[Important updates below] The summer solstice is forecast to bring triple digits to wide areas of Texas with the heat index rising above 110 F for three consecutive days in many places including metro-Houston, Austin, and most of the Texas Triangle.

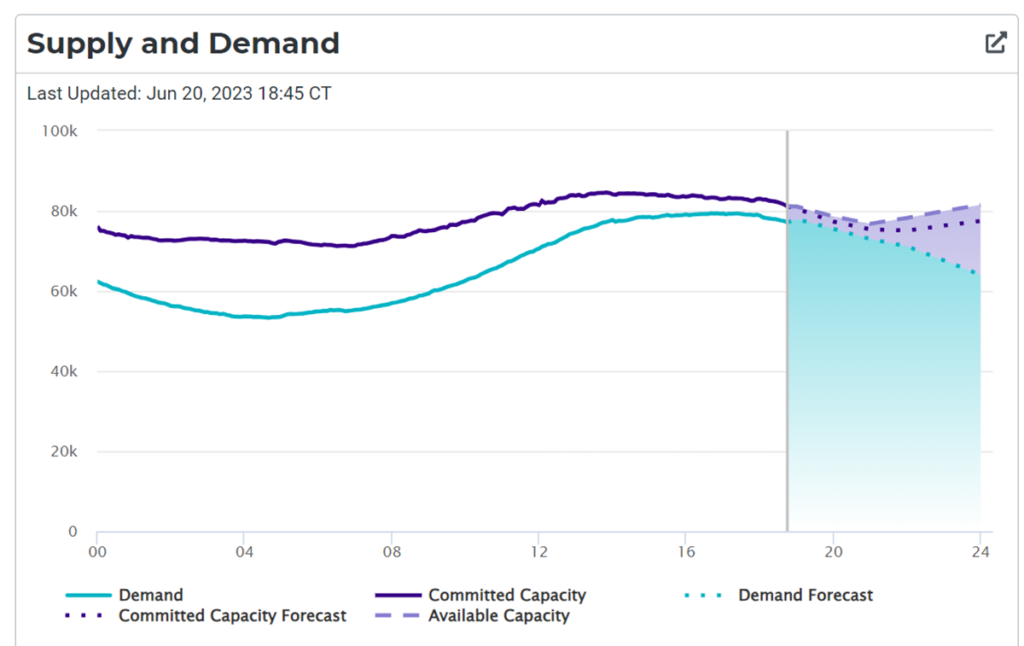

The Electric Reliability Council of Texas (ERCOT) has announced a “Weather Watch” through June 21. Grid capacity, supply, and demand can be monitored at the ERCOT dashboard. The Houston Chronicle has published a helpful primer on how to interpret the dashboard’s outputs.

S&P Global offers its own Texas forecast for next week including, “The load forecast keeps changing and has had a great deal of error due to unpredictable convective risks,” said Campbell Faulkner, senior vice president and chief data analyst at OTC Global Holdings, an interdealer commodity broker. “What will determine if load records are broken will be if the high pressure heat ridge intensifies in a way that the various weather models are currently struggling to nail down. But ERCOTs price sensitivity to heat load became very clear last year due to issues with being able to cleanly forecast both solar/wind output and gross line congestion across the system.”

ERCOT’s electric generating capacity is — or should be — sufficient to meet historical demand. There is, however, real risk of demand exceeding its historic parameters. There is also the risk of losing capacity inputs at just the wrong time and place. The risk of “gross line congestion” can be an even more insidious factor. As this blog noted a few days ago, Texas and the entire US grid needs many more “major high-voltage power lines that connect different grid regions.” (More and more)

According to the NERC Summer Reliability Assessment:

Given an Anticipated Reserve Margin of 23% and Reference Reserve Margin of 13.75%, ERCOT expects to have sufficient operating reserves in expected normal summer system conditions… ERCOT’s probabilistic risk assessment indicates a low probability of energy emergency conditions during the summer peak load period, but the risk increases into the early evening hours due reductions of solar PV generation. There is a 4% probability that ERCOT will declare an EEA1 [Energy Emergency Alert 1] during the expected daily peak load hour increasing up to 19% probability at the highest risk hour ending at 8:00 p.m. System stability and strength stemming from the growth of IBRs [Inverter Based Resources] remains a concern. ERCOT is also experiencing large increases in renewable production curtailments due to transmission constraints, and these curtailments are increasingly occurring at solar PV sites.

