Last week J.B. Hunt released its 2022 fourth quarter and year end results. The Wall Street Journal reported:

Slowing shipping demand helped push fourth-quarter profit at J.B. Hunt down 17% from the same quarter the year before and revenue growth fell short of expectations as retailers pulled back on inventory restocking and consumer spending sagged during the traditional shopping season heading into the holidays. Operating revenues at the freight bellwether rose 4% in the last three months of 2022 over the year before to $3.65 billion, the company said Wednesday, but freight-related revenues excluding fuel surcharges were off about 3% from the fourth quarter of 2021.

During last week’s analyst call J.B. Hunt’s CEO said, “We have had good signals from our customers about Q2 starting up back to a more normalized or having a more normal environment…” What does normal mean in the context of the US freight market?

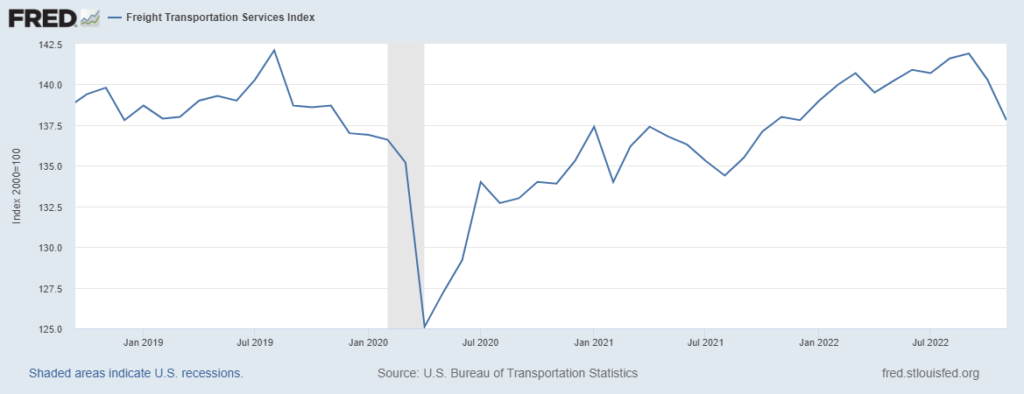

Below is a chart based on a a US DOT freight transportation services index that uses a 2000 baseline (this was updated yesterday through November 2022). After about twelve months of strengthening, the index has experienced sharp losses since a very good September 2022. December will probably continue down… which will bring the index back to its immediate pre-pandemic levels.

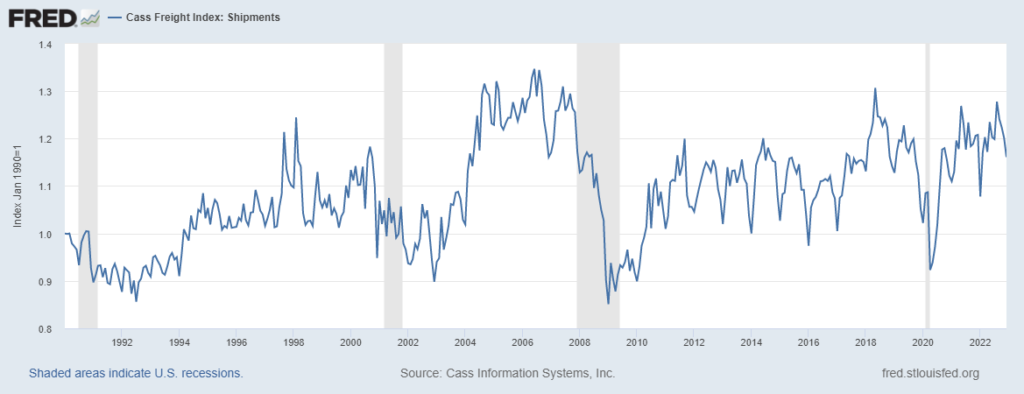

The second chart below is a more narrowly scaled index focused on freight expenditures and volumes captured by Cass Information Systems. This angle of observation combined with the longer duration perspective displayed suggests that if you carry freight, it helps to make friends with volatility. The slope of the current curve over the next three months will matter a great deal. But right now — in the context of the last thirty years — we still have strong flows. Inflation — and especially higher fuel costs — are strength-sapping. But if fuel costs are contained, overall inflation eases, and consumer demand does not crater (lots of ifs there), J.B. Hunt’s hopes for the first half may not be in vain.

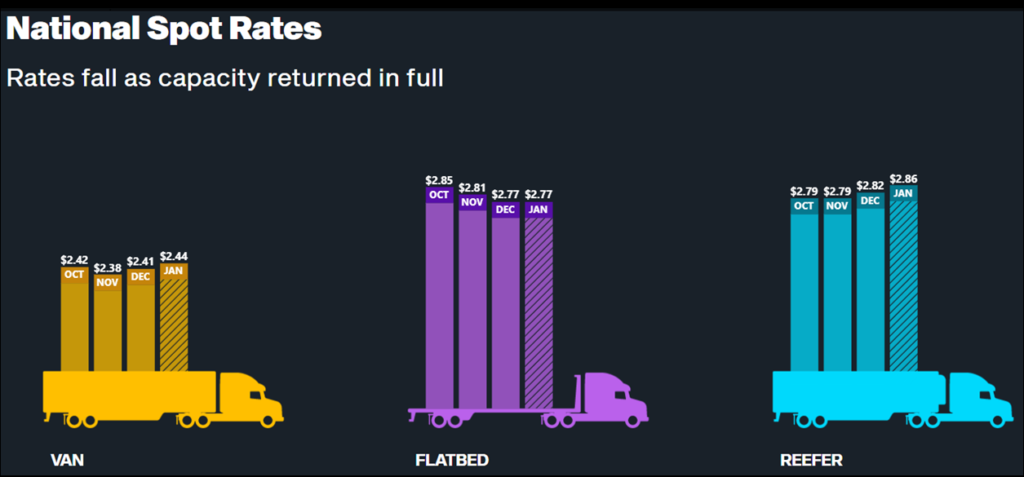

The third chart below may reinforce this vanity. Spot rates (not inflation adjusted) are, at least, not falling as sharply as the index numbers might suggest (more and more). Freight is very responsive to consumer behavior. As always, pull shapes push. This morning FreightWaves is reporting, “Looking at the Outbound Tender Volume Index (OTVI), truckload demand is still anything but reliable as it follows no historical pattern entering 2023. While the situation may have looked better than expected coming out of the holidays, the market appears to still have room to fall for both contract and more so for spot freight.”

If pull begins to increase again, current freight capacity is ready. If pull stabilizes there is likely to be a gradual reduction in top-line capacity. If pull seriously slows, historically there has been a tendency for freight capacity to lag higher and then dive deeper. I don’t have any confidence regarding which way we will go this year. But as suggested by J.B. Hunt’s CEO, by the end of the second quarter we should have a much better sense of direction.