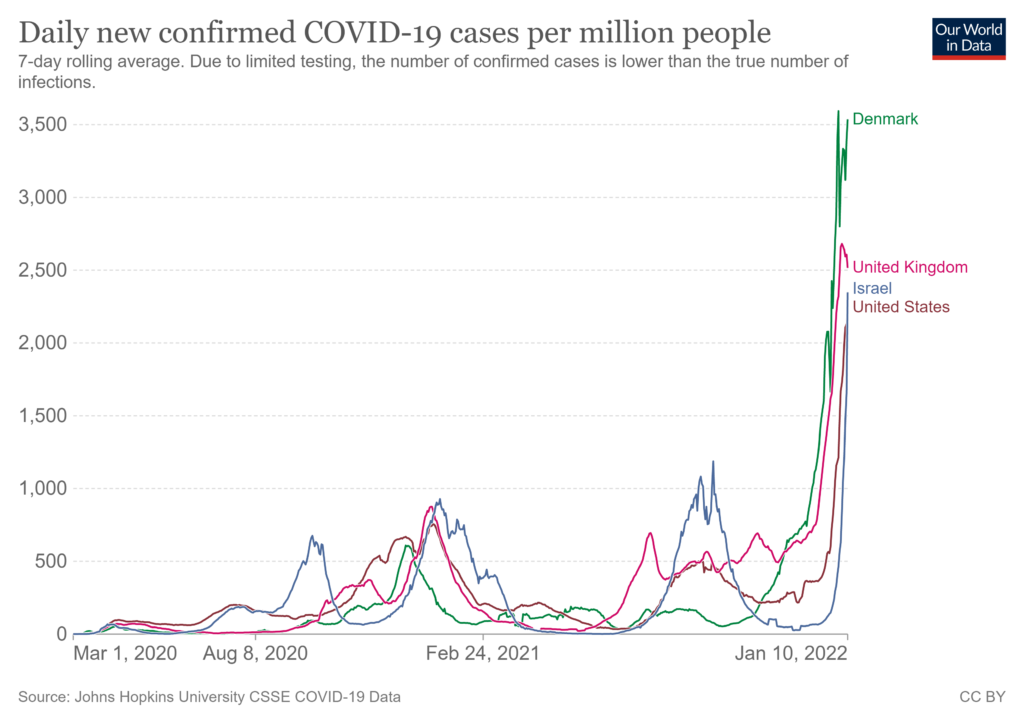

Global and US covid case counts continue to surge (see first chart below). According to Reuters, yesterday (Monday, January 10) the United States reported 1.35 million new infections. Monday counts are usually higher. The seven-day average is closer to 700,000 per day, still plenty high. Given the US testing context, even these record-high numbers are material undercounts.

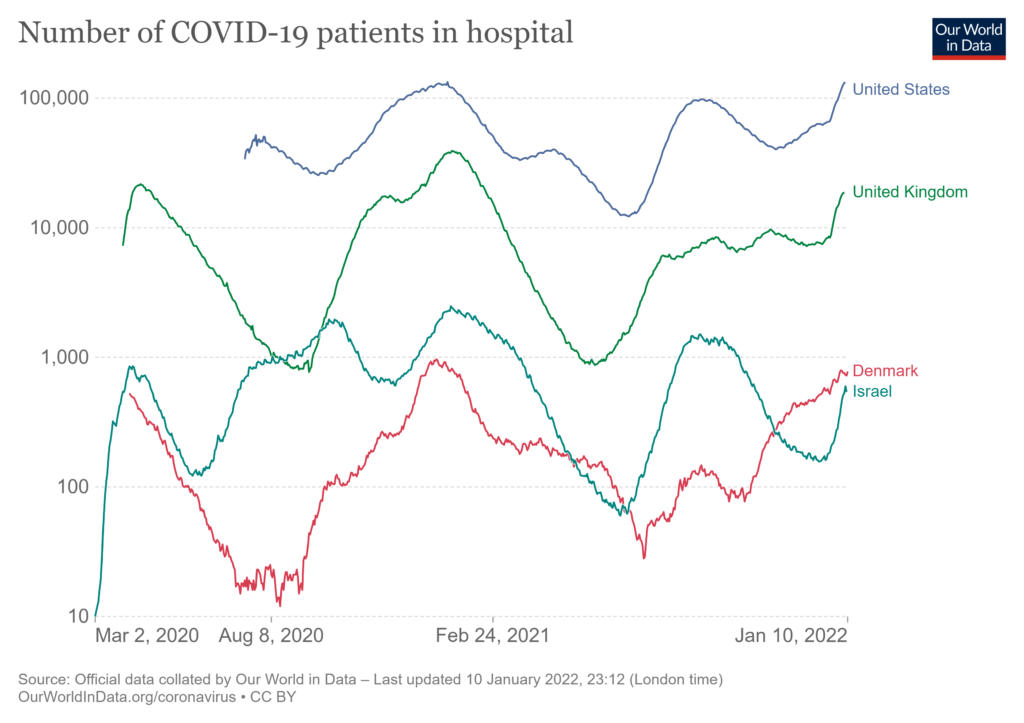

US hospitalizations (a much harder number) have also hit a new high and will continue higher, exceeding the worst numbers from January 2021. Yesterday there were at least 136,604 residents of the United States hospitalized with covid (more). Some of these are not hospitalized for covid. But covid hospitalizations outside the United States (see second chart below) — and clinical challenges inside many hospitals (more) — confirm that omicron can be a serious health threat, especially for the unvaccinated. Accumulating evidence indicates that on-average omicron causes a milder version of covid. But omicron is so contagious that the numbers falling outside this average are flooding the healthcare system.

Related workplace absenteeism is increasing (more and more and more). As cases and symptoms escalate, more nurses and teachers and truckers and grocery and many other workers will become sick. The percent of cases with significant symptoms is likely to be much lower than before, but overall numbers will be as high or higher. So, flows of services and goods will slow. Shelves will not be refilled as quickly or as fully. Some nervous buying is predictable. Supply will more frequently not fulfill demand.

For how long? Please consider UK case counts on the first chart below. Counts are still high, but now declining from a peak. This mostly reflects a significant decline in metro-London’s case counts since New Year’s Eve. Some are suggesting NYC may now be approaching its peak. In much of the United States over the next two or perhaps three weeks, store shelves are likely to show symptoms of omicron.

This will be a treacherous time. Well-established, high-volume, high-velocity flows are predisposed to persist. Per evidence of the last two years, I will not bet against the creative adaptability of US supply chains. But the margin for error is as tight — probably tighter — than any period since March 2020. Local conditions, say a blizzard, week-long atmospheric river, earthquake, significant cyber-complication (you know the all-hazards drill), could suddenly transform bad into much worse.