Before the war Ukraine was one of the world’s top five grain exporters. According to Deutsche Weld, in 2021 Ukraine accounted for 10 percent of the world wheat market, 13 percent of the barley market, 15 percent of the corn market, and more than half of global trade in sunflower oil.

Since the February 2022 invasion, grain exports from Ukraine have been at least one-third less than 2021. It might have been much worse except for a deal brokered by the United Nations and Turkey to facilitate Black Sea flows.

According to the EU, as of March 2023, “over 23 million tonnes of grain and other foodstuffs have been exported via the Black Sea Grain Initiative. Almost 49% of the cargo was maize, the grain most affected by blockages in Ukrainian granaries at the beginning of the war (75% of the 20 million tonnes of grain stored). It had to be moved quickly to make space for wheat from the summer harvest.”

The 2022 summer harvest was disrupted by the war. According to government sources, as of January 2023, “Ukrainian farms have harvested 49.5 million tonnes of grain from 10.7 million hectares of crops, with the grain yield averaging 4.64 tonnes per hectare.” Final results from the harvest are expected at 51 million tonnes of grain for 2022, down from a record 86 million tonnes in 2021, because of land occupied by Russian forces and lower yields (more).

Of course the war continues — Spring offensives and counter-offensives are pending. Further reductions in planting and harvesting are anticipated (more and more). In April Russia limited extension of the Black Sea flow to thirty days (more and more). Many do not expect the initiative to survive mid-May. Exports by river and rail heading toward Western European markets and ports have also been logistically and politically complicated (more and more and more). Some credible sources suggest that this year Ukraine’s harvest will fall another 37 percent year-over-year to 34 million tonnes. Export channels will continue to be troubled, especially if Black Sea routes are lost.

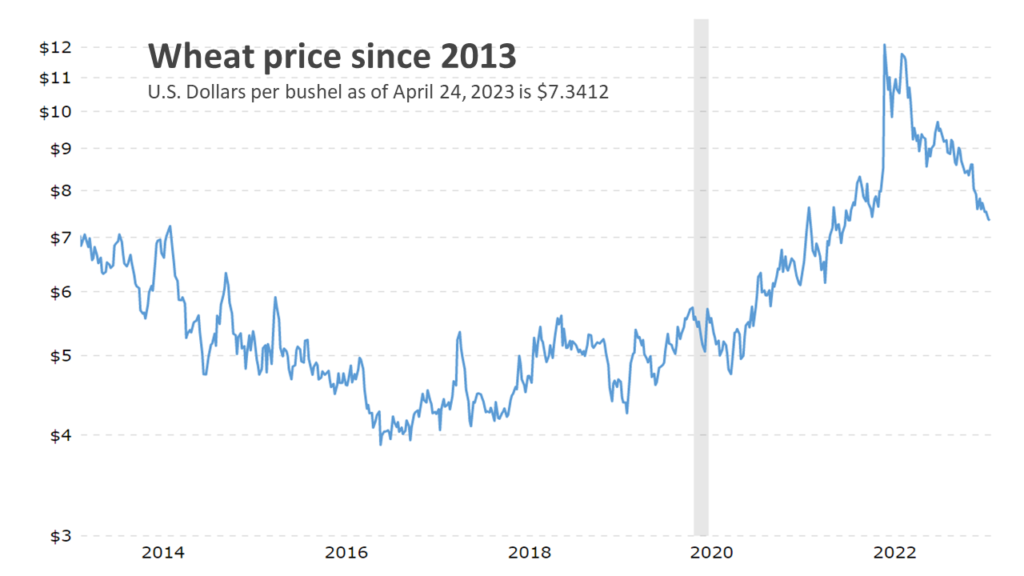

It is very early in the Northern Hemisphere’s planting season. Harvests cannot yet be confidently predicted. Still, the USDA offers, “The global wheat outlook for 2022/23 is for increased supplies, higher consumption, and reduced trade and stocks. Supplies are raised 0.7 million tons to 1,061.1 million, primarily on higher beginning stocks for Syria and increased production for Ethiopia.” Hence the price action displayed below. USDA is not as optimistic regarding corn and rice.

+++

April 28 Update: Javier Blas considers the mismatch of supply and demand for Ukraine’s grain, “Ukrainian grain is badly needed in Europe – just not where is accumulating [e.g., Poland, Romania and Hungary]. Instead, it’s sought after in Spain and Italy, already suffering from a drought, and in the Netherlands, home of a very large livestock industry. But moving it there is difficult.” Blas very helpfully outlines logistical and supply chain difficulties that policy-makers have not — yet — engaged.

Current conditions in Spain and June forecasts for Spain, France, and other parts of Western Europe suggest another hot, dry summer.

Unusually cold weather in Northern China is likely to seriously reduce this year’s harvest of apples and other fruit.

Sudden snowmelt in California threatens planting and harvesting of a variety of crops.

April 29 Update: Nice summary from Bloomberg Green: “Dry conditions are occurring across much of Spain, through southern France and into northern Italy. The eastern and southern Black Sea areas are also stressed, according to the European Drought Observatory. In addition to southern Europe, large parts of Norway, Sweden and Finland are lacking soil moisture. New figures show the US is facing similar trouble. The latest from the US Drought Monitor shows 25.55% of the contiguous US (the 48 states) is in drought. Most of that is in central and lower Great Plains: 81.92% of Kansas and more than half of Texas is in drought.”