Inflation measures the rate of price increases over time.

Surrounded by demand and supply networks, I experience price increases when demand exceeds supply. The greater the gap between demand and supply, the faster and sharper the rate of price increases.

Mind the gap.

Some inflation is helpful. An emerging gap signals where demand is going. Closing that gap — per time and/or space and/or content — spurs creativity, productivity, investment — the wise effort of consumers, enterpreneurs, and great enterprises.

Narrow gaps suddenly crumbling into yawning chasms are dangerous.

During the pandemic’s first year rapid demand-destruction permanently closed almost 80,000 restaurants, over 10 percent of the sector. Supply far exceeded demand. Early in the pandemic’s third year, high speed swerves in demand have opened sink-holes for some who did fine that first year (e.g. Peloton). Even steep price discounts cannot always stop the slide.

If prices for food, fuel, or other fundamentals rapidly exceed an ability to pay, such vulnerability can unfold into fear. If the gap continues to widen, fear can become hunger. The gap can prompt violence. The more who are unable to cross the chasm, the more suffering… the more fear… the more potential for violence.

Please see the Global Report on Food Crises (2022). Please listen to or read this interview with the CEO of Feeding America. According to the Bureau of Labor Statistics food prices since last April have increased 9.4 percent, the largest 12-month increase since the period ending April 1981.

Even when the threat is not as existential, a quickly widening gap between demand and supply can depress consumption. From a systems perspective, inflation can be understood as a warning signal of excess demand: consumption exceeding production capacity.

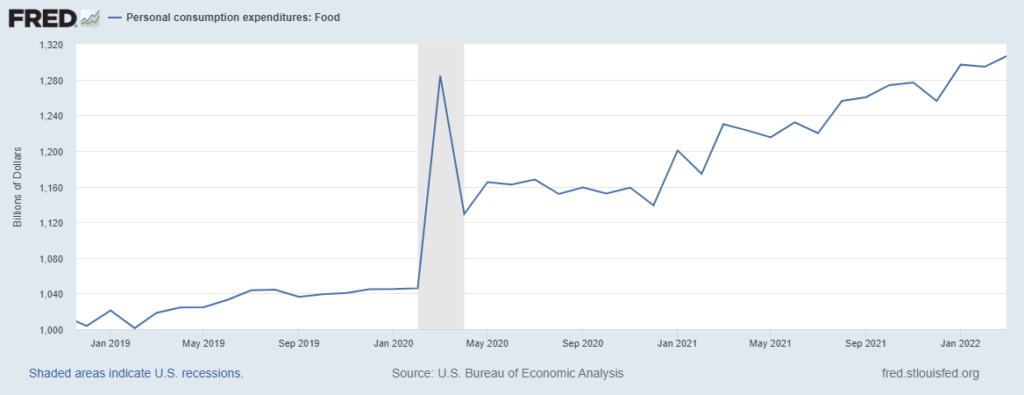

But despite a high inflation rate in March 2022, US Personal Consumption Expenditures continued strong and even grew a bit. Personal expenditures on food were the highest ever recorded (see chart below), even higher than March 2020 hoarding. That March 2020 spike, also known as nervous buying or pantry stockpiling, emerged from the run-up and aftermath of mandated lock-downs. The sustained increase in food expenditures over the next many months reflects increased purchases of Food-At-Home, making up for folks not eating out nearly so much during 2020.

By Spring 2021 Americans started spending about as much on Food-Away-From-Home as we had pre-pandemic — and, yet, our spending on groceries continued to grow (more and more). Subtract food inflation from the overall increase in food expenditures and we still have a double-digit increase one year after we restarted full-scale eating out.

I am surprised. I don’t understand why Food-At-Home consumption has not fallen back to something much closer to pre-pandemic patterns. But, whatever the cause, these data help explain the persistence — even escalation — of food inflation. Sure, there have also been — and will be — supply-oriented inflationary influences. Drought, labor shortages, diesel prices and such have nudged up costs. Increased fertilizer prices will impact this year’s food prices. But a two year ascent in aggregate demand is the principal cause of the gap between demand and supply for food.

Food production capacity has also expanded. The United States is processing more food than ever before. But growth in demand has been even more abundant than growth of supply (more). I assess that today we have a “normal” gap of roughly five percent plus another one-tenth caused by the persistent increased demand for Food-At-Home.

The April Consumer Price Index reports that the rate at which US overall demand exceeded overall supply was the narrowest in twelve months — about one-fourth as fast as March 2022. Is this a trend or just an example of volatility?

The answer will depend mostly on current and near-term US consumer behavior. Many Americans still have an unusually large amount of savings. Employment is very close to its pre-pandemic peak. Wages continue to grow. There are at least 11 million unfilled jobs. This context is receptive to continued strong demand… and an expanding gap between demand and supply… in other words: more inflation.

There is, however, the possibility — unlikely as it may be — that consumers could slightly cut back food expenditures for three or four months. If high earning, well-fed Americans would spend (only) about ten percent more than they were spending in 2019, food inflation would flatten. Demand and supply would approach equilibrium. The gap would narrow. The chasm would almost close. No one would need to lose their food industry job. No one would need to sacrifice taste or even calorie counts. Price increases would slow and might even stop. Similar consumer behavior in other high-demand categories could have similar results.

Prospects for this happening are so improbable, it may seem delusional. But I notice that near the close of the inflation-fighting “Volker Recession” of the early 1980s, food expenditures peaked in October 1982 and then fell for five of the next six months just as record-breaking interest rates fell and the nation pulled out of recession. This sharp turn in food expenditures is unusual both in depth and duration, but the four decade old precedent supports the possibility…

May 12 Update: Overnight a reader sent me this link to Martin Wolf’s Tuesday column in the Financial Times. I had missed it. She comments, “The two of you are looking at the same behavior and perceive similar patterns. You emphasize a positive that is possible, but unlikely. He acknowledges the positive possibility and explains why it is unlikely. The complex adaptive system is self-organizing to create equilibrium. Which will win: your “wise effort” (sammā-vāyāma?) or gluttony?” I very much appreciate the link… and such a careful reader (even between the lines). She asks a meaningful question. The choice she offers would seem to favor Mr. Wolf’s assessment…