The trickle of agricultural exports leaving three Ukrainian ports has continued. Sailings include not just those ships trapped since February, but new ships arriving to receive new loads. That new ships have arrived so soon surprises me. It is further evidence of the power of effectual demand — even in the midst of very high risk (more and more and more and more).

There is now a sufficient flow that according to S&P, “The Black Sea dry bulk shipping markets have resumed spot trading as the Ports of Odessa and Yuzhny saw an influx of spot grains cargo inquiry into West Africa and the Mediterranean… On a time-charter basis, one Supramax near Algeria was reported to be asking $30,000/d for a trip via the Black Sea, with redelivery in the Mediterranean. By comparison, similar ships were asking between $15,000/d and $20,000/d for similar duration trips in the North Sea.”

Flows of Ukraine’s grain, fertilizer, sunflower oil, and more nonetheless remain constrained and disrupted. According to Reuters and Ukrainian officials, “Agricultural exports between Feb. 24 and Aug. 15 this year fell to 10 million tonnes from around 19.5 million in the same period last year.” Half full is also half empty, but better than even less.

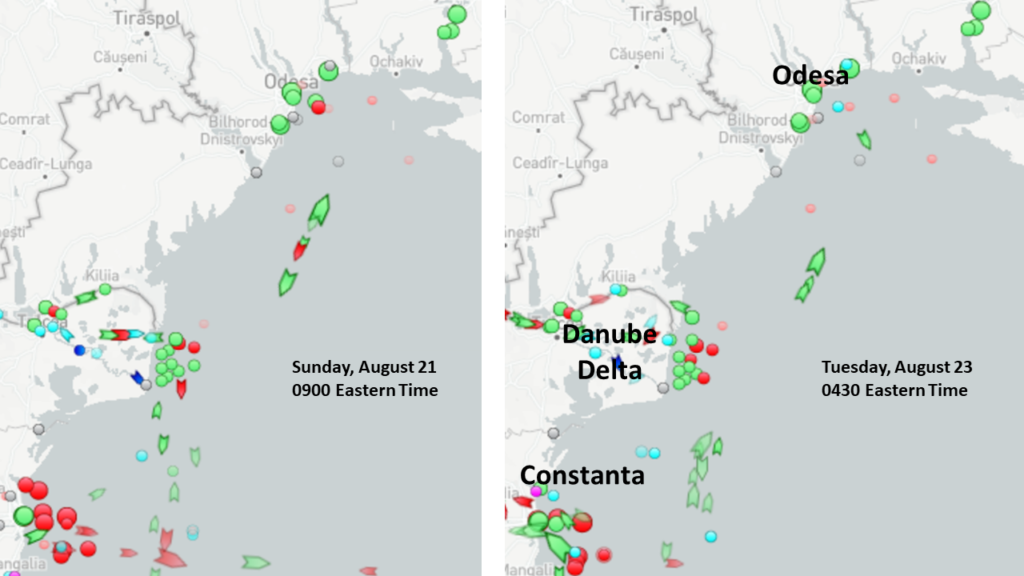

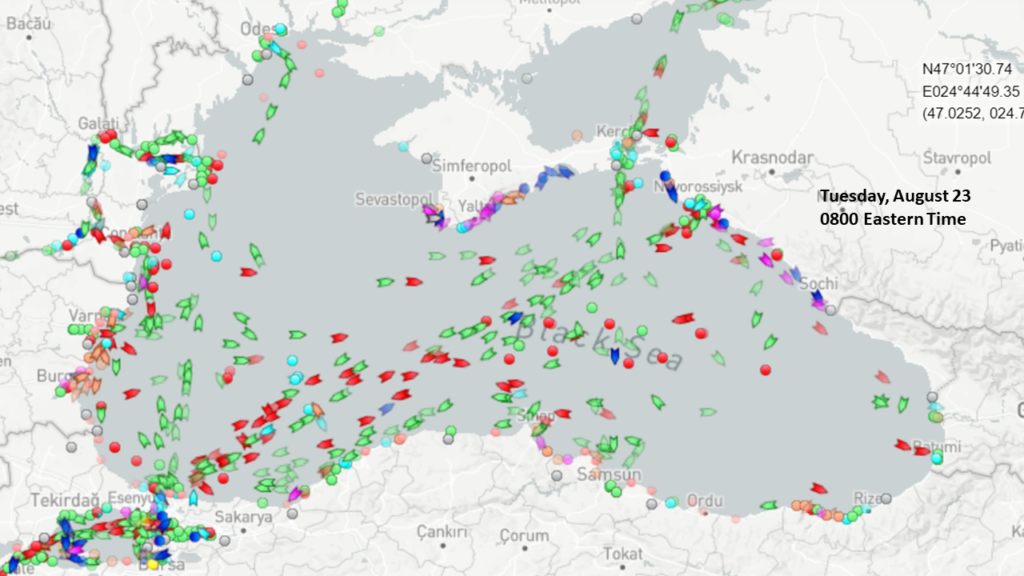

Below are recent views of Black Sea channel flows (updated map here). Based on very irregular monitoring, I seem to see a steadily increasing number of ships gathering in the “Southern Waiting Area” east of Constanta (Romania) before moving north into the corridor that connects with berths at Odesa, Yuzhny, and Chornomorsk (more).