The October Consumer Price Index cooled. According to the Bureau of Labor Statistics, “In October, the Consumer Price Index for All Urban Consumers increased 0.4 percent, seasonally adjusted, and rose 7.7 percent over the last 12 months, not seasonally adjusted. The index for all items less food and energy increased 0.3 percent in October… up 6.3 percent over the year…”

The Wall Street Journal describes this morning’s report as, “the smallest 12-month increase since January 2022. The reading was down from 8.2% in September. June’s 9.1% inflation rate was the highest in four decades.” Several stock market indices jumped with joy at this news.

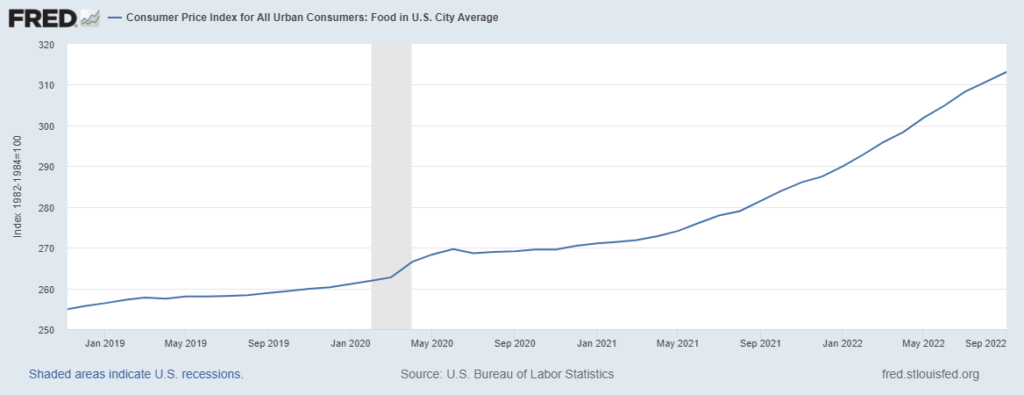

Specific to food (see chart below), the BLS reports:

The food at home index rose 0.4 percent in October, the smallest monthly increase in this index since December 2021. Four of the six major grocery store food group indexes increased over the month. The index for other food at home increased 0.9 percent in October, after rising 0.5 percent in September. The index for meats, poultry, fish, and eggs rose 0.6 percent over the month while the index for cereals and bakery products increased 0.8 percent in October. The index for nonalcoholic beverages rose 0.5 percent in October, after rising 0.6 percent last month. In contrast, the index for fruits and vegetables fell 0.9 percent over the month after increasing 1.6 percent in September. The index for fresh fruits fell 2.4 percent and the index for fresh vegetables fell 0.5 percent. The index for dairy and related products also declined in October, falling 0.1 percent.

As a supply chain guy my focus on inflation is rather narrow. I am mostly interested in what inflation suggests about the balance between demand and supply. Inflation signals an imbalance exists: there is more demand than capacity can currently fulfill and/or increased production/distribution costs are pushing retail prices higher. At some point persistent inflationary patterns will result in demand destruction.

As previously confessed (and complained about), I have been surprised that despite historically very high inflation, demand for Food-At-Home has remained well-above pre-pandemic levels even as Food-Away-From-Home purchases have fully recovered. Supply capacity for food (here and here) has incrementally increased, but remains challenged by consumer pull (here and here) that is elevated both nominally (as a result of inflation) and substantively (in terms of volume/value being consumed). Each month US consumers are continuing to spend at least 20 billion more inflation-adjusted dollars on food beyond pre-pandemic trends (this is much closer to trend than in January 2022, but still surprisingly high… seems to me).

Given the limits of wage-growth and the savings rate, I don’t see how this level of food demand can be sustained. I am not alone in this judgment, which is one of the reasons that food manufacturing capacity has not filled the gap. Sooo… to move closer to equilibrium, demand needs to decline just a bit more. Today’s CPI can be read to imply this is happening. The Personal Consumption Expenditures report later this month will be more directly informative.