US retail sales growth for March was more than double what many economists expected. The Financial Times reported, “Data from the US Census Bureau published on Monday showed that retail sales, which include spending on food and petrol, rose 0.7 per cent last month. Economists surveyed by Reuters had expected an increase of 0.3 per cent.” It is worth remembering that February US retail sales were not as strong as expected, see chart below. China’s March retail sales were 3.1 percent higher, well below expectations for around a 4.8 percent gain (here and here). EU retail sales data for March are not yet available, but momentum is sluggish (more).

China’s manufacturing output strengthened in March. Export volumes achieved new records, but export values decreased. Some perceive an escalating problem with “over-capacity” characterizing many of China’s key manufacturing sectors (more). Others have argued that China is exporting deflation (here and here). (Might the United States be critiqued for an over-capacity to consume and, thereby, export inflation?) German exports continue below January 2023 levels (more and more). “Total Market Production” in the European Union has basically been flat or falling since the second half of 2022. The data is deeply retrospective, but US real — inflation adjusted — Gross Domestic Product has done very well in the post-pandemic period.

According to the latest US Department of Agriculture’s World Agricultural Supply and Demand Estimate global wheat and rice production is — and is expected to continue to be — abundant for the current year. Soybean production is flat or slightly lower on reduced demand. There is profound hunger in the world, but this reflects insufficient ability to signal demand (e.g. Somalia) and/or distribution problems (e.g., Gaza), not lack of potential supply.

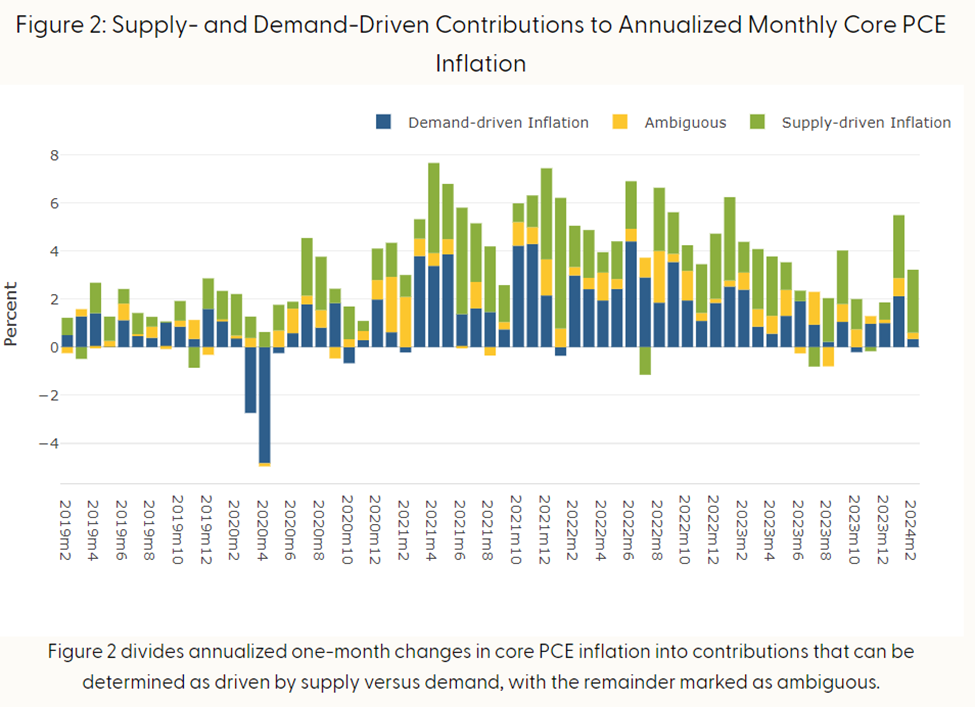

Midstream flows are troubled by volatile — and often higher — fuel prices. Accumulating network friction — such as drought at the Panama Canal and Houthi missiles, drones and more at Red Sea approaches to the Suez Canal — are the cause of cost and delay increases (here and here , but Panama’s precipitation forecast is encouraging). US truck shipments were flat in February (here and here and here). Compared with the last two years and last two months consistently fewer US rail cars are moving. As a result, it makes sense that the supply chain component of core PCE has been increasing (see second chart below). Given continued — even surprising — US consumer demand plus all the midstream pinch points this is healthy adaptation.

You can compare this month’s flow fitness update to last month’s here. I need a bit more time to look at what is happening with both near-term and longer-term energy flows before reaching a fitness judgment regarding those factors.

I worry that the recent pace of US consumer spending is unhealthy. But given weak demand elsewhere, US consumers are arguably the best buddies of the global economy. There are all sorts of potential risks that could suddenly spike (more). But US productivity outputs have continued to be healthy. So… for yet another month pull is motivating push, demand is mostly being supplied. While there is profound uncertainty regarding future trajectories, right now supply chain speed, direction, and resilience are generally positive.

April 18 UPDATE: The Federal Reserve has released its Beige Book for April. After reading the Beige Book reporters at Bloomberg highlighted:

The US economy seems to be weathering the recent spate of supply disruptions with few signs that worrisome inflationary threats or major logistics headaches are returning… Attacks on commercial vessels near the Red Sea and the destruction of Baltimore’s Francis Scott Key Bridge “caused some shipping delays but so far did not lead to widespread price increases,” it said… “Third-party logistics contacts noted that both demand and shipping rates appeared to have bottomed out following what was characterized as an 18-month freight recession.”