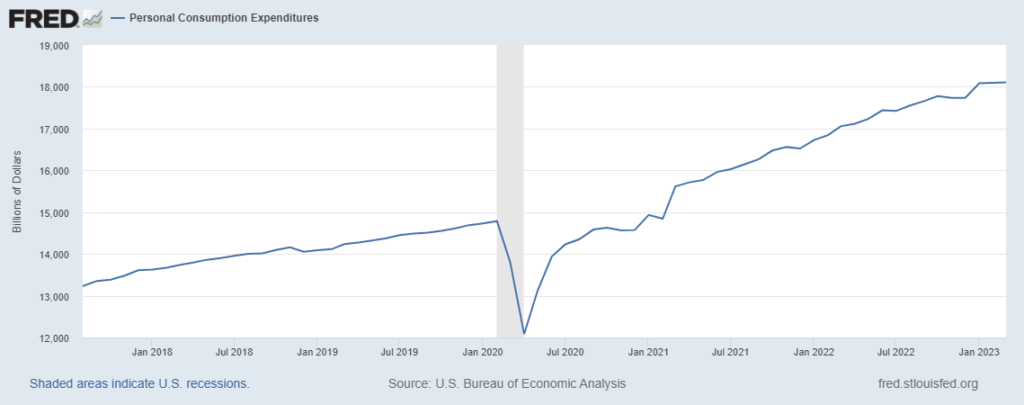

March Personal Consumption Expenditures suggest an essentially flat first quarter for pull. Please see first chart below.

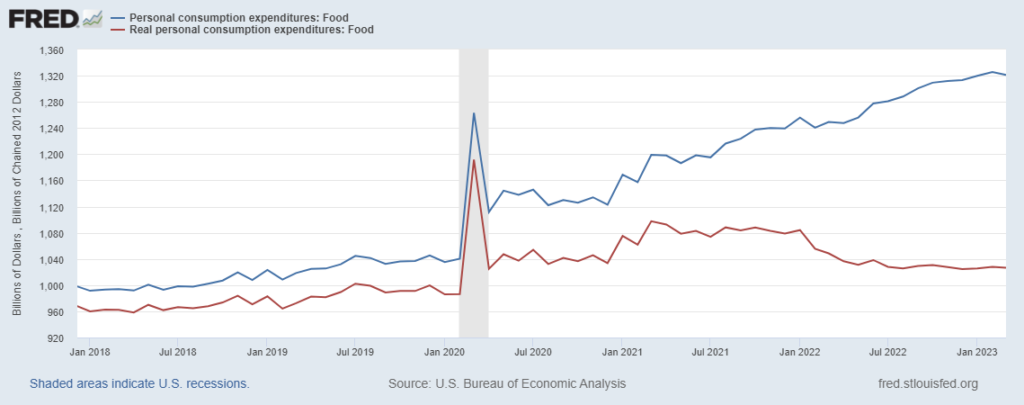

For the first time since April 2022 nominal food consumption was slightly softer (real expenditures as well, red line in second chart). Reduced SNAP benefits almost certainly played a part.

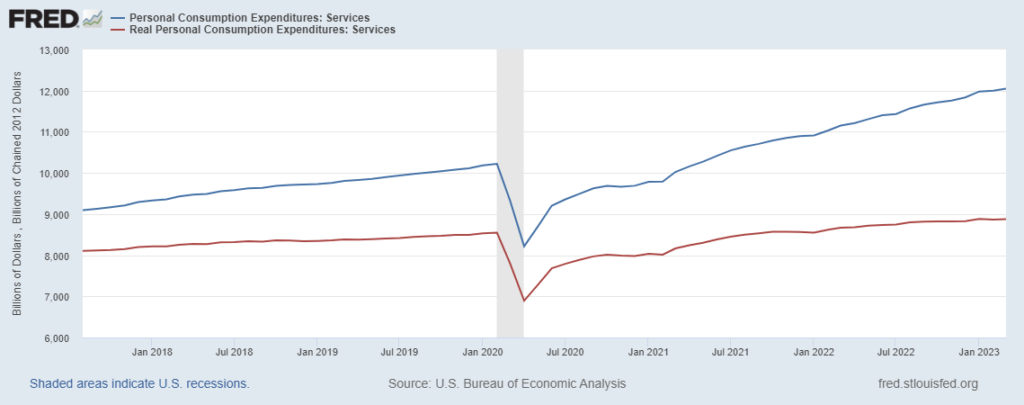

Even services seem to have been slightly less enticing in March (please see third chart below).

Most media and market analysts look at PCE results to reckon inflation’s trajectory and possible credit tightening (here and here). The implications for supply chains are, perhaps, more encouraging. “Real” consumption remains robust. Given the comparatively high level of consumption expenditures, flat growth is sustainable, potentially profitable, and better than the reverse.

Consumption has been soft in the Eurozone (more). China’s current demand dynamics remain uncertain. Tomorrow is the start of a five day holiday in China. Spending over the next few days may deliver some insights regarding the prospect for more or less pull over the next few months.

[To which a reader promptly provided this rebuttal regarding China’s potential holiday spending surge. The Bloomberg report includes: “People are still not confident in the strength of the recovery. CPI remains muted and the jobless rate stays elevated,” said Wang Huan, fund manager at Shanghai Zige Investment Management Co., adding that an increase in tourists may not necessarily translate into revenue growth.” Then shortly before midnight on Saturday, I received another Bloomberg blurb suggesting something less than strong pull from China any time soon according to the April Purchasing Managers Index.]

+++

May 2 Update: Early reports on consumer spending during China’s Golden Week are reminiscent of “revenge spending” seen in other economies as each emerged from pandemic restrictions. See here and here.

May 4 Update: The Financial Times reports that China’s holiday spending has recovered pre-pandemic levels. “China recorded 274mn domestic trips over the five days to Wednesday, according to the Ministry of Culture and Tourism, 71 per cent higher year on year and 19 per cent higher than in 2019.”

May 8 Update: The Financial Times reports that regardless of May Day holiday spending, the pace of China’s recovery is slower than some expected. Included in the FT report: Tim Ryan, US chair of PwC, noted in an interview that US companies’ awareness of “concentration risks” in China had grown from the tariff battles early in Donald Trump’s administration to the supply chain disruptions caused by the pandemic. “To be clear, I’m not seeing a decoupling” between the US and China, he said. “What I am seeing is more attention to how do you manage risks. What’s happened in the past couple of weeks is more validation that they need to continue to manage risks.”

May 9 Update: Bloomberg reports, “Overseas shipments expanded 8.5% from a year earlier to $295 billion, the customs administration said Tuesday in Beijing — slowing from the double-digit gain in March. Imports, though, dropped 7.9% to $205 billion, much worse than the median projection of a 0.2% decline.” The year-over-year volatility should not obscure that exports remain almost one-sixth above pre-pandemic and imports are about 12 percent higher than April 2019.