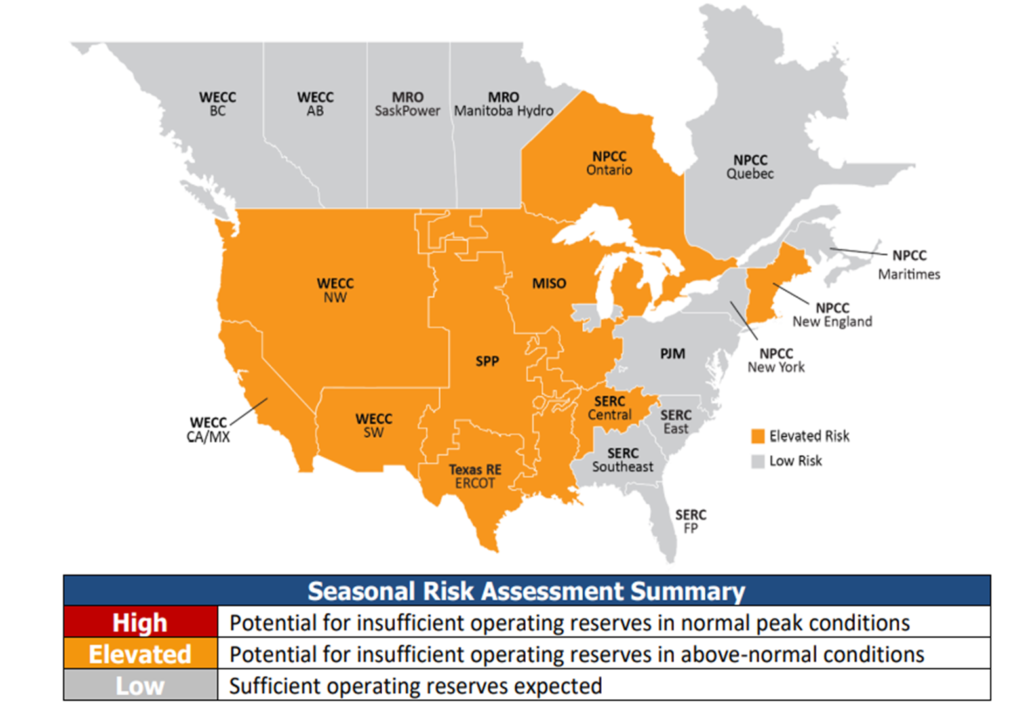

This is not just a Texas problem. This blog has given particular attention to the risks emerging from last year’s Christmas Eve surprise that impacted some of the most robust and resilient regional grids (more). According to the Summer Reliability Assessment, six other sectors of the North American grid have lower Anticipated Reserve Margins than ERCOT (in case of high demand, outages, and derates). The particular problem areas are shown in orange on the map below.

As they say, this is a developing story. Look below for more next week.

+++

Saturday afternoon additional comment: A couple of readers have wondered about my focus on Texas heat rather than a possible Caribbean hurricane. I am watching the NHC forecasts too. But — right now — I am more attentive to Texas because we have a much more precise sense of force-on-target (even measurable force on concentrated capacity) than is yet possible for so-called Disturbance 1. In response-mode Supply Chain Resilience is mostly about recognizing if and how crucial capacity concentrations will be impacted and taking mitigation action. By Tuesday it may be possible to give similar attention to capacity concentrations in both East Texas and the Eastern Caribbean.

June 20 Update: Today’s Texas temperatures — and heat index — will still be tough. But at least early this morning, this week is now not expected to be quite as extreme as forecast and less troublesome than what is now forecast for next week. In the Caribbean, Bret is strengthening but force-on-target is still not predictable. A further update as of midday: The anticipated capacity deficit has now been discerned as unfolding in real time. ERCOT has warned of a “projected reserve capacity shortage with no market solution available” after 1500 hours Central Time today. Consumers are requested to reduce demand. Part of what is happening is the Houston forecast of 101 F has now been ratcheted up to 103 F. Austin may hit 106 F. Without reduced consumer demand, rolling black-outs may be instituted. (More and more and more.)

June 21 Update: The Texas grid avoided the worst… one more time. As the following chart suggests, it was a close. Demand for electricity hit new records on both Monday and then on Tuesday. But it also appears that many consumers cooperated with requests for voluntary reductions in demand. It could — easily — have been worse. (More and more and more.) Mexico is also facing similar capacity-challenging demand. TS Bret is about to peak and then degenerate… without impacting significant aspects of concentrated capacity.