[Update Below] Global refining capacity is very tight (more). Most North American and European refineries are just fulfilling demand by operating at well-over 90 percent capacity. The most significant current concentration of “excess” capacity is in China — which is producing about one-third below capacity (perhaps 18 million barrels per day) due to its domestic economic slowdown (and is not, in any case, organized to export significant flows of refined fuels).

Disrupted flows of Russian crude have complicated refining operations in Europe. Impending constraints on Russian refined product have complicated fulfilling current demand. Recent strikes at French refineries reduced EU fuel inventories, raised prices, and caused spot shortages. Nigeria’s new Dangote refinery has suffered several delays in opening. New capacity in the Persian Gulf and East Asia is not scheduled to begin production until late 2023 or beyond.

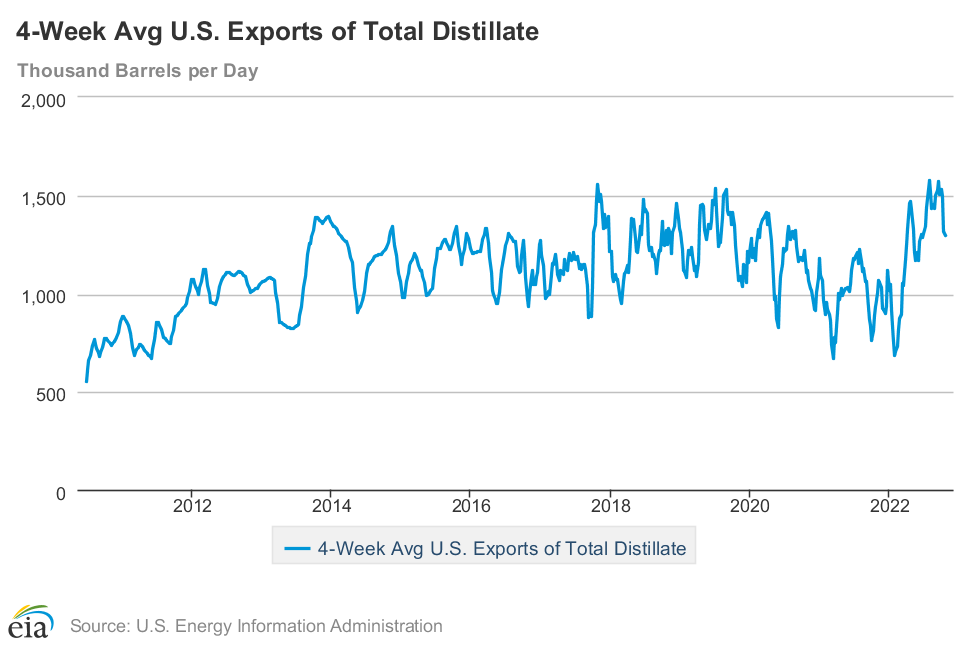

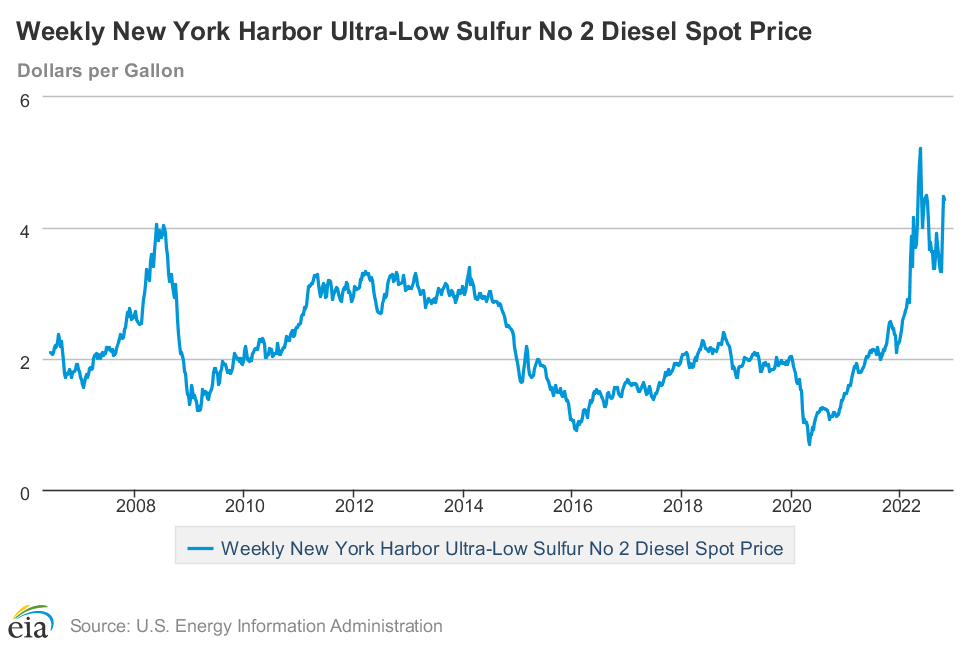

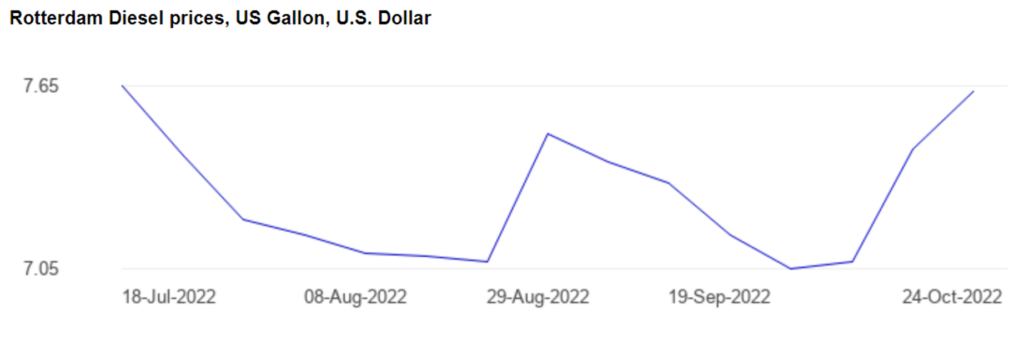

The United States is exporting diesel at volumes not seen since pre-pandemic (see first chart below). Latin America has long been a significant consumer of US refined products, especially from US Gulf Coast refiners. This year European demand for US diesel has surged (more and more). Since Russian flows have been disrupted, there has been a particular tug-of-war between diesel demand (and prices) at New York Harbor and Amsterdam-Rotterdam-Antwerp (see second and third charts below). Depending on week-to-week differentials, NYH can still attract diesel flows that would otherwise serve diesel-thirsty Europe. Volatility has been the most discernable pattern (more).

This volatility is reinforced by a structural feature of fuel networks serving the the US east coast — and especially the mid-Atlantic (say, New York to Norfolk). From Maine to Florida (PADD 1) there are only seven operational refineries with total capacity barely above 800,000 barrels per day. Total consumption along the Atlantic is typically more than 7.5 million barrels per day. A big part of the difference is filled by 2.5 to 3 million barrels per day of refined product transported from Texas and Louisiana by the Colonial Pipeline. Another 700,000 barrels per day of Gulf Coast product is carried by the Plantation Pipeline. Maritime deliveries to Florida of about 840,000 barrels per day originate with the same Gulf Coast sources. About 1 million barrels per day of refined product imports serve the east coast, mostly from Canada and OPEC.

