Here again is my irregular update on five subsurface indicators of supply chain fitness that may help us anticipate the next six months or so.

Southern Hemisphere Agricultural Production: Argentina’s crops are in trouble (more). But Brazil is expecting bumper crops, especially of soybeans (more). Argentina is even buying from Brazil to fulfill its domestic needs. Western Australia crop yields are pushing that nation’s wheat exports toward an all time record. (Even while Ukraine’s flows slow and US wheat exports are less price competitive.)

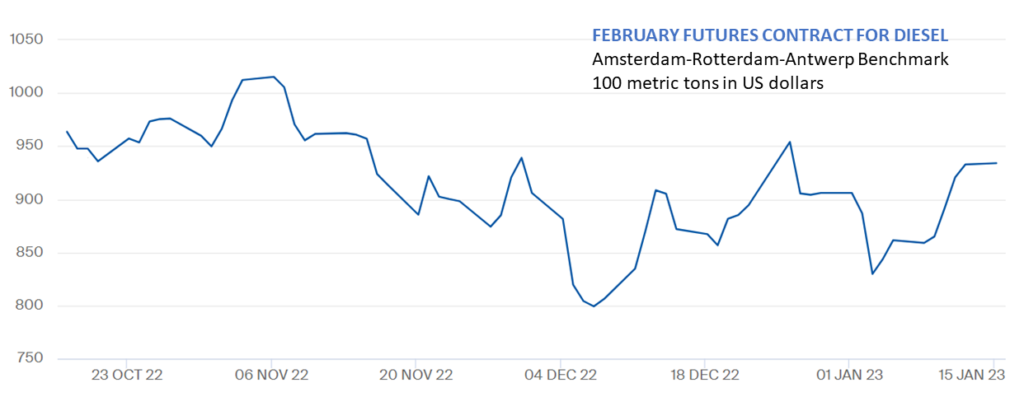

Global Diesel Demand, Production and Price: Reuters reports, “European traders are rushing to fill tanks with Russian diesel as the clock runs down on a Feb. 5 European ban expected to tighten supplies, redraw global shipping routes and increase price volatility.” (more and more). US diesel stocks have been slightly lower, especially as exports respond to European demand and freezing weather constrained end of year production. Global flows of refined product — including diesel — are being supported by Russian oil being processed by India and China. S&P Global reports, “With India becoming the largest buyer of Russian crude in late 2022 and China posting close to double-digit growth in Russian inflows over January-November, refiners in South Korea, Japan and Thailand are finding it easier to procure term and spot crude supplies from Middle Eastern producers…” The February benchmark price for European diesel is moderately higher, off a low early January starting position (see chart below).

Covid Hospitalizations (and mutations): While there is a “new” highly transmissible variant making the rounds, for many nations hospitalizations have fallen from a New Years peak. The situation in China is emergent. Please see here for several updates from January 5 until today. My best guess is that by this time next month (post-Lunar New Year) we will have a more confident sense of China’s health outcomes. The implications for global health — good or bad — might take a few weeks more to confirm (and mutations are ubiquitous). See January 20 Update below.

China’s Export Volumes and Value: As reported in my end-of-year update China’s exports have declined considerably in 2022. December results were almost ten percent below 2021 as valued in US dollars. Earlier today China’s National Bureau of Statistics confirmed an accelerated decline in population plus comparatively anemic 2022 GDP growth of 3 percent (more and more and more).

North American Electricity Supply and Demand: The Christmas eve crisis that impacted several US electric utilities has continued to resonate (more and more and more). There were significant financial costs to fulfill higher-than-expected demand (more). Extreme weather in California has reinforced concerns. At the end of November I wrote regarding grid continuity, “The worse this winter’s weather, the more cause for worry.” But even I was surprised to see PJM — and the Eastern Interconnect — experience such a very close call.

Food and fuel flows are doing much better than widely expected just three months ago. More evidence is needed before assessing covid trends. China’s economic performance confirms the slow-down in global goods and wealth flows. Recent experiences of the North American grid reflect our amplified risks as legacy infrastructure and transitioning from fossil fuels encounter amplified extreme weather. In terms of current Supply Chain Resilience we have robust and resilient flows with plenty of early warning signs for mitigation investments.

+++

January 20 Update: Bloomberg reports, “The sudden dismantling of China’s Covid Zero restrictions in December means hundreds of millions of people are headed home for the Lunar New Year holiday for the first time since 2019. The crush of travel risks supercharging the world’s biggest Covid outbreak, spreading it to every corner of the country… ” (More and more)