[Updates below] The International Energy Agency’s November Oil Market Report summarizes recent market behavior:

Diesel prices and cracks (differential to crude oil price) surged to record levels in October, and are now 70% and 425% higher, respectively, than year-ago levels while benchmark Brent prices increased just 11% during the same period. Distillate inventories are at multi-decade lows. French refinery strikes last month and upcoming embargoes propelled diesel prices in Rotterdam, Europe’s main trading hub, to more than $80/bbl above North Sea Dated at one point, before easing somewhat. Diesel premiums in the United States have also soared ahead of the winter heating season in the Northeast.

Diesel is not the only petroleum product with shallow inventories. Based on the IEA report, Bloomberg outlines, “Combined government and industry oil stockpiles in developed nations have fallen below 4 billion barrels for the first time in 18 years, having declined by 177 million barrels this year…”

Looking ahead, IEA anticipates more global diesel (and other petroleum) production capacity by the close of 2023 and, probably, flat or lower demand between now and then (on the back of high prices and economic slow-downs). The balance between demand and supply is, however, sufficiently tight and near-term push options are sufficiently constrained that outbreaks of regional disequilibria would not be surprising.

Tomorrow, November 16, we will get EIA’s update on US diesel inventories.

+++

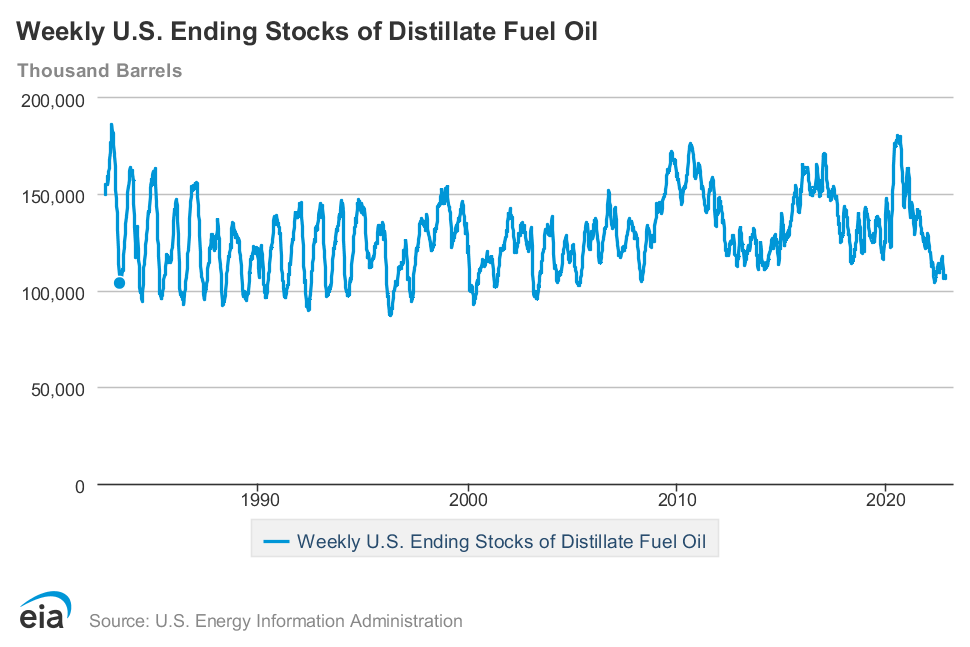

November 17 Update: I will call the weekly change in US diesel stocks non-material: making moves that do not change our essential condition. Total national distillate inventories increased from an estimated 106,263,000 barrels to 107,383,000 barrels. See historical moves and comparisons in chart below.

Regional inventories are probably what will matter most in a pinch. The Central Atlantic (PADD 1B) is especially tight. Local refining capacity is anemic and it is a long distance from Gulf Coast refining capacity or European sources discombobulated by the uncertainties of war-time winter. But no US region has average, much less above-average diesel stocks. Many — all? — skate the edge of a supply chasm in case of any significant loss of current capacity resulting from natural, accidental, or intentional impediments.

Based on EIA data, S&P Global highlights strong US demand, “Robust refinery demand contributed to the draws. Nationwide refinery utilization climbed for a third straight week, rising 0.8 percentage point to 92.9% of capacity, while refinery net crude inputs edged up to 16.15 million b/d, an eight-week high. At those levels, utilization and net crude demand were 5.4% and 2.6% above their respective five-year averages.”

About midnight the Financial Times reported (in a helpful overview),”The contraction of diesel stocks comes amid steady demand and rising exports to Europe to offset now-sanctioned supplies from Russia. Pressure on US stocks is expected to worsen in the winter, when European sanctions on seaborne Russian crude oil tighten in December and are extended to refined petroleum products in February.”

November 21 Update: Reuters reports, “The European Union will ban Russian oil product imports, on which it relies heavily for its diesel, by Feb. 5. That will follow a ban on Russian crude taking effect in December. Russian diesel loadings destined for the Amsterdam-Rotterdam-Antwerp (ARA) storage region rose to 215,000 bpd from Nov. 1 to Nov. 12, up by 126% from October.”

November 22 Update: Bloomberg delivers an excellent update and overview regarding the global diesel market. Two paragraphs highlight prior reports by this blog:

Within the next few months, almost every region on the planet will face the danger of a diesel shortage at a time when supply crunches in nearly all the world’s energy markets have worsened inflation and stifled growth...

To be sure, prolonged, diesel shortages throughout the US are improbable since the country is a net exporter of the fuel. But localized outages and price spikes are likely to become more frequent, especially on the East Coast, where a dearth of pipelines creates huge bottlenecks. The region is heavily reliant on the Colonial pipeline that’s often full…