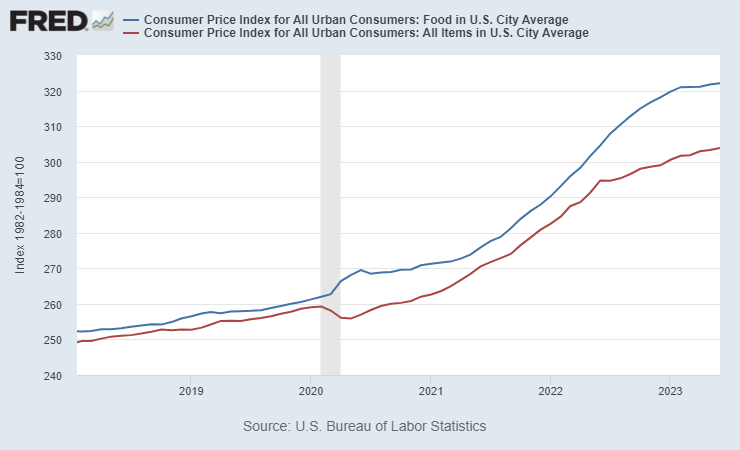

Since February US demand for food — especially Food-At-Home (groceries)– has moderated. The June Consumer Price Index suggests this trend is continuing (see chart below). As demand growth has flattened it has been easier to fulfill. Demand and supply — pull and push — are currently close to equilibrium. Yesterday the Bureau of Labor Statistics reported, “The food index increased 0.1 percent in June after increasing 0.2 percent the previous month. The index for food at home was unchanged over the month while the index for food away from home rose 0.4 percent in June.” Here are a few more details on Food-At-Home.

Two of the six major grocery store food group indexes increased over the month. The index for fruits and vegetables increased 0.8 percent in June, following a 1.3-percent increase in May. The cereals and bakery products index rose 0.1 percent over the month. The index for meats, poultry, fish, and eggs decreased 0.4 percent in June, as the index for eggs fell 7.3 percent over the month after falling sharply in May. The other food at home index decreased 0.2 percent in June after increasing 0.4 percent the previous month. The index for dairy and related products fell 0.3 percent over the month, and the index for nonalcoholic beverages declined 0.1 percent in June.

What I perceive is happening (though reasonable people can disagree) is that with the case of Food-At-Home, both costs and demand have increasingly stabilized. Meanwhile Food-Away-From-Home (restaurants, food service, fast food) continue to see higher costs, (especially related to wages) and increasing seasonal demand. As a result, the greater pull on constrained push generates more price pressure (aka inflation) for FAFH than for FAH. (More and more and more.)

+++

July 14 Update: According to Bloomberg, “In food, overall units sold are down 2% this year, with some of the biggest declines coming in frozen meals, fruit juice and soup.”

July 15 Update: There are many factors that influence food purchases. I am inclined to focus mostly on “demand capacity” which is closely related to both real and perceived wage growth (or the opposite). Nominal wages have been increasing at a rapid rate (see chart below), but not always as sharply as increased prices (inflation). During May and June wages have outpaced inflation (here and here and here). According to Marketplace, “In May, wages just barely outpaced inflation by 0.2%. But in June, wages grew 1.2% faster. And while two months do not a trend make, this still feels significant. It’s a sign of a healthy economy when wages grow faster than inflation.”