Last week the North American Electric Reliability Corporation (NERC) released its 2023 Long-Term Reliability Assessment (not to be confused with the winter reliability assessment). Here’s the first substantive paragraph in full:

The North American BPS (Bulk Power System) is on the cusp of large-scale growth, bringing reliability challenges and opportunities to a grid that was already amid unprecedented change. Key measures of transmission development and future electricity peak demand and energy needs, which NERC tracks and reports annually in the LTRA, are rising faster than at any time in the past five or more years. New resource projects continue to enter the interconnection planning process at a faster rate than existing projects are concluded; this increases the backlog of resource additions and prompts some Regional Transmission Organizations (RTO) and Independent System Operators (ISO) to adapt their processes to manage expansion. Industry faces mounting pressures to keep pace with accelerating electricity demand, energy needs, and transmission system adequacy as the resource mix transitions.

While not the most elegant set of sentences ever written, this is a reasonable statement of what is happening as the old grid makes a paradigm-shift over the next decade-plus. Following are some choice cherries found in the report. I hope these will mostly motivate you to read the entire report.

Demand-Pull

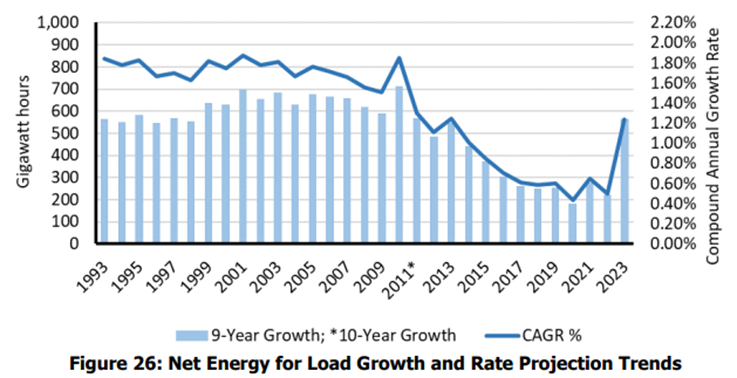

Electricity peak demand and energy growth forecasts over the 10-year assessment period are higher than at any point in the past decade. The aggregated assessment area summer peak demand forecast is expected to rise by over 79 GW, and aggregated winter peak demand forecasts are increasing by nearly 91 GW. Furthermore, the growth rates of forecasted peak demand and energy have risen sharply since the 2022 LTRA, reversing a decades-long trend of falling or flat growth rates. (See first chart below).

Supply-Push

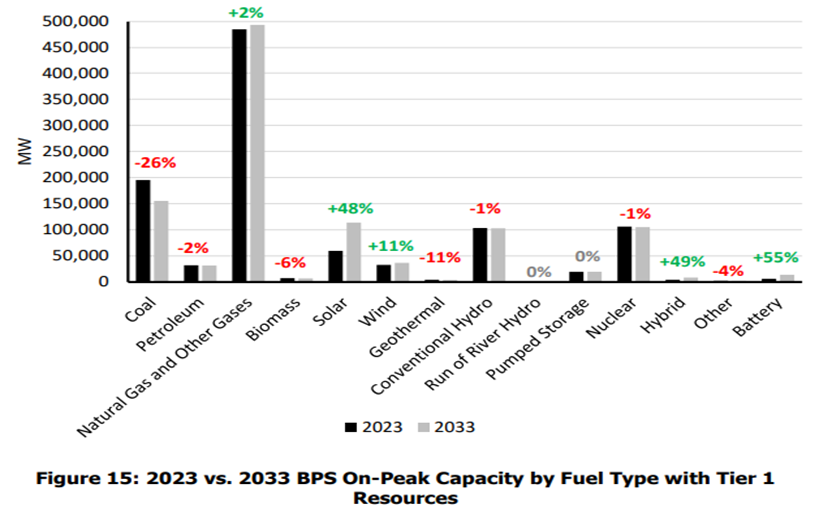

The total capacity of traditional baseload generation fuel types will continue to decline as older generators retire and are replaced with new generation that has different capacity characteristics. (See second chart below)… The change in resource mix is gradual. Over this 10- year assessment period, Thermal generation, which consists mainly of natural-gas-fired, coal-fired, nuclear plants, and hydroelectric power are projected to continue providing 85% or more of the BPS on-peak generation capacity… The pace of change in the resource mix is likely to be influenced by the addition of more wind, solar PV, battery resources, and the retirement of more fossil-fired generators.

S&P Global reports, “the assessment found a total power capacity increase of 34 GW over the next 10 years, with most incremental capacity coming from solar, while simultaneously new emissions regulations are likely to prompt further resource retirements.”

Channels

The amount of BPS transmission projects reported to NERC as under construction or in planning for construction over the next 10 years has increased, indicating an overall increase in transmission development. Siting and permitting challenges continue to inflict delays in transmission expansion planning. Regional transmission planning processes are adapting to manage energy transition, but impediments to transmission development remain.

S&P Global reports, “Olson (a NERC official) also stressed the importance of expanding the nation’s electric transmission capacity. To that end, NERC has been tasked with conducting a two-year study on the need for more interregional transfer capability with a final report due to the Federal Energy Regulatory Commission by December 2024… As new resources are often in different places than current resources and load behaviors are changing, it’s important that the transmission network is able to adequately serve needs.”

UtilityDive offers a stark summary for a very nuanced report, “Rising peak demand and the planned retirement of 83 GW of fossil fuel and nuclear generation over the next 10 years creates blackout risks for most of the United States… While most regions should have sufficient electricity supply in normal weather, both the Northeast and Western half of the U.S. face an elevated risk of blackouts in extreme conditions. And parts of the Midwest and central South areas could see power supply shortfalls during normal peak operations.”