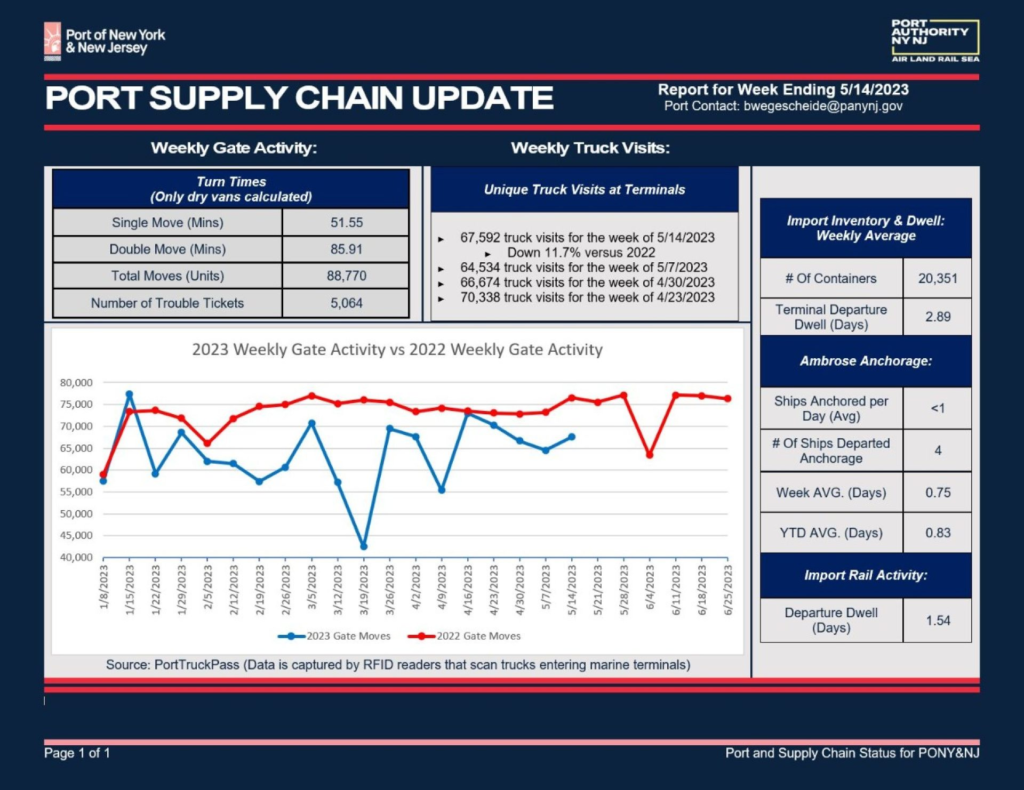

According to Loadstar, “US west coast ports saw a 22% decline in container imports in April, compared to the record volumes of the previous year, to 812,611 teu… the top US east coast ports saw a 20% dip in container imports to 887,950 teu, to take the total of import containers handled by the Top 10 US ports to 1.7m teu in April representing a 21% fall on the same month of the previous year.” See chart below for Port of NY/NJ.

In its May 4 retrospective on first quarter 2023, AP Møller-Maersk reported, “… the trends observed in Q4 2022 continued in Q1 2023, with normalisation in Ocean and Air being accentuated by a strong destocking affecting volumes across all segments. Results continued to come off their Q3 2022 peak with a decrease in revenue year-over-year of 26% to USD 14.2bn (USD 19.3bn). ” Maersk loaded nearly one-tenth fewer containers in the first quarter this year than in 2022 (more).

Maersk expects that January-March will be its best quarter of 2023 with volume declines bottoming by the end of June.

According to the Financial Times the global collapse in container volumes (admittedly from a high peak) is hitting container manufacturers very hard, “production of 20-foot equivalent units — the industry’s standard size for a container— fell by 71 per cent from 1.06mn to 306,000 between the first quarter of 2022 and the same period this year.” Over 90 percent of shipping containers are manufactured in China. (More and more.)

Reduced demand is the principal cause of reduced volume of container flows. Velocity has also been slowed and a bit scattered by curtailed sailings, reduced speeds, and — even — drought impacting Panama Canal throughput (more).