The expansion of ExxonMobil’s Beaumont Refinery is significant (more and more). After three years of declining US refining capacity, adding a quarter-million barrels per day is helpful.

US domestic demand for refined products is experiencing long-term decline. But ready production capacity needs to be larger than realistic demand capacity — and this ratio has been closing fast, probably too fast. Beaumont’s expansion — and new refineries outside the United States — offer much needed adaptive capacity, constructive for resilient volumes and pricing.

Since the turn of the century, US refining capacity has increased from about 16.3 million barrels per day to just a bit more than 18 million barrels per day (even as real GDP has increased from about $1300 billion to more than $2000 billion). This increased capacity has been achieved despite thirty-three US refineries closing since 2000. There are now 128-to-131 US refineries poised to operate, depending on maintenance schedules.

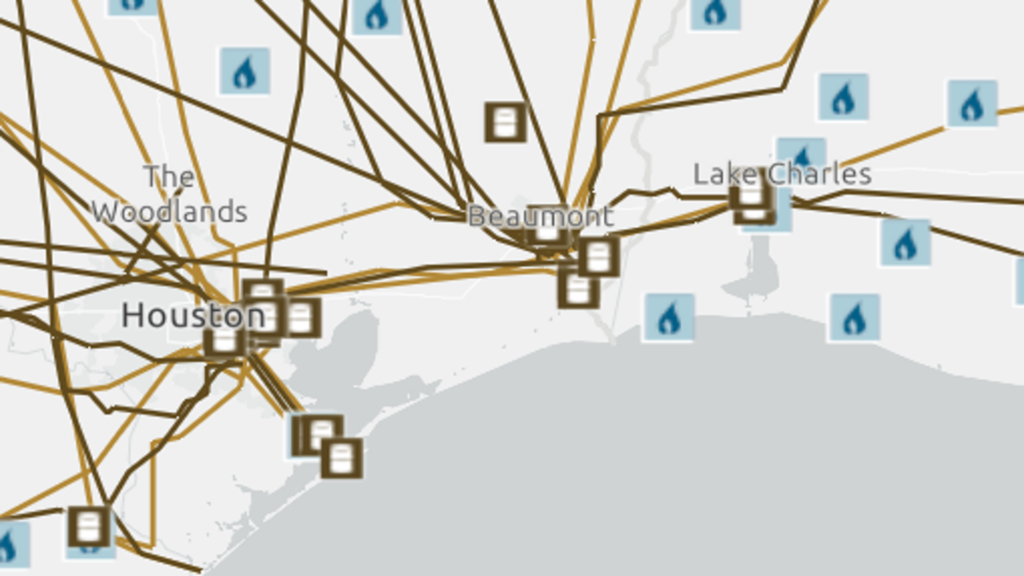

The top-ten percent of the US refinery fleet by capacity can produce close to one-third of total flows. The top twenty percent can generate more than half of total flows. Seven of the largest capacity refineries (plus others) are shown on the first map below. These seven refineries alone represent one-fifth of total US refining capacity… all well-within the well-worn paths of hurricane alley.

On the Pacific capacity concentrations reflect even higher proportions of each region’s flows. Please see the second map below. Four refineries north of Seattle produce most of the fuel on which Western Washington and Oregon depend. The refineries along the edges of San Francisco Bay are as crucial for northern and central California. Refineries in the Los Angeles basin serve Las Vegas, San Diego, and Phoenix too. All these refineries and their related pipelines are susceptible to potentially serious seismic consequences.

The Threats (T) are very real, so are the concentrated Vulnerabilities (V). Given these capacity clusters and population dependence, the Consequences (C) will be terrible when a high-impact threat scores a direct hit on any of these core vulnerabilities (that are usually strengths).

+++

April 28 Update: Valero’s quarterly results provide a helpful window into tight capacity serving robust demand.