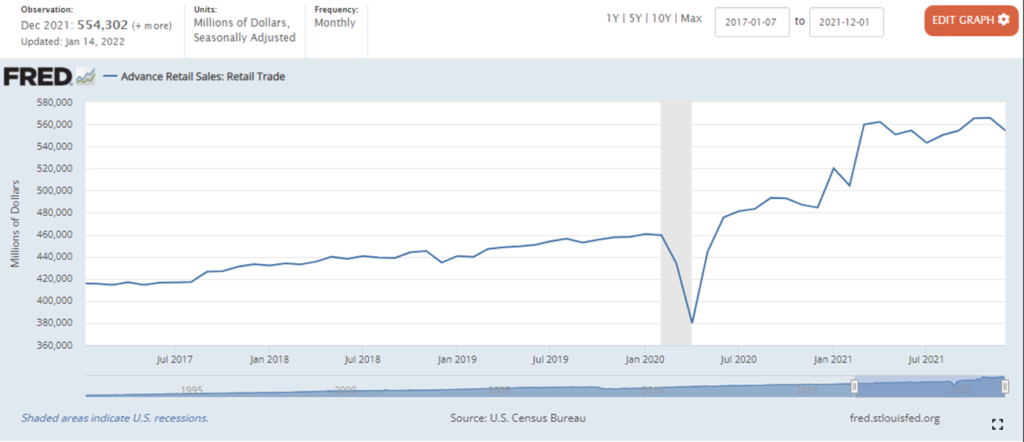

Many reports neglected to mention that October and November retail sales were the highest ever recorded. December 2021’s total retail sales were more than 12 percent higher than December 2020 and over 17 percent higher than pre-pandemic December 2019. (Please see chart below.)

Very strong sales persist. Given cash reserves currently available to consumers (see second chart below) a sharp decline in consumer purchases seems unlikely anytime soon.

To state what’s entirely obvious, retail sales have been unusually high since Spring 2021. This followed a collapse — and enormous shift — in demand early in the pandemic. During 2020 millions of US households — especially high-earning households — accumulated savings by spending much less. Billions of dollars were also distributed to assist millions adapt to pandemic-related economic dislocation. Starting late in the first quarter of 2021 — coincident with significant vaccination roll-outs — most households accelerated spending. But even while spending increased, the personal saving rate for current income remained well elevated until at least October (e.g., in April the PSR was 12.6, only in October did it finally fall to 7.1, much closer to the normal range of the last decade).

In most product categories, production/distribution capacity did not dramatically increase between late 2019 and mid-2021. In many cases, actual working capacity has been considerably constrained by various pandemic factors. Disequilibrium between demand and supply has often increased. Many supply chains have been increasingly stressed while trying to serve this extraordinary demand with less-than-ordinary supply capacity and volatile flows. Over the last nine months of 2021 US producer and consumer prices edged higher as lots of cash chased the same amount of goods and services.

Unusual — sometimes unpredictable — supply chain stress will persist until demand pull is better calibrated with supply push.