Yesterday Freeport LNG announced another delay in restarting their Texas facility. Shut-down since a June 8 explosion, flows had originally been expected to resume in September, but based on regulatory action had then been delayed until October. (See text of action by Pipeline and Hazardous Materials Safety Administration.)

According to a news release, “Although typical construction risks could impact the recovery plan, it is anticipated that initial production can commence in early to mid-November, and ramp up to a sustained level of at least 2 BCF per day by the end of November, representing over 85% of the export capacity of the facility. The recovery plan will utilize Freeport LNG’s second LNG loading dock as a lay berth until loading capabilities at the second dock are reinstated in March 2023, at which time we anticipate being capable of operating at 100% of our capacity.” (More)

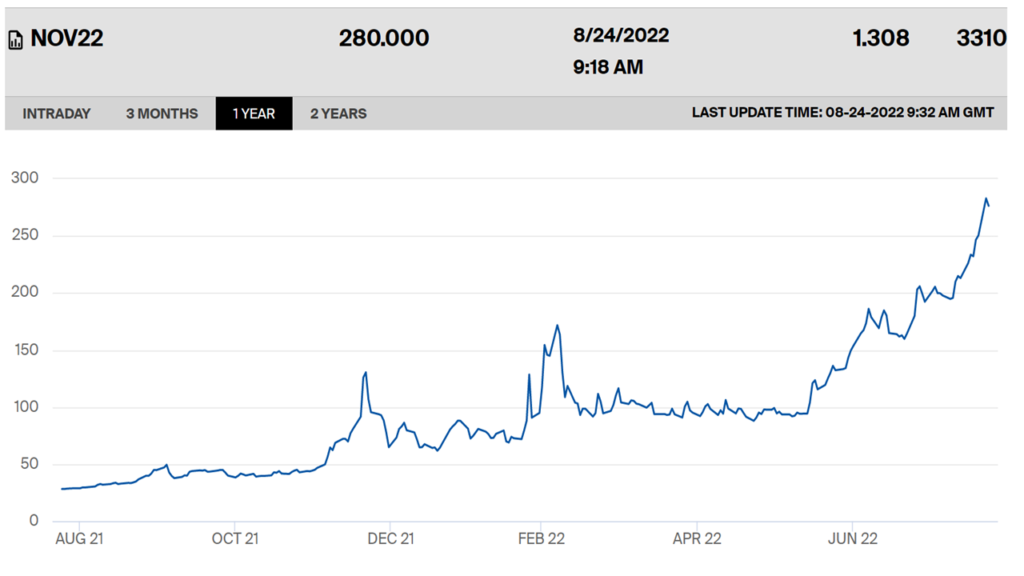

Yesterday, before the Freeport LNG announcement, benchmark European LNG futures prices for November deliveries hit a new all time high (see chart below). Recent turmoil in the European natural gas market can claim many mothers and fathers, but a big part of the most recent price rise reflects Friday’s announcement by Gazprom that the Nordstream 1 pipeline will suspend flows from August 31 to September 2 for previously unscheduled maintenance.

US natural gas prices fell yesterday reflecting the continued constraint on export capacity (more and more), Freeport typically accounts for about 15 percent of US LNG exports. As of this morning, global natural gas prices are still churning as implications are played out on 3-D chess boards worldwide (here and here). Prices may be approaching the point of demand destruction.

European natural gas inventories — critically important for this winter — currently stand at almost 78 percent. Pretty good for a normal August. But this is an abnormal August worried about a potentially surreal mid-winter (more and more and more).

So… I hope I am not the only one who is cautiously comparing PHMSA actions at Freeport to FDA action at Sturgis (here and here and here). In each case there were (are) real safety risks justifying regulatory interventions. In regard to the Abbott production plant at Sturgis there was also failure to fully anticipate the implications of an extended shutdown.

Fortunately, the flow capacity concentrated at Freeport — while significant — is no more than half that concentrated at Sturgis… and depending on what you count as replacement flows, even less. Replacement flows for Sturgis were also tightly constrained by various government import and procurement policies. Natural gas operates in a much more open market with much higher volume flows. Comparing natural gas to specialty formula is not an easy apple to apple market comparison.

But in terms of risk management, the analogy may be more like-to-like. There are many good reasons for an FDA or PHMSA action to be narrowly framed in terms of existing statutory and regulatory authorities. There are many good reasons to ensure that specific safety issues not be complicated by more ambiguous economic or, especially, political issues. There are many good reasons for private sector engineers and lawyers to cooperate with narrowly targeted safety regulations.

I also remember in late March when I received my first call from a senior federal official worried about the downstream implications of the shutdown at Sturgis. He seemed surprised when I outlined limited options: restart, import, or empty shelves. I did not notice this surprise motivating many changes for another four weeks or more. By then shortages of specialty formulas were, in some cases, life-threatening.

I hope the professional expertise of PHMSA staff is deep and respected. I hope their peers at Freeport LNG are competent and fully committed to safe operations. I also hope USDOT Senior Executive Service staff and/or the right Deputy Assistant Secretary and/or a thoughtful National Security Council staffer are asking for regular updates and communicating downstream implications. While I want the safety inspectors to be able to stay in their lane, I also want others to fully engage how that lane connects to flow of LNG to Europe and the strategic implications of containing Putin’s aggression.

Dutch TTF Gas Futures for November Euro cents per megawatt hour