Here are just a few of a recent flood of related headlines:

Port Gridlock Stretches Supply Lines Thin (Bloomberg)

America is Running Out of Everything (The Atlantic)

Global Supply Chain Problems Escalate (Wall Street Journal)

The Supply Chain Crisis and US Ports (The Financial Times)

The Global Supply Chain Nightmare is about to get Worse (CNN)

America’s Broken Supply Chain (Washington Post)

Grocery’s Biggest Players Seek to Reassure on Holiday Supply Chains (Grocery Business)

Despite the intense attention, none of this is new. Supply chain friction has been accumulating for many months — as well reported by each of the news organizations linked above. But the prospect of Santa’s supply chain failing for this Christmas has evidently become a source of civilizational angst. Accordingly last week the White House gave supply chains some sustained attention (and here and here).

Beyond this year’s fads (whether for children or not), what is really happening with our demand and supply networks?

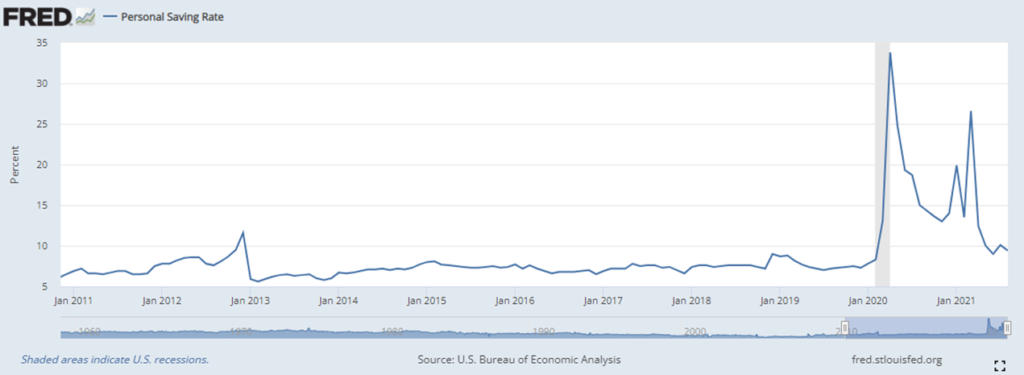

On October 15 the US government reported August sales of $1.68 trillion (“the combined value of distributive trade sales and manufacturers’ shipments”), compared to 2020 August sales of $1.44 trillion and 2019 August sales of $1.50 trillion. Despite this strong spending, the US savings rate remains above nine percent, almost two percent higher than decade-long averages. US demand is strong and has the potential to stay strong for several more months.

Every product category tracked for the broadest sales indicator shows increases from August 2020, especially for food and beverages. The pandemic prompted significant growth in 2020 grocery sales. Just a bit above $72.5 billion in food and beverage sales for August of last year was more than $5 billion better than 2019. August 2021 sales beat 2020 by another $4 billion (now helped by expanding restaurant sales). There are currently spot stock-outs of some grocery items. Given the context, that should not surprise.

Stock-outs are, at least in my mind, different than shortages. We are producing and importing more than ever before. American (and other) consumers apparently want even more. Inventories are often lean or even anorexic. But is it more helpful to say supply is short or demand is strong? There is a disequilibrium of supply and demand. What helps us better perceive and potentially deal with the causes?

