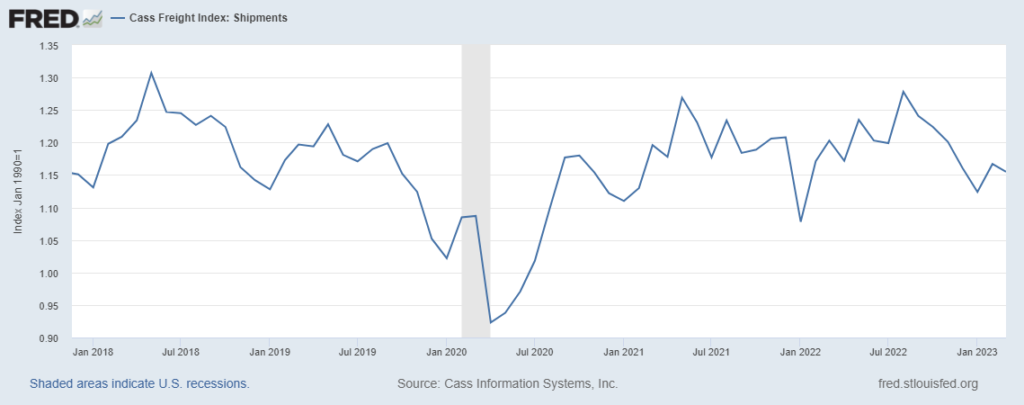

Last week UPS “announced first-quarter 2023 consolidated revenues of $22.9 billion, a 6.0% decrease from the first quarter of 2022. Consolidated operating profit was $2.5 billion, down 21.8% compared to the first quarter of 2022, and down 22.8% on an adjusted basis. Diluted earnings per share were $2.19 for the quarter; adjusted diluted earnings per share of $2.20 were 27.9% below the same period in 2022.” During a teleconference with financial analysts, Brian Newman, the CFO, explained, “In the first quarter, we expected average daily volume to decline between 3% and 4%. For the quarter, average daily volume was down 5.4% year-over-year, primarily because volume in March moved lower than we expected.” This is consistent with other freight market measures (for example, see first chart below).

Freight demand is down in the United States and in most of the world (here and here). Less pull prompts less push. Demand (even for durable goods, see third chart below) remains considerably higher than pre-pandemic patterns. But three consistent months of declines in durable goods purchases — from high levels in the context of purposeful demand destruction via North American and European monetary policy — does not support prospects of a swift bounce-back. In terms of future flows, last week the UPS CFO noted, “The biggest change in terms of the base case versus downside is the volume. We were looking at volumes of down one percent in the base case, and now we’ve pivoted to the downside of down three percent. “

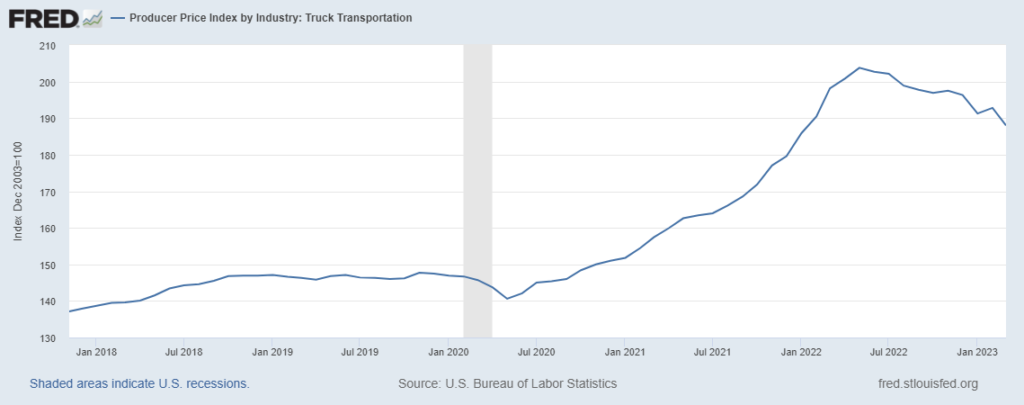

On Friday FreightWaves headlined a “trucking bloodbath.” According to this report:

America’s $875 billion trucking industry is struggling. The number of authorized interstate trucking fleets in the U.S. declined by nearly 9,000 in the first quarter of 2023… Folks throughout freight — from CEOs to truck drivers to dispatchers — are raising red flags about a downturn that could go in the history books. J.B. Hunt President Shelley Simpson wrote in a LinkedIn post recently that the current conditions remind her of 2009, which was the longest and most brutal freight recession of the 21st century.

Year-Over-Year spot rates reinforce the sense of dread. Flat bed rates are down nearly one-fifth. Both van and reefer spot rates are down more than one-quarter. (More and more.)

But what seems like a bloodbath to some is a process of “normalization” for others. Two weeks ago J.B. Hunt also hosted an earnings call. The freight firm’s President pronounced a “freight recession”. The executive team assiduously avoided offering any formal forward guidance. But CEO John Roberts clearly does not feel trapped in a movie by Sam Peckinpah or Quentin Tarantino:

Well, I think the real question is the timing… it’s not really a question of if the freight demand will come back to normal. It’s just really a question of when… And so, if we look at where we are right now, and we think, oh well, maybe this time we didn’t quite get that right. That’s going to be part of the reality that we live in. And because we have the experience and because the folks that are around this table have made mistakes and made good decisions, I think we’re really just questioning how we — how we time our reentry into a more normalized system… Those things are teaching us that we’ve got to be a little bit more fluid… while we get to that other side which we know is not a question of if it will present itself but when. So we just have to be patient and careful and thoughtful.

Global and US freight markets have been anything-but-normal for at least three pandemic-punctuated years. A prior year (2019) featured an accelerating US-China trade war that had already skewed pattern expectations. John Kemp at Reuters has put together a chart book that highlights the challenges of accurately perceiving reality or even conceiving what a normal freight market might mean anymore. (Please see Yossi Sheffi’s The New (AB)NORMAL.) The same data that looks awful month-over-month can look fine year-over-year and, sometimes, fantastic over five years. Perhaps paradoxical is the new normal.

The global economy is undergoing significant shifts in terms-of-trade, cost-of-credit, energy flows, demand patterns, sourcing behavior, inflation, and much more. Fundamental structural changes are likely. The war in Ukraine is skewing agricultural, energy, and many freight markets. The war’s global impact will almost certainly loom larger in 2023 than during the war’s first year. The prospect of war(s) in East Asia is a veritable crash of gray rhinos grazing entirely too close. The extreme effects of climate-related shocks accumulate as systemic stresses reflected in mass human migration, political turmoil, economic uncertainty, and immediate human suffering. We should now better recognize pandemic probabilities. Combine these risk factors with an increasing proclivity for political self-subversion and normal seems rather elusive.

Freight movements are the most obvious expressions of supply chain flow. Current US and global freight capacity is robust — potentially even a bit excessive. Near-term (through September) pull prospects are more uncertain than usual. Credible arguments can be set-out for either increased or diminished freight demand over the next few months. Since widespread use of steamships and railways, the behavior of high volume, high velocity freight flows have usually increased (here and here). More has been normal — not always year-over-year, but consistently decade-over-decade. Given human aspirations and potential, more flow is likely. But there is “a real question of timing”, related adaptability, and strategic evolution by freight carriers, shippers, and receivers.

Both murders and births can be bloody.