It has been about one month since my last update, here we go again:

Southern Hemisphere Agricultural Production: Brazil is poised for a record-breaking soybean harvest, while Argentina’s harvest goes from bad to worse (more and more to even less). Australian yields and export volumes are strong. Ukraine’s outflows have marginally improved, but future flows are profoundly uncertain. US exports are slightly down. (Good global overview from USDA.)

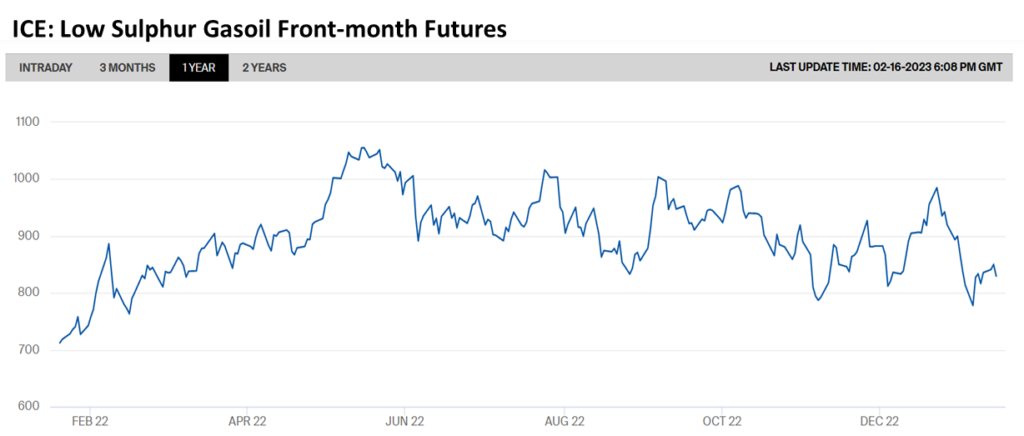

Global Diesel Demand, Production, and Price: The February 5 EU import ban on diesel refined in Russia was widely expected to drain stocks and increase prices. Not yet. Europe bought even more Russian diesel as the ban approached and Chinese exports to Europe have also surged (refining Russian crude?). US diesel inventories have improved since January lows, partially because others have not needed as much as expected (more). European futures have edged mostly higher since February 5, but not really much (see chart below).

Covid Hospitalizations (and mutations): The Lunar New Year holiday has come and gone with plenty of excess deaths in China but no recognized acceleration in mutations or increased virulence.

China’s Export Volumes and Value: Last year was a record-year for China’s exports, but demand cooled considerably in late 2022. According to Trading Economics, “Exports from China slumped 9.9% from a year earlier to USD 306.08 billion in December 2022, broadly in line with market consensus of a 10% fall and following a revised 8.9% drop a month earlier. This was the steepest fall in exports since January-February 2020, amid cooling global demand due to stubbornly high inflation and rising borrowing costs.” Bloomberg economists and others expect reduced demand for China’s exports to persist in the months ahead. Related reporting from the Financial Times, “This month it cost $1,444 to ship a standard 40ft steel container from eastern China to the US west coast at short notice, according to shipping data specialist Xeneta, down from a peak of $9,682 in March last year. The widespread delays and queues, which hit ports at the height of the pandemic, have also dissipated.” (But longer-term shipping costs are still well-above pre-pandemic.)

North American Electricity Supply and Demand: Earlier today the Federal Energy Regulatory Commission ordered improved operational analysis, training, and grid-wide collaboration to reduce the risk of extreme weather to the national electrical grid (more and more). The late December grid crisis caused by sudden weather changes and unexpected shifts in demand across much of the Eastern half of the United States is prompting several efforts at systemic improvement, such as here and here and here and here and here. When this factor was included in these five vital signs, I was not expecting the depth of trouble we have seen this winter. But these hard hits and even more close calls are accelerating mitigation measures.

Two weeks ago the International Monetary Fund released its economic forecast for 2023. Among much more detailed projections, the IMF also offered, “the global economic outlook hasn’t worsened” which many received as good-enough news (more and more). Four months ago when I started monitoring these particular vital signs, I could imagine plausible outcomes much worse than those outlined above. As we move into the Northern Hemisphere’s springtime (wartime?), slightly different vital signs may be more meaningful. But flows of food, fuel, viruses, freight, and electricity are likely to be worth watching in one form or another.

+++

February 17 Update: Helpful complementary round-up on global food flows (and a few other bits) from Bloomberg. European natural gas prices fall to an 18 month — pre-war — low. German supplies of natural gas are in good shape, but there is a concern that demand management efforts are not meeting their objectives… warmer weather has been a much bigger help.

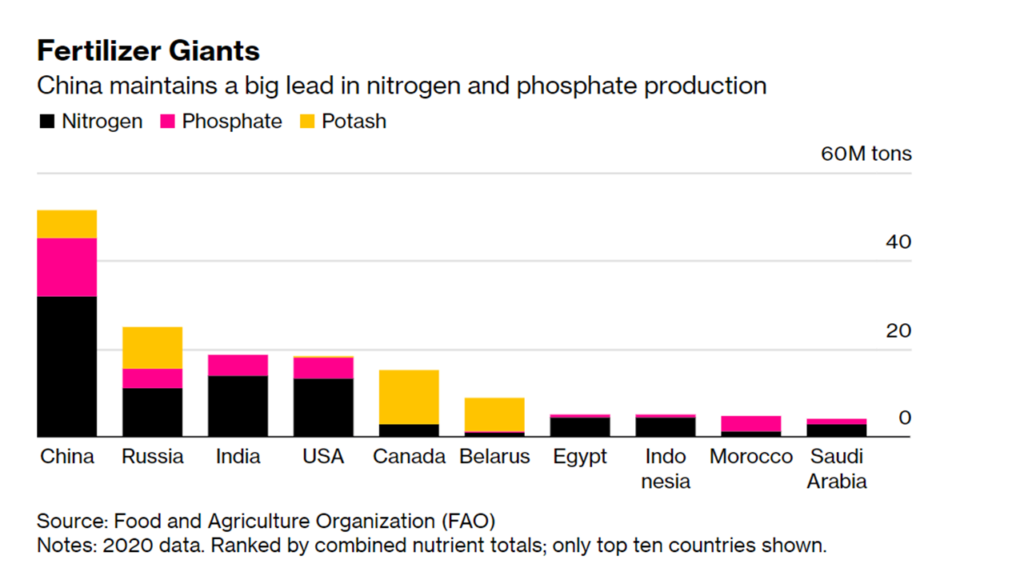

February 20 Update: Bloomberg gives us a “Big Read” on the out-sized role of Russia and China regarding flows of fertilizer.