During April, diesel volumes via the Colonial Pipeline declined. Mid-Atlantic diesel inventories saw sharp drawdowns (more). US Gulf Coast refiners diverted flows toward higher prices in Latin America and other markets (more and more).

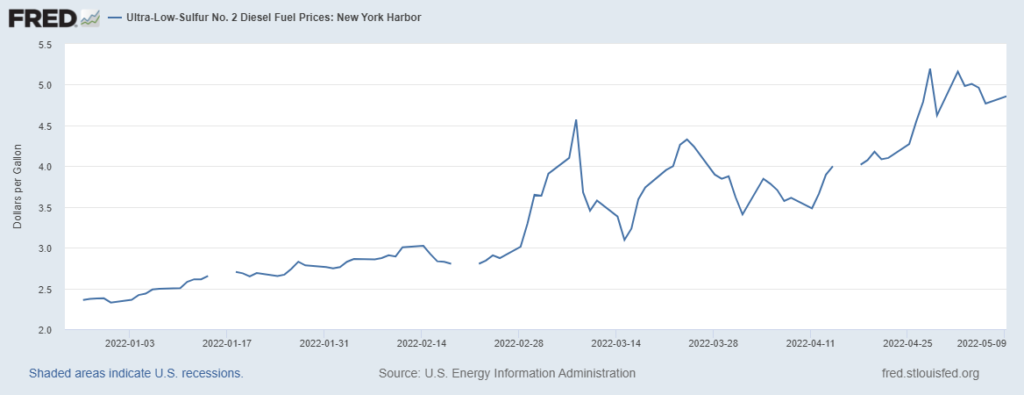

During the last week in April the price of diesel delivered into the New York Harbor market increased from $4.27 per gallon to $5.16 (see chart below). US diesel prices have mostly continued to climb (more). The second chart below is for June futures contracts on NY Harbor diesel.

Meanwhile, Latin American demand has softened. After the end of the trading day on Friday, May 13, S&P Global reported, “Latin American diesel prices are fading from record highs… Waterborne premiums also were falling in the US Gulf Coast, the main source of diesel for the region, and plunged May 13. The premium paid for barges and cargoes compared with the more liquid pipeline assessment had risen to 13.45 cents/gal by mid-April, the highest level in at least seven years. But it was tagged May 13 at pipeline plus 3 cents/gal. Market sources from both sides of the Atlantic attributed the waterborne decline to less USGC cargo demand from Latin America.”

Refining capacity is tight for all products. Global demand is strong for refined product — especially diesel. The US Energy Information Administration recently predicted that US refineries will operate at up to 95 percent of operating capacity for the summer driving season (with about 31 percent of capacity dedicated to diesel). Given constrained capacity, the tendency for push to follow the highest-priced pull is especially strong. New York is much more attractive this week than three weeks ago.

Attractive enough to pump more diesel volume into the Colonial Pipeline?

It is possible to track flows of natural gas in Ukraine’s pipelines (even in war time). Flows of refined product from Greensboro, NC to Linden, NJ and in-between are not as transparent. Colonial typically transports about 100 million gallons of fuel per day. Several have claimed that late April pipeline flows were well below this capacity. How much? I don’t know. I have talked to three old friends who focus on the fuel market everyday. None of them are sure if more is flowing today. But they each independently expect (one offered to bet) that we will all know by Memorial Day. Two of the three perceive that the increased price into NY Harbor will pull enough to meet demand — and even rebuild inventories a bit.

If I was in a different position — say, the Governor of North Carolina’s chief-of-staff, the CEO of a mid-Atlantic chain of truck stops, the Executive VP of a national trucking firm, staff with the National Security Council — I probably would be calling my friends in Alpharetta with some questions. And if I did not have any friends in Alpharetta, I would decide it was time to make some new friends.

New York Harbor June Diesel Futures as of May 15

+++

Special Note: On May 13, S&P hosted a podcast focused on tanker market dynamics since the Russian invasion of Ukraine. Sanctions on Russia have complicated and at least marginally reduced flows of Russia’s diesel into the European market. This disruption and related uncertainties have created new opportunities and widespread volatility, especially for midstream transportation providers. The podcast’s discussion does a good job of framing this context and (for better or worse) allowing outsiders to listen-in while insiders talk through some rather arcane midstream realities.