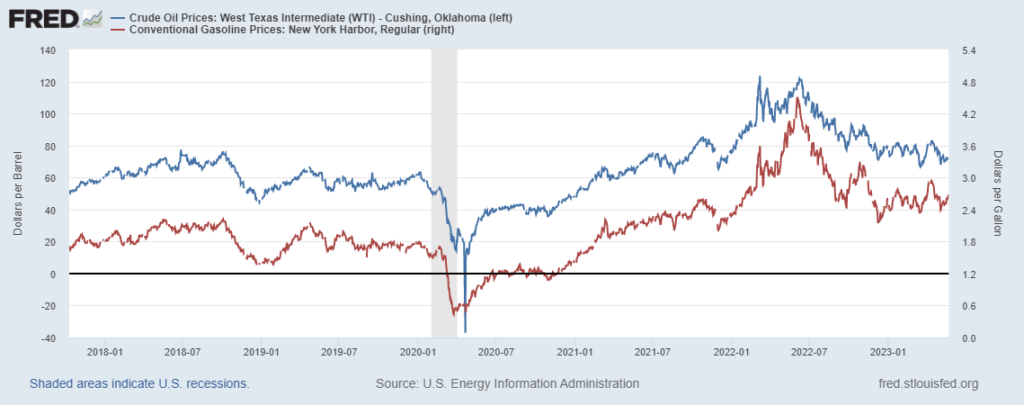

EIA and S&P report, “US crude inventories fell 12.5 million barrels the week ended May 19 as refiners continued to boost runs while export demand remained strong.” See first chart below (more). This includes the US recently increasing its flow of diesel to Europe. According to Bloomberg, “cargoes from the US are set to be the highest since August 2020.” Steady demand for fuel plus reduced inventories pushed WTI and related crude oil prices slightly higher this week, despite global demand still being in the doldrums and plenty of arguments for demand to continue to be constrained. Downstream product prices as usual are tracking upstream behavior. See second chart below and much more from EIA.