If the grid stays on or comes back quick, supply chains almost always persist. When and where the grid is gone and not bouncing back anytime soon (or anywhere close), supply chain resilience quickly becomes fundamental.

Where water, food, fuel, and pharmaceuticals are still flowing while the grid is gone, human suffering can be mitigated. Where the grid is gone and flows have seriously slowed or stopped, suffering and death will be amplified.

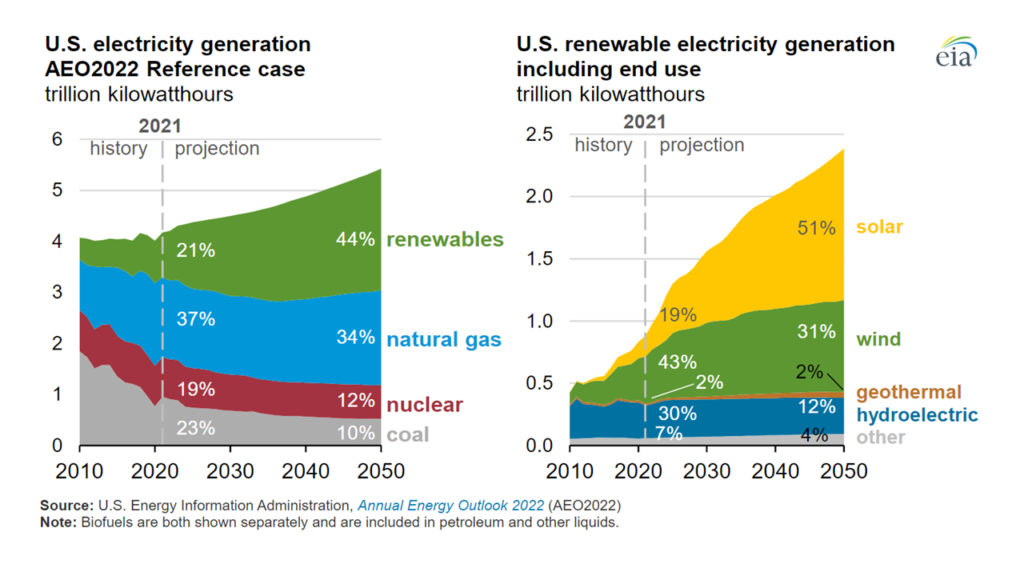

The global grid — including the US network — has undertaken a significant transition in sources and structure. Last year, 2023, the leading sources of US power generation were roughly: 43 percent natural gas, 18 percent nuclear, 16 percent coal, 10 percent wind, 6 percent hydro, 4 percent solar, 3 percent all other. Several projections anticipate this mix to undergo rapid changes in coming years, see chart below.

The financial and technological challenges involved in this transition are considerable. These supply-oriented challenges are super-charged by sharp increases in baseline demand for electricity in some places and, especially, weather-related demand surges (sometimes in the same places).

For almost two decades US electricity demand has been flat. The Energy Information Administration continues to project overall slow growth of about one percent through 2050. But within this general trend are dramatic local differences. Reuters recently reported:

Southern Co expects data centers to propel its electricity sales growth to 6% each year from 2025 to 2028, up from predicted growth of 1% to 2% annually through next year. Sales from its Georgia Power business unit are seen jumping to an unprecedented 9% a year… Executives from American Electric Power, an electric utility based in Ohio, said the company’s retail customer demand grew 2.5% in 2023, much faster than its earlier 0.7% projection, due primarily to the acceleration of data center power use.

On top of these sort of baseline increases, some regions — especially in the southern and western United States — face prospects of volatile demand related to extreme weather (more and more and more and more). For example, according to the Electric Reliability Council of Texas between June 27 and August 10, 2023 the Texas grid experienced ten successive all-time peak demand records as a result of high heat. The more expansive — and populated — these areas of extreme temperature, the more challenging to deliver reliable supplies. (Cold can also complicate, see here and here.)

NERC Summer Reliability Assessments for 2024 will be available next month (related here and here and here).

Meanwhile we already have several indicators of a significant 2024 Hurricane Season. Last week the Weather Channel projected, “24 named storms, 11 of which will become hurricanes and six of which will reach Category 3 status or stronger. That is well above the 30-year average tally for both hurricanes and storms, and also markedly above the tally of 20 storms, seven hurricanes and three Cat 3-plus hurricanes in 2023.” In a similar season forecast, the well-respected team at Colorado State University “predicts that 2024 hurricane activity will be about 170% of the average season from 1991–2020. By comparison, 2023’s hurricane activity was about 120% of the average season.”

We know how tough grid loss can be as a consequence of hurricanes. Grid failure in the immediate advance of a major hurricane could be even worse, seriously complicating warning, preparation, evacuation, and grid recovery.

The energy transition plus increasing demand plus the increased threat of extreme weather will be a risk multiplier for both the grid and supply chains over the next decade and probably much longer.