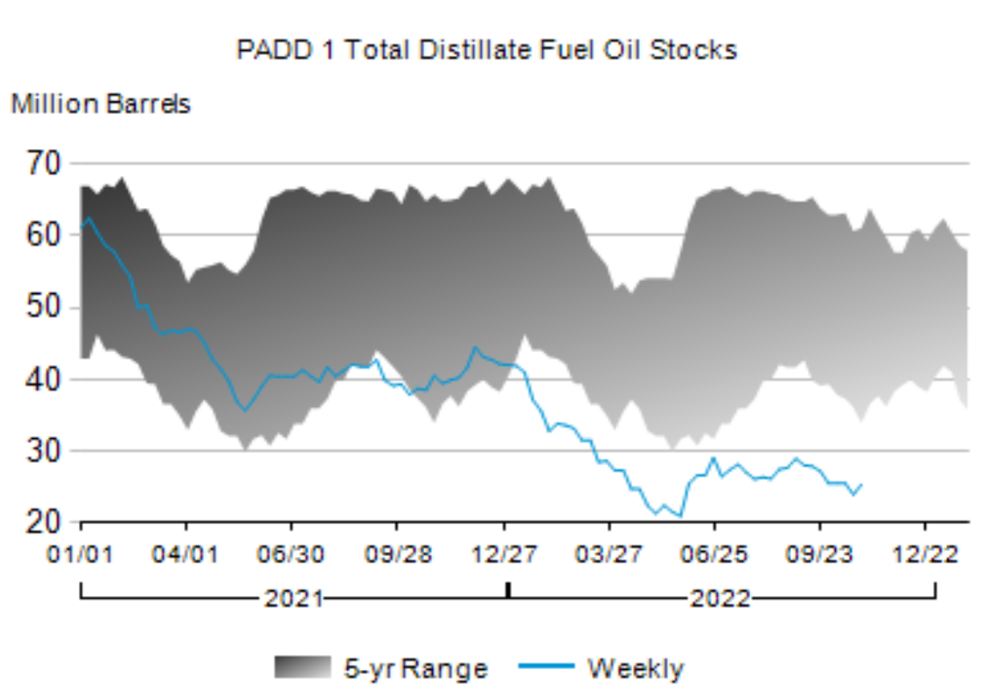

This gives Gulf Coast refiners plenty of sales options: Rio, Rotterdam, Riga, and really wherever. Since the Russian invasion of Ukraine there have been plenty of days when non-US consumers were ready to pay way more for Gulf Coast diesel than prices being paid where the pipeline ends near New York Harbor (more). Especially when pipeline capacity is fully allocated, there is a clear incentive to sell where margins are best… and, supposedly, where demand is most desperate. But this also means that East Coast diesel inventories — already suffering late-pandemic anemia — have not been restocked even as pre-pandemic demand patterns re-emerge (here and see final chart below). On a proportional basis diesel stocks are equally low or even lower in Amsterdam-Rotterdam-Antwerp and Singapore than in the United States.

If recent global diesel demand persists, it is unlikely that East Coast diesel stocks will be refilled any time soon (despite the increase last week). If US Gulf Coast refineries continue to operate at 90 percent or better capacity, the Colonial and Plantation pipelines are likely to be fully allocated through this winter. If so, East Coast inventories will probably not see materially deeper deficits per the five year range. If the US economy slows and diesel demand declines, recovery in regional diesel stocks becomes more likely.

+++

November 10 Update: According to Reuters, “U.S. gasoline stocks were down by 900,000 barrels in the week to 205.7 million barrels, the EIA said, compared with analysts’ expectations in a Reuters poll for a drop of 1.1 million barrels. Distillate stockpiles, which include diesel and heating oil, fell by about 500,000 barrels, a smaller-than-expected decline.” Here’s the baseline data from the Energy Information Administration’s Weekly Petroleum Status Report. Nice overview of diesel prices and prospects by the New York Times.