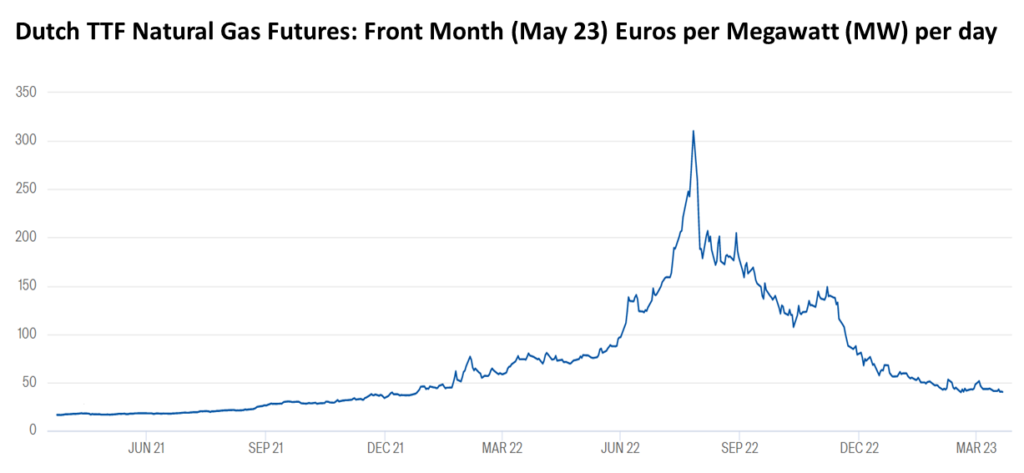

Below is a two year view of a benchmark futures contract for natural gas in Europe. This nicely scopes and scales nervous demand for replacing Russian flows with alternate flows for the winter now behind us.

It went much better than I was expecting last May-June.

In August 2022 more than 300 Euros were required to purchase what was available yesterday for a shade over 40 Euros. That’s an eighty-seven percent drop.

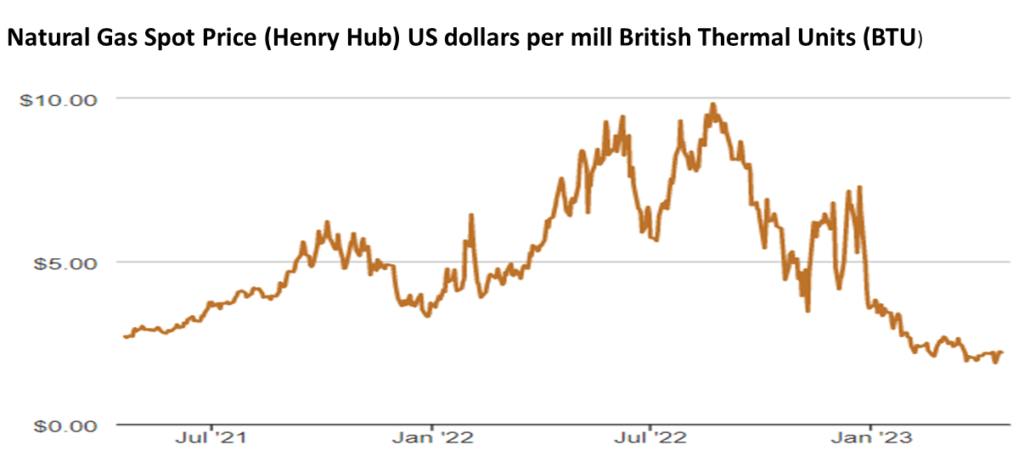

The second chart below is the spot price for natural gas at the Henry Hub (on the US Gulf Coast). The same-volume could be promptly purchased for less in New York or Chicago (Henry Hub pricing is much more export oriented). Seems to me this is the same mountain range as Dutch TTF was traveling, just a slightly different path. Since August we have descended from a high of almost 10 dollars to last Wednesday’s spot price of $2.20. That’s a seventy-eight percent drop.

Last summer might a buyer in Rotterdam be nine percent more nervous than a buyer in Lake Charles? Amsterdam-Rotterdam-Antwerp (ARA) traders have a well-deserved reputation for self-composed discipline. For example, yesterday you could a buy a Dutch TTF February 2024 contract for 55.5 Euros/MW.

I expect European natural gas stockpiles to be re-filled in time for next winter. But I am not willing to bet on next winter being quite so mild… and I expect the war in Ukraine to get very hot (here and here and here). There are plenty of other externalities that I am not as inclined to discount as deeply as my Dutch cousins and Flemish friends.