Several consecutive days of high temperatures across much of North America and Europe means much more demand for electricity, especially for air conditioning. Over the last decade-plus there has been considerable conversion to natural gas for grid generation. Today close to 40 percent of US electrical generation depends on natural gas.

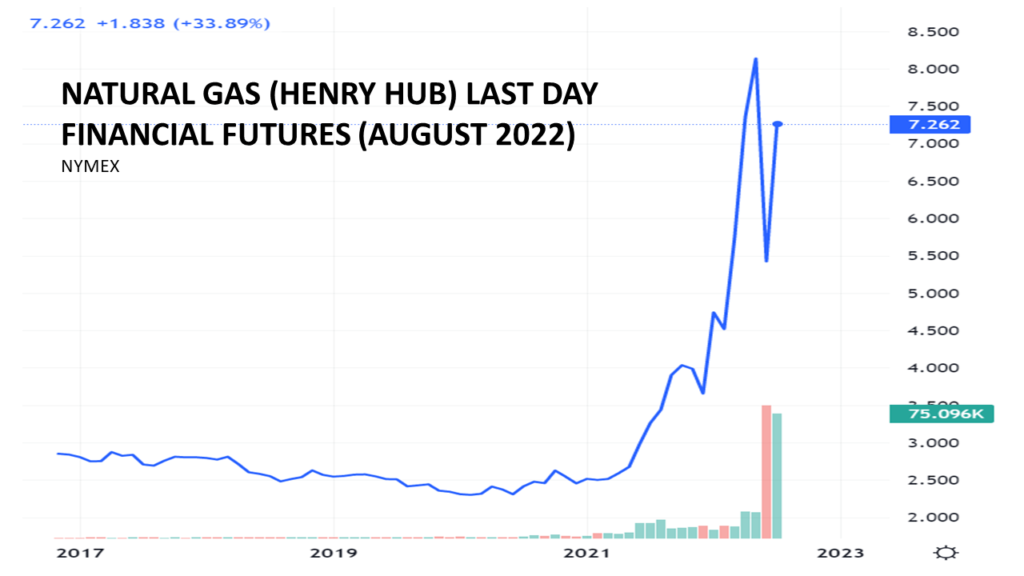

Until recently, natural gas could claim a significant price advantage over other alternatives. Not so much now. US prices lag global, but the 90-101 percent increase in global benchmarks since January has also pulled US natural gas prices higher especially with recent spikes in domestic demand. According to S&P:

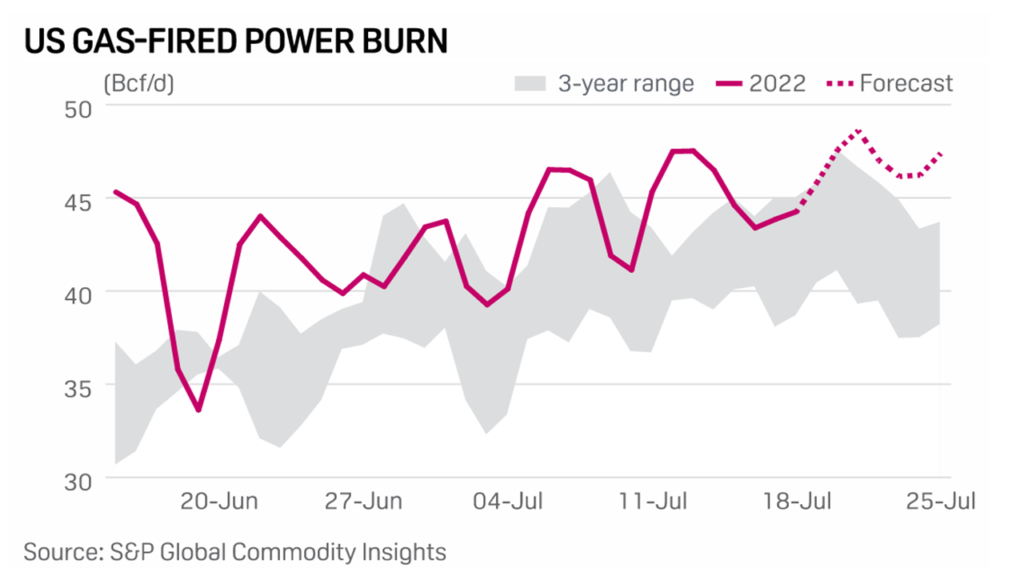

On July 21, the US power burn is forecast to average 48.6 Bcf/d in what would be a new single-day demand record, according to data from Platts Analytics. Assuming the forecast is accurate, the new high would outpace the prior single-day record from July 2020 by over 500 MMcf/d, or about 1%.Already this month, generator gas demand has trended a record-breaking pace for July of 44 Bcf/d. Compared with July 2020, when low prices made gas a go-to fuel for power generators, demand is up about 650 MMcf/d, month to date. Compared with July 2021, generator demand is up by a brow-raising 6 Bcf/d or almost 16%, this month… [See chart below]

Higher prices are tracking this demand. For example the US benchmark Henry Hub futures market is displayed in the second chart below. But paying more for abundant supply is much better than European prospects for not having enough no matter how much is paid (more and more and more and more and more to come).