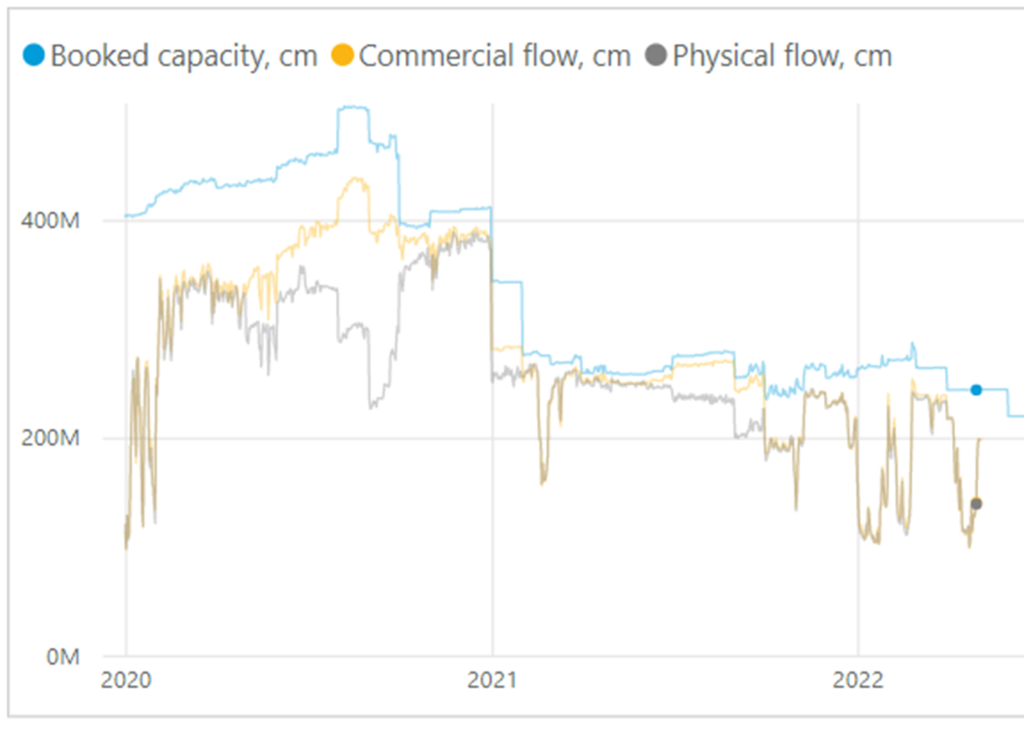

{May 11 update below] Russia’s natural gas suppliers continue to pay Ukraine’s pipeline operators to transport product to paying customers farther west (please see map below). As shown in the chart, bookings and flows have been roller-coastering, but recent volumes often remain within range of early 2020 and most 2021 levels (more from Reuters and S&P and NYT). Russia’s oil outputs have been harder hit by Western sanctions (more from the BBC). But at the right price, buyers can still be found. Quick price hikes for global fossil fuels following Western sanctions have been contained by China’s economic slowdown… and the potential of lower global demand (more). More stubborn demand equals more stubborn supply. Less stubborn can also generate symmetries.

May 11 Update: According to Bloomberg: “Ukraine’s gas network operator said late Tuesday it would stop receiving Russian fuel through the cross-border Sokhranivka station at 7 a.m. local time because it can’t control the infrastructure in the occupied territories. Russian gas giant Gazprom PJSC said it can’t reroute supplies to another entry point, Sudzha, because of how its system currently works. The development marks the first time the war in Ukraine has disrupted gas deliveries to Europe via the country. Russian gas had been flowing normally through both entry points despite the conflict, although most of the time at lower rates than the transit deal envisages.”