US retail sales increased slightly (0.4 percent) in April, according to the US Census Bureau… not adjusted for inflation.

Reuters headlined “solid spending.” CNBC emphasized the increase was “less than expected.” Bloomberg called it “steady.” (Solid and steady appeared in several summaries.) The Associated Press headlined an explanation for the growth: “buoyed by solid job market and declining prices in some areas.”

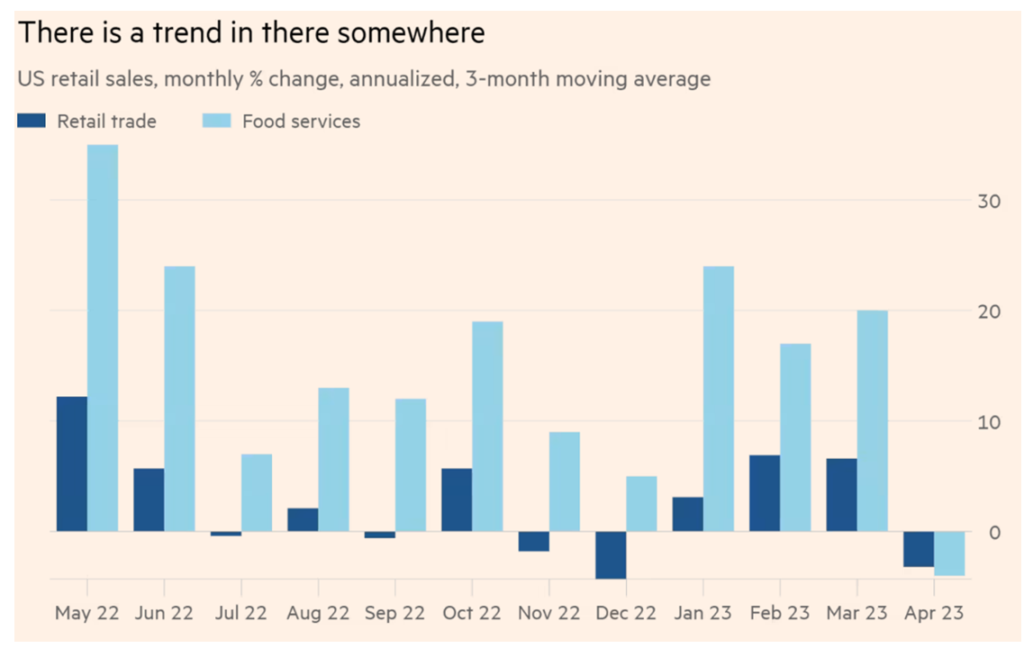

Writing in today’s Financial Times, Robert Armstrong highlights ambivalence, “The government’s retail sales report will not do much to clarify things… The April numbers came out yesterday and, compared with March, the numbers were better than expected — up 0.4 per cent, or 0.7 per cent without cars, car parts and gas. But the monthly numbers are volatile. The strong April follows a weak February and March, and an amazingly strong January.”

Related stories reference increased credit card debt (more), ballooning and looming student loan payments, and a still strong, but softening job market as good cause for skepticism regarding the future of “steady spending.” (And to reinforce ambivalence, here’s an alternate angle.)

This blog is especially interested in food consumption patterns. The first chart below is the Food-At-Home retail sales slope. In nominal dollars, US consumers are spending about one-fifth more on groceries than April 2019. But we have finally stopped spending more each month. (PCE food-at-home does a better job of giving us real slopes.) The second chart below, developed by Armstrong and others at the FT, shows us how the rate-of-change in late-pandemic retail sales has been highly dependent on spending at food service places (or Food-Away-From-Home).

Early 20th Century psychologists (usually starting with German vocabulary) gave us an understanding of ambivalence as “simultaneous conflicting feelings.” This is more or less a pejorative term with implications for uncertainty, indecisiveness, almost becoming a synonym for ambiguous. I prefer a more literal Latin derivation: both are strong, all around is vigorous. There are contending strengths.

Which strength will prevail or how will multiple strengths be conjoined? I agree it is not yet clear. Threats are certainly percolating. But these contending strengths offer opportunities. While demand growth is slowing, effectual demand for many flows remains quite high. Fulfilling such significant demand — with less volatility, up or down — can be a very constructive context for efficient, effective — even resilient — supply chains.