Updated below with take-aways from the April 14 Retail Sales Report.

On April 11 World Trade Organization economists predicted that 2022 global GDP will grow about one-third less than previously predicted because of, “1) the direct impact of the war in Ukraine, including destruction of infrastructure and increased trade costs; (2) the impact of sanctions on Russia, including the blocking of Russian banks from the SWIFT settlement system; and (3) reduced aggregate demand in the rest of the world due to falling business/consumer confidence and rising uncertainty.”

Domestic consumption in China is currently disrupted by anti-covid measures. Economic activity in Japan is slowing. In March Eurozone consumer confidence collapsed in response to Russia’s invasion of Ukraine. India’s consumer sentiment also suggests reduced consumption ahead. For millions of consumers worldwide sharp increases in food and fuel prices will leave much less disposable income available for anything else.

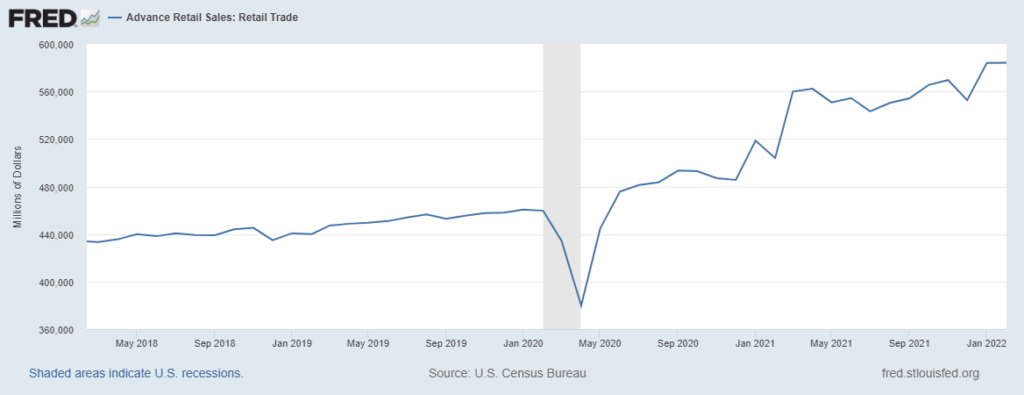

In contrast, US retail sales in January and February were the highest ever recorded (see chart below, through February), but the February sales increase did not make up for retail price-increases. Some continued softening in real net spending is likely, but nothing precipitous is — so far — being signaled for March to current (more).

According to the March US Consumer Price Index (released this morning) gasoline prices are up 48 percent compared to twelve months ago, food-at-home is up ten percent, and food-away-from-home is up almost seven percent. Other price movements are mixed, including several recent price declines for many types of apparel and even used cars. But, for example, used car prices still average a whopping one-third above prices one year ago.

Employment is strong. Wages are increasing, even if not always matching inflation. Low earning Americans are likely to spend what they must for food and fuel. What will higher earners decide to do? Many still have much higher savings than usual. Many have just recently begun to spend again on services. Prospects and prognostications are mixed (see here and here).

For most of 2021 US demand and supply was out of whack. There was much more demand for “stuff” than timely capacity to make and ship at volumes and velocities demanded (my wife and I still cannot purchase two long out-of-stock chairs). Demand for stuff (other than new cars and electronic gear?) is diminishing. US spending on experiences — eating out, entertainment, recreation including travel — is increasing. Demand capacity is getting much better calibrated with supply capacity.

Many prices are increasing too, which tends to clarify the distinction between “effectual” and “absolute” demand. But — so far — prices on a wide range of durable goods seem to be stabilizing and (at least until recent China lockdowns) both inventories and flows have displayed less friction. Reviewing these and other market shifts, Craig Fuller at FreightWaves recently wrote, “This is all good for consumers – prices for freight will come down. Supply chain bottlenecks will ease. What were recently inventory shortages are now gluts, and will likely result in price discounts, not increases. This is a late-stage supply chain correction.” Craig is not as affirmative on implications for freight markets.