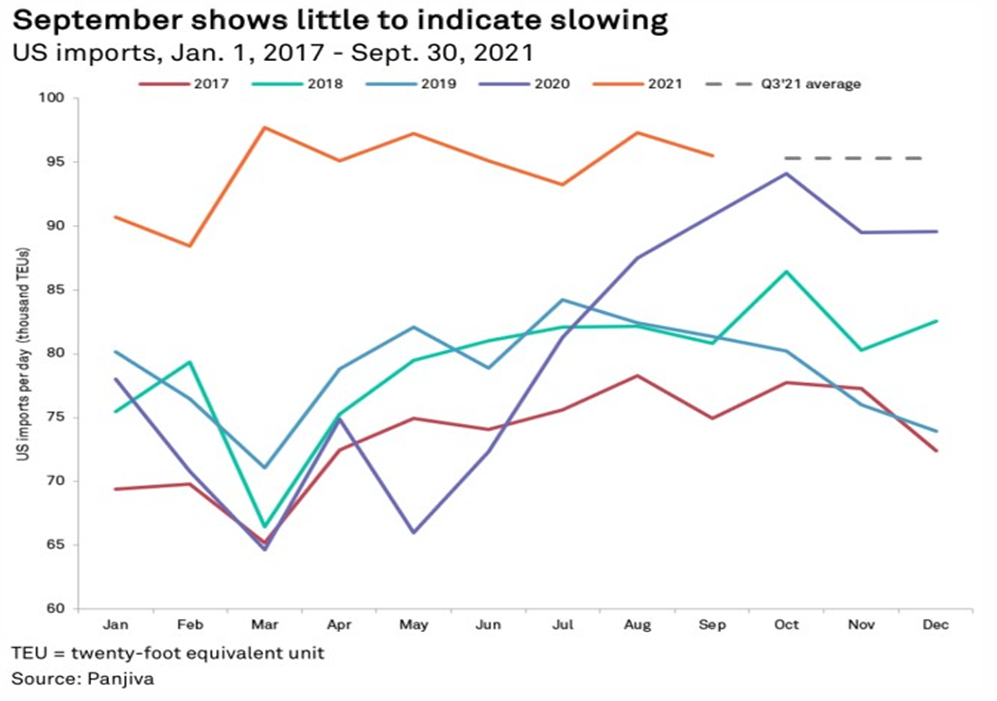

The delayed discharge of containers at the Ports of Los Angeles and Long Beach has received generous attention. There are dramatically obvious problems with dock density, operating hours, and overall port congestion. Still… in 2018 the Port of Los Angeles moved a record-breaking 9.45 million containers. In 2019, with trade-tensions constraining flow, this dropped to 9.33 million containers. The 2020 pandemic contributed to a further drop to 9.21 million containers (mostly due to loss of flow in February to May). Through August 2021, the port has moved 7.27 million containers — thirty percent more than by August 2020. The port of LA looks very likely to break its 2018 container record.

More broadly — and for better or worse — the United States is well on its way to importing more volume in 2021 than ever before. According to S&P Global:

Imports to the U.S. by volume grew 5.1% year over year in September, continuing the logistics surge that has caused congestion in ports across the country. This was slower than in previous months but 17.4% higher than September 2019. The comparison with 2020 is now exceptional for a different reason — this time, it is against a post-pandemic surge rather than lockdown-related lows. September also brings the growth rate for the third quarter to 10.2% year over year, or 15.3% compared with the third quarter of 2019. There was an average of 95,341 twenty-foot equivalent units per day in the third quarter. If imports remain at this level, the fourth quarter is expected to show a growth rate of 4.7% year over year, exceeding the record-breaking 2020 holiday season.

Demand is, well… demanding. To fulfill this demand, many flows moving toward demand have increased one-fifth to one-third above pre-pandemic baselines. This sudden and substantial increase creates problems. The number of docks with cranes has not increased nor has the number of trucks. Even comparatively rapid expansion of warehouse square footage has not increased as much as demand. There are also challenges hiring truckers and warehouse workers and many others on which efficient flows depend. But flow volume is still higher, not lower than 2019.

While demand is pulling hard and flow is pushing hard, what about upstream production capacity? As with flow, unusually swift shifts in demand have created several problems. The sudden slow-down in demand for older-version automotive semiconductors in the first half of 2020 has complicated serving increased demand ever since. The increased demand for cutting edge semiconductors in a wide array of high-performance electronic tools and gadgets has been tough to fulfill. There are other examples. There are serious constraints to growth in specific product categories.

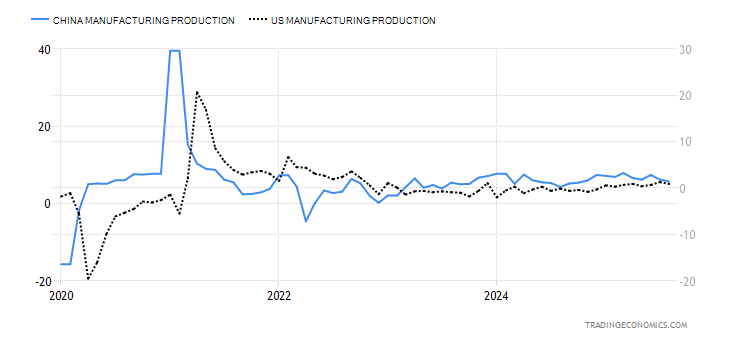

But overall manufacturing production has soared in response to strong demand. In August 2021 (in the midst of the Delta variant’s worst effects) 18 of the G20 nations had increased manufacturing production over the same month in 2020. US manufacturing production remains above where it has been most of this century (see related chart below). There are forward going concerns about cost and availability of energy, especially in Europe and China. Disease penetration and/or disease mitigation measures have reduced productivity in some cases (examples here and here and here). Unreliable flow velocity can upset production calendars, even when sufficient volumes are available. In a system-of-systems distress in one place can complicate every place.

Nonetheless, unusually high demand is usually being fulfilled. Demand has effectively pulled more manufacturing forward. More manufactured products are being pushed toward demand. Preexisting capacity — for both production and movement — is not infinitely flexible. But in many cases, more than one-fifth more is being made and moved than in late 2019. In some cases, additional capacity is being developed.

Deficit and disequilibrium are different. Today’s most challenging supply chain problems are caused by many millions of consumers wanting more than ever before. Abundant demand has generated a flood of supply. This flood has overwhelmed some factory floors, ports, and preexisting freight capacity. A flood creates problems, but it should not be confused with drought.

Coda (October 20)

Derek Thompson concludes America is Running Out of Everything with, “The best solution to the Everything Shortage is to have a policy to make more of just about everything.” Given human desire and capitalist culture, his prescription is well-matched to context. But another possible angle is to want — or at least consume — less. This too would facilitate enhanced equilibrium of supply with demand… and could even craft a more sustainable give and take between the personal and planetary.