According to Bloomberg, “A.P. Moller-Maersk A/S, the world’s second-largest owner of container ships, said in a statement on Friday that it has instructed its vessels heading for the southern entrance of the Red Sea to pause their voyages. Its vessel Maersk Gibraltar was attacked. Shortly after Maersk’s announcement, Germany’s Hapag-Lloyd AG announced a halt until Monday…” (More and more.) According to S&P Global these two shipping firms account for a bit more than 21 percent of global container flows. Significant oil and LNG shipments follow the same route. S&P Global also reports, “The Bab al-Mandeb, which lies between the Horn of Africa and the Middle East with a narrow width of 20-mile, connects the Red Sea to the Gulf of Aden and the Arabian Sea. It accounted for 8.8 million b/d of total oil flows in the first half of 2023, according to the US Energy Information Administration. LNG flows through the strait were 4.1 billion cf/d during the same period, EIA data showed.”

December 18 Update: Several more carriers have announced they will avoid the Bab al-Mandeb — and therefore the Suez Canal. Here and here and here. Late Afternoon: Bloomberg reports, “From BP Plc to A.P. Moller-Maersk A/S, companies that transport consumer goods, commodities like coal and corn, and energy supplies face longer journeys. While there’s some slack in global supply lines to absorb the recent capacity strains, the sudden closure of the Suez Canal in 2021 showed how fragile networks are when major links break down.” Reuters reports, “The disruptions would likely affect supply of consumer goods ahead of the Chinese new year in particular, with delays leaving retailers with unsellable stock and ultimately driving up prices for consumers, said Marco Forgione, director general at the Institute of Export and International Trade.” S&P Global reports, “The US is seeking a regional coalition to secure Red Sea navigation, with a summit to be convened virtually Dec. 19, as a series of vessel attacks launched by Iranian-backed Houthi militia in Yemen has already prompted BP and several shipping companies to reroute cargoes.”

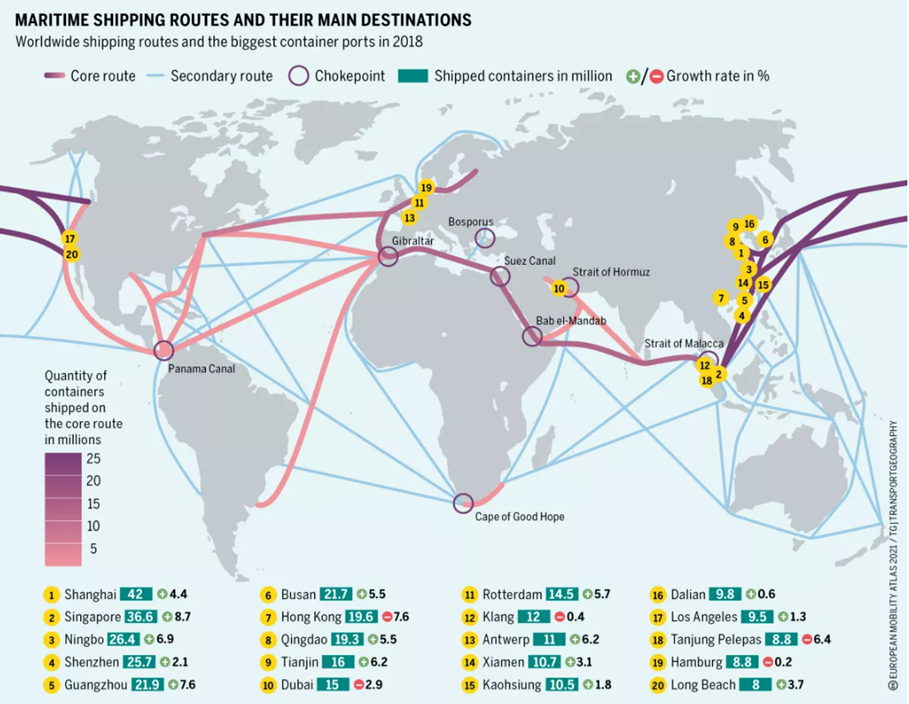

Risks associated with Bab al-Mandeb disruptions are amplified by continuing constraints at the Panama Canal.

December 21 Update: S&P Global Reports, “Although selling economics in the recent weeks for LNG was incentivizing supplementary cargoes to move from the Pacific to the Atlantic, heightened global tensions amid the attacks in the Red Sea have subdued redirecting cargoes between basins. Additionally, constraints with the Panama Canal has further worsened trading between basins and market participants battle the uncertainty in both the Panama and Suez canals… With traders now keeping cargoes within their respective basins, and demand still lagging behind, vessel availability has improved significantly since last month. While the number of available spot vessels in the Atlantic was steady week on week, it has nearly tripled since the end of last month till now. In the Pacific, vessel availability has risen slightly on the week and has nearly doubled since the end of November.” (More and more and more.)

December 22 Update: FreightWaves reports, “Current fallout from the Red Sea crisis is focused much more on container shipping than other vessel segments. Virtually all container vessels are rerouting around the Cape of Good Hope. Container ships that had already transited southbound through the Suez but had yet to reach the Bab-el-Mandeb Strait are now turning back, paying another toll to get to the Mediterranean. Numerous bulk commodity ships are heading to the Cape, as well, but not to the extent container ships are. That could change with a military escalation, which could increase reroutings across all shipping sectors.”

Bab al-Mandab strait into and out of the Red Sea (and Suez Canal)