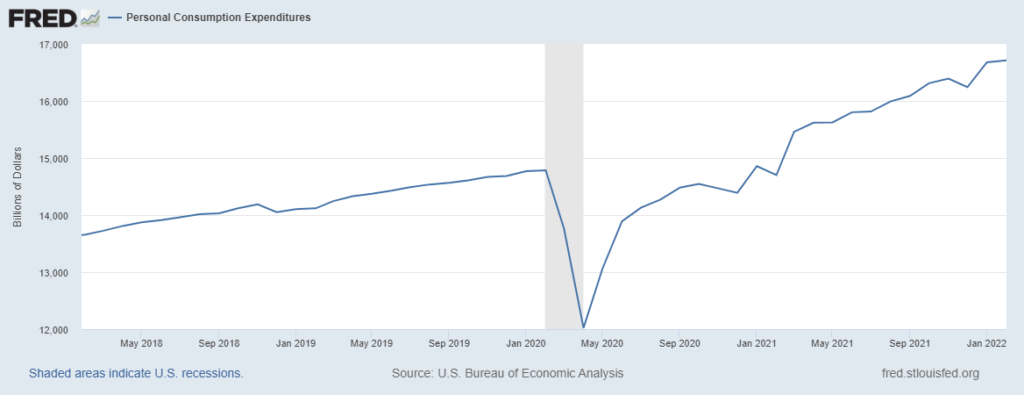

If the goal is rough equilibrium of supply and demand — with strong employment and positive financial prospects — then less demand for imported stuff and more demand for domestic services is helpful. And… we still have reasonably high demand across a wide range of product categories. Can we keep it? The second chart below is Personal Consumption Expenditures. This suggests we are currently consuming about $700 billion more per month than would have been the case without various pandemic factors at play. We don’t need further increases in demand. A slow, modest deceleration of demand, consistent with “full” employment and an inflation rate closer to four than today’s 8.5 percent would be a tonic… If all the Chicken Little’s could somehow be reassured.

Reduced demand for energy outside the United States — especially by China — increases the possibility of somewhat lower USA pump prices. An early ceasefire in Ukraine could have a similar impact on global food inflation. The combination of lower fuel costs and a less anxious global food market will at least soften US food price increases. (My guess is that we are in the midst of a systemic structural shift in US food prices.) But with or without this help, a great deal depends on how Americans spend their money. If we suddenly reduce spending (demand destruction), everyone is in trouble. If we persist with personal consumption expenditures no higher than February and at or above $16,000 billon per month for the next three to six months (demand deceleration), we should be able to pull US supply chains — and the US economy — through this particular storm without losing our way.

Next storm? Ask me when landfall is predictable. But, as usual, it will depend on demand.

April 13 Update: What’s above is much more open to positive possibilities than most current analyses. So, I am glad to see DHL’s Jim Monkmeyer’s comments at Bloomberg: “We have backlogs for cars, for RVs, for raw materials that are going to drive and spread that demand over a longer period of time — and I think that’s a positive… My hope is that we’re heading to maybe a slight slowdown that isn’t going to be the recession doom and gloom — I’m not in that camp… It’s funny how last year we all hoped for a slight slowdown. Now we’ve got it, and everybody’s worried of course that we’re going to swing the other way.”

April 14 Update: The US Census March Retail Sales Report confirms that US consumers continued to spend with considerable gusto. Total dollars spent increased from $587,808 million in February to $590,365 million in March. Because of inflation, we are buying slightly less with each dollar than the prior month. So, let’s describe March retail sales as flat. But flat is a very relative measure: in February 2020, mostly pre-pandemic, US retail sales were $459,610 million. March 2022 spending is differentiated from one year ago (at the start of sustained supply chain disequilibria). We are spending 37 percent more at gas stations and 9.5 percent more at grocery stores (mostly reflecting increased prices). We are spending 9.7 percent less on electronics and appliances and almost one-fifth more at restaurants and bars (reflecting considerably stronger consumer demand). In terms of the deceleration prescription outlined above: so far, so good.