In my experience supply chain resilience can more-or-less be assumed if the grid persists and fuel is available. It may be difficult and treacherous, but where electricity and fuel can flow, demand and supply will conspire to keep other flows moving too.

I have long argued that Supply Chain Resilience — as strategy and practice — is mostly about how well volumes persist and push fulfills pull when the grid is gone for an extended time over wide areas. In such circumstances, fuel flows and alternative sources of power spike in substantive and financial value.

The world is in the midst of significant, fundamental energy transitions (purposeful plural). A quarter-century from now the grid and other energy sources will be structured and behave very differently than today. The path between now and then is variable, exploratory, and very risky… especially when and where energy demand is surging. (Not making the transition would entail even greater risk.)

Earlier this week I confessed to needing more time before offering anything meaningful about our current energy fitness. I am trying to discern — and accurately condense — how various fossil fuel dependencies and emerging alternative energy sources can (or won’t) play together in case of major hurricanes, earthquakes, cyberattacks, and other very hard hits on people and places.

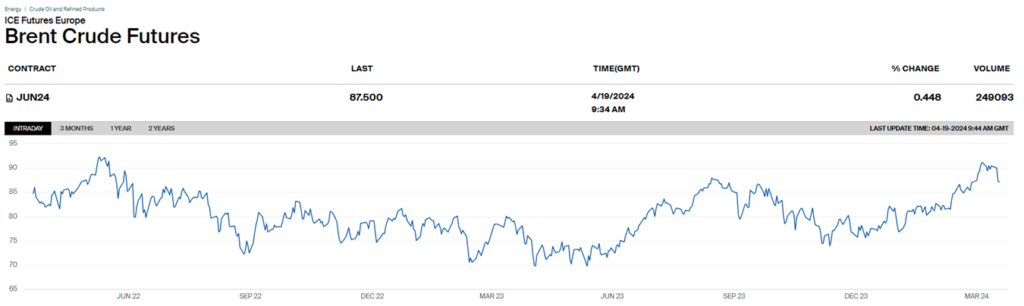

As my quarter-century framing suggests, there are several longer-term speculative issues to engage. There are also nearer-term issues of grid reliability, natural gas availability, velocity of technological adoption, and many other factors to actively observe and try to anticipate. This morning, though, I am fixated on the following chart of trades on Brent Crude future contracts over the last two years and last few hours.

Given our recent and continuing geopolitical context and as someone who cut-my-teeth on the 1970s oil market, I am amazed — thankful and hopeful — but still amazed and edgy at how this morning’s news is reflected in market expectations. I certainly acknowledge that today’s energy system (and geopolitics) is vastly different from a half-century ago. But in the face of this morning’s price action I should also acknowledge deeply discounting just how different (and what this means for Supply Chain Resilience).

This is not a time to discount risk or reality. This is very much a time to engage reality and risk at full value. Much more to come…