Nordstream 1 is closed (Nordstream 2 never started). Natural gas continues (rather amazingly) to flow west from Russia through Ukraine to Velke Kapusany then farther along (more and more and more). Current Natural Gas inventories in Europe range from a low of about half-full in Latvia to two-thirds full in Bulgaria to more than 90 percent full in Britain, Denmark, France, and Poland. The EU average for natural gas in storage is hovering around or above 85 percent of available containment.

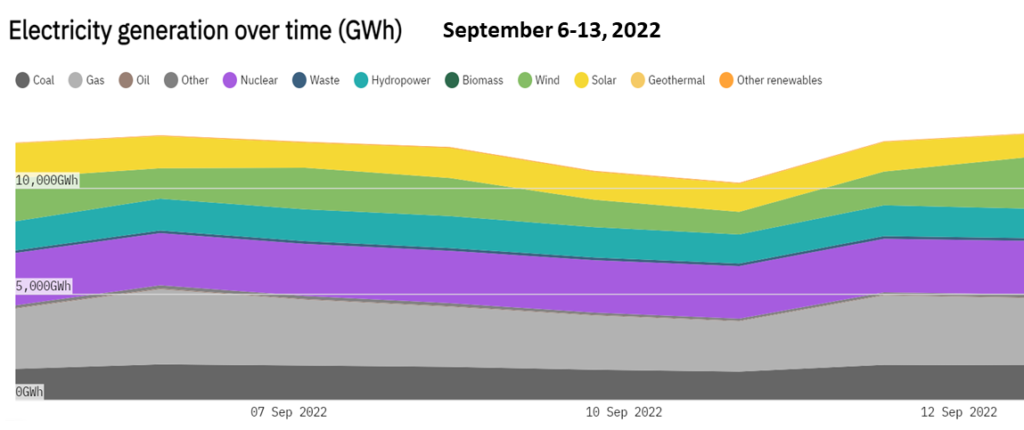

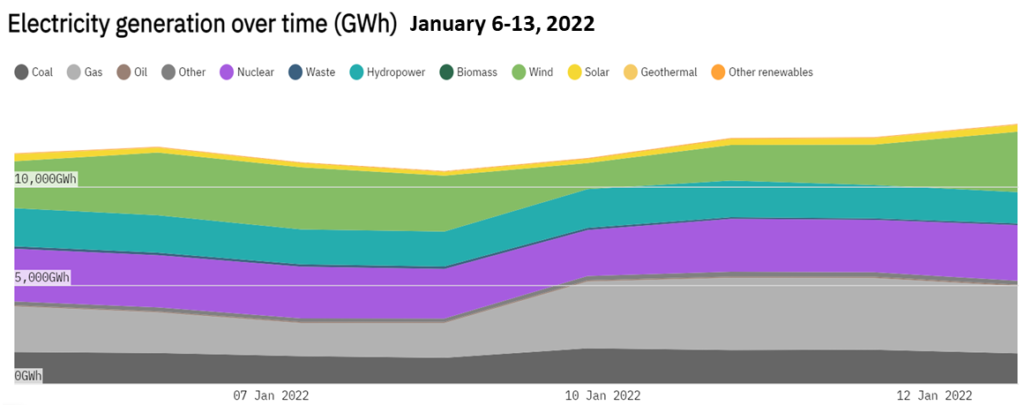

European electrical generation typically depends on natural gas for one-fifth to one-quarter of its energy mix. The need for natural gas is typically (but not always) a bit less in summer (first chart below) and a bit more in winter (second chart below). But core capacity to power the grid is largely fixed, barring major infrastructure changes. With access to Russia’s natural gas now seriously compromised, grid generation this winter will use more coal, nuclear, and non-Russian natural gas (more and more and more). This is the supply-side contribution to a solution (more and more).

The EU is also moving toward an ambitious demand-management effort. (Britain is not.)

Tuesday, September 13, the European Commission proposed:

To target the most expensive hours of electricity consumption, when gas-fired power generation has a significant impact on the price, the Commission proposes an obligation to reduce electricity consumption by at least 5% during selected peak price hours. Member States will be required to identify the 10% of hours with the highest expected price and reduce demand during those peak hours. The Commission also proposes that Member States aim to reduce overall electricity demand by at least 10% until 31 March 2023. They can choose the appropriate measures to achieve this demand reduction, which may include financial compensation. Reducing demand at peak times would lead to a reduction of gas consumption by 1.2bcm over the winter.

Efforts by the EU and its members states to reduce energy consumption began in the weeks following Russia’s invasion of Ukraine. As the summer ended, these efforts have escalated (more and more).

Much will depend on winter weather. As previously noted, for President Putin colder is presumed to be much better.

Both charts above were generated by EnergyMonitor