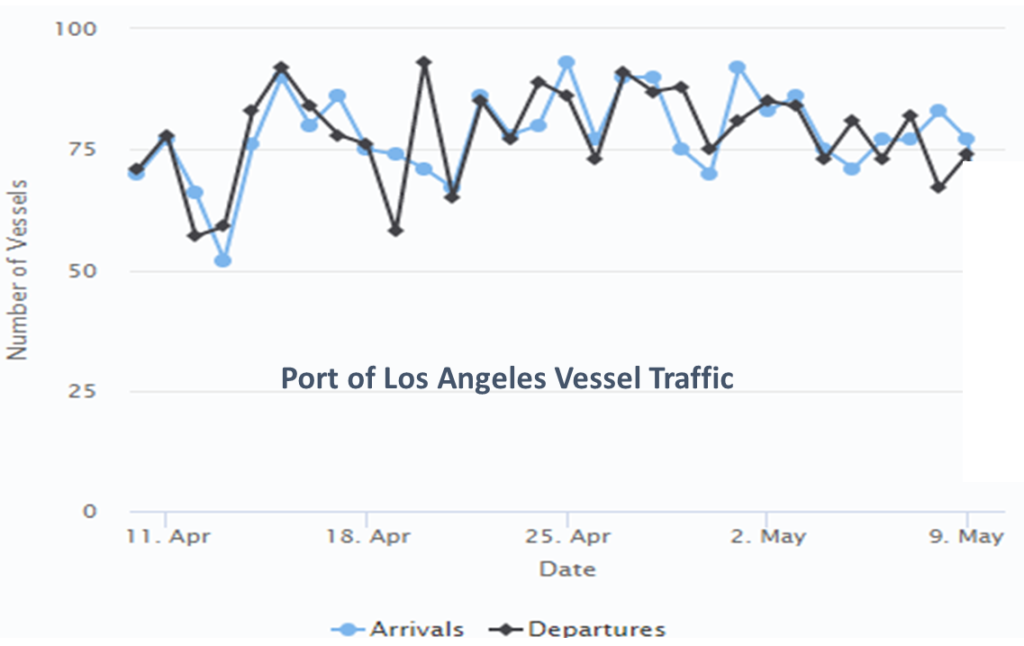

[Updates below] This morning there are 111 vessels at the Port of LA with at least sixty-seven on the way, according to MarineTraffic (see chart below). This is less crowded than last fall, but still plenty congested compared to any pre-pandemic day. On Friday the Executive Director of the Port of LA said April cargo volume had been the second highest on record (last year was higher). He does not see dramatic changes in vessel traffic heading his way from China (more and much more).

Covid-related lockdowns in China have decimated domestic demand, imports are down from oil to soybeans (more). Production is down and very spotty. For example, take steel exports, according to S&P, “In the first four months of 2022, China shipped 18.156 million mt of finished steel, 29.2% lower on the year.” Transportation to and from many major ports is deeply disrupted (very helpful link). Flows between China and North Europe are clearly declining (so is European demand). Prices for trans-Pacific transport are softening (more and more). Upstream drought will eventurally reduce downstream discharge.

And… where there is pull there is often push. So far, Americans are continuing to buy. Purchases of imported consumer goods during 2022’s first quarter were higher than 2021 and well above pre-pandemic patterns. Most of these goods originate in China. Despite crazy covid constraints, steel is still being shipped. China’s aluminum production is strong and exports have increased. While Shanghai is locked-down, Shenzhen has reopened. Over the last month, the number of vessels arriving and departing Shanghai has typically ranged between 1200 and 1500 per day; nearby Ningbo is running about about 600. Yantian (Shenzhen province) serves fewer — but very big — vessels and has seen comparatively normal come and go. Some sources see China’s port congestion slightly easing… There is a drought, but the well is not yet dry.

There are profound problems with China’s recent economic productivity. Prospects for early improvement seem to be dissipating. What started as short-term delays are edging toward systemic demolition of some flows. There have been and will be implications for US consumers (and more). But what will be impacted when and where — and how badly — are not yet clear to me. I absolutely perceive a demand and supply network under severe duress, but I also see surviving demand, surviving capacity, and considerable adaptation. It is plausible to lean toward worst cases. A bit more analytic restraint — and patience — may, however, be prudent.

Totals through midnight on May 8, 2022

+++

May 14 Update: In a long-form detail-rich assessment of China’s economic slowdown, the Wall Street Journal concludes, “The amount of drag China puts on the global economy will depend on how severe the country’s downturn gets. Fortescue Metals and Rio Tinto both said they are optimistic that Chinese demand will recover and some economists are hopeful that ebbing caseloads and government stimulus will propel faster growth later in the year. With Western demand easing, supply-chain strains may not get as bad as they were last year, some analysts say.”

