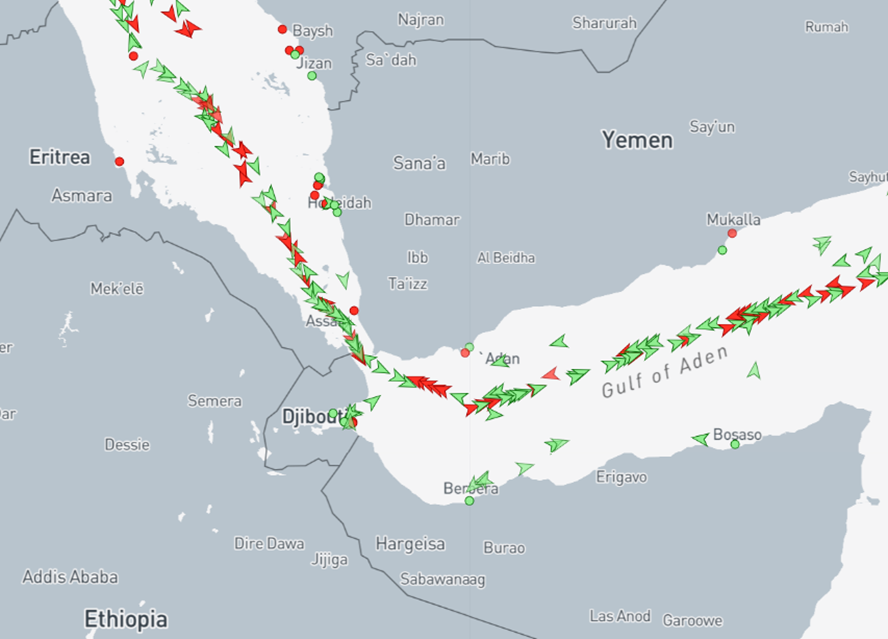

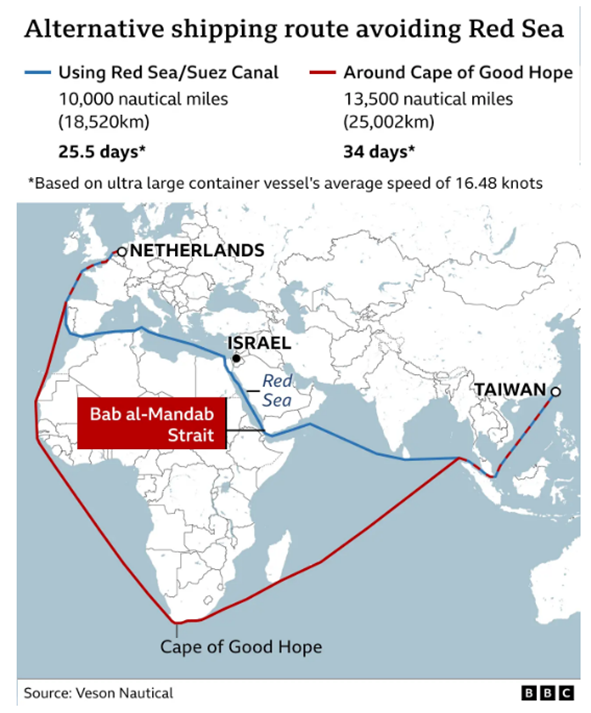

Houthi forces have continued to attack ships passing through the Bab al-Mandab strait (more). A December 31 attack was repulsed by US Navy assets. A Maersk container ship was the intended Houthi target. In response Maersk has, again, suspended operations in the area (see map below). This will result in much longer sailings between East Asia and Northwest Europe (see second map below). Maersk explains: “Following an incident involving one of our vessels, the A.P. Moller – Maersk group (Maersk) has today decided to pause all transits through the Red Sea / Gulf of Aden until 2 January… Maersk Hangzhou was among the first vessels to go through the Red Sea again following confirmation that the multinational security initiatives, Operation Prosperity Guardia (OPG), had been deployed in the area. Maersk is currently working to ascertain the full details of the incident involving Maersk Hangzhou. We are in close dialogue with the OPG naval operation and authorities to assess the security level in the area and any potential impact to our voyage plans.” (More and more and more). Many ocean carriers have indicated they will take the longer route for the foreseeable future (more). January 2 Update: Some updates from S&P Global, especially related to raw petroleum flows.

+++

January 3 Update: Bloomberg has published an extensive Big Read on the Panama Canal’s long-term options. Now and in the near-term Bloomberg reports, “The constraints have since eased slightly due to a rainier-than-expected November, but at 24 ships a day, the maximum is still well below the pre-drought daily capacity of about 38. As the dry season takes hold, the bottleneck is poised to worsen again.”

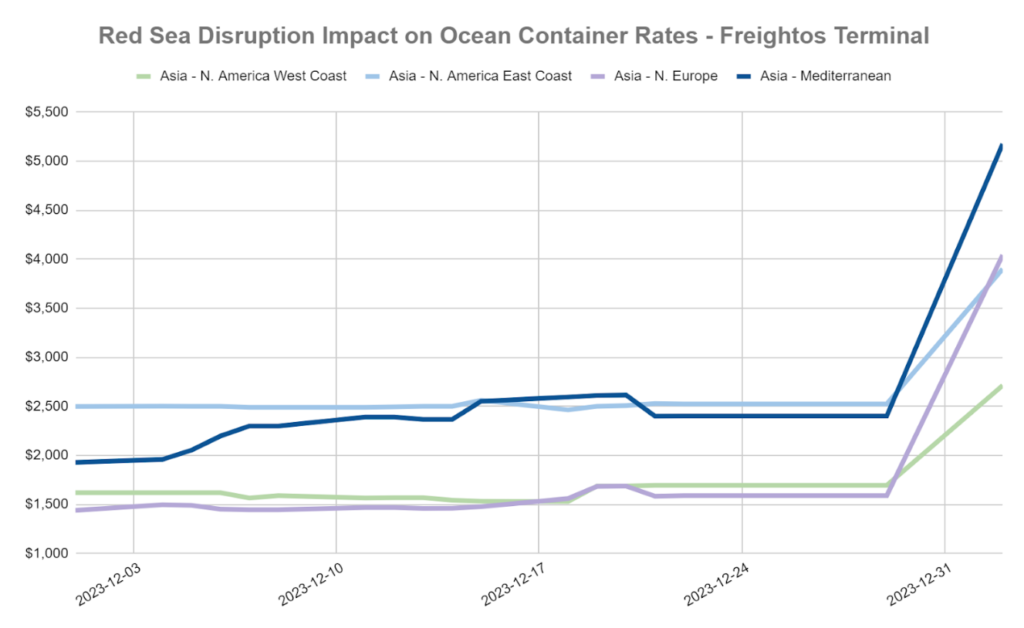

January 4 Update: Freightos is reporting surging spot rates for container shipping. See chart below.