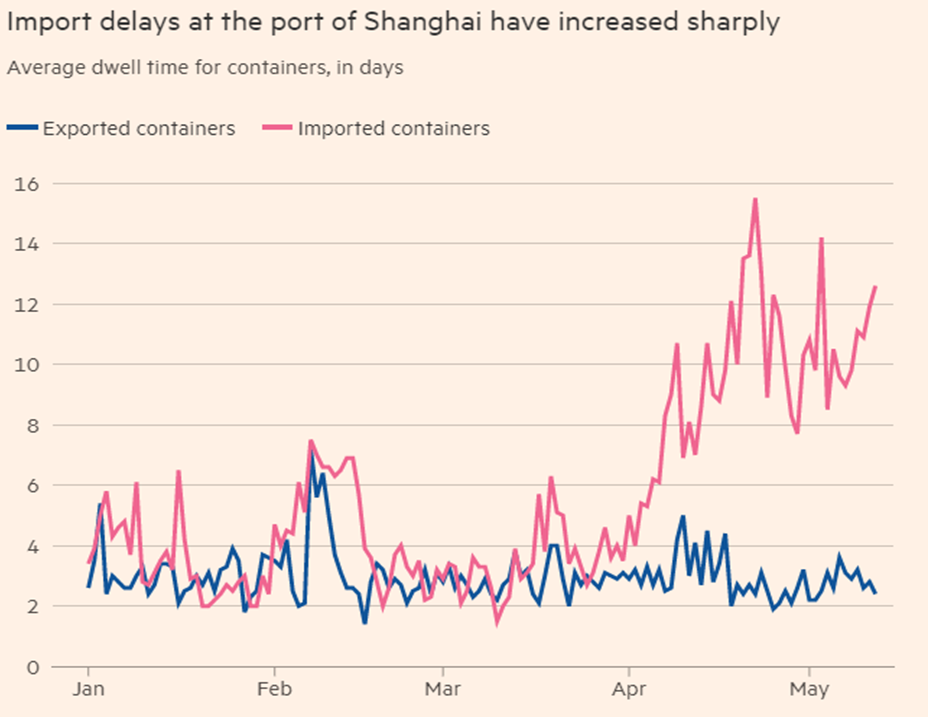

May 15 Update: A Financial Times “Big Read” joins us in looking closely and trying to discern what is happening inside China and with outbound flows. The FT reports profound problems across China, but — so far — reasonably responsive flows still emerging from China. Please see chart below. Shanghai is especially troubled, yet cargo is still being loaded and shipped. Shanghai is important, but there are other — less troubled — ports in China that continue to receive and discharge flows. Other East Asian ports are operating close to normal. The disruption of domestic demand and supply in China does have dramatic consequences for China’s consumers, producers, and mid-stream providers. There are accumulating constraints on fulfilling global demand. Impacts differ category to category and product by product. For what it is worth (and probably not much), I currently perceive that US consumers are unlikely to experience generalized short-falls in China-sourced flows until September-October with the stock-build for Christmas. How big and troublesome these gaps could become will reflect demand and supply variances that I cannot yet confidently predict.

Financial Times and project44 as of May 12

May 16 Update: Economic data released today confirms a contracting China economy. According to Reuters: “Retail sales in April shrank 11.1% from a year earlier, the biggest contraction since March 2020, data from the National Bureau of Statistics (NBS) showed on Monday, a steeper decline than forecast in a Reuters poll. Factory production fell 2.9% from a year earlier, dashing expectations for a rise and the largest decline since February 2020, as anti-virus measures snarled supply chains and paralysed distribution.” (More and more and more.)

May 17 Update: Helpful report on trans-Pacific flows from Bloomberg, including excerpts from an interview with the Executive Director of the Port of LA. Gene Seroka said, “Freight is “finding its way through to the Yangshan deep-sea port and if not, it’s going down to neighboring port Ningbo, which is up 25% over this past two months,” the L.A. port chief said. “We’re watching day and night, but so far, the cargo flows seem to be very consistent.”

May 18 Update: The Financial Times provides a concise overview of demand destruction in China. The unanswered question is: how much does this domestic demand destruction bleed into disrupted global supply capacity? Time-and-space factors are especially unclear. Given calendar and context, is capacity relocating? How much, how quickly? How sharply can capacity rebound? How gradually will capacity rebound? Does cratering demand in China reinforce softening demand in other markets?