According to the US Census Bureau, after strong September retail sales, “Advance estimates of U.S. retail and food services sales for October 2023, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $705.0 billion, down 0.1 percent (±0.5 percent)* from the previous month, and up 2.5 percent (±0.7 percent) above October 2022. Total sales for the August 2023 through October 2023 period were up 3.1 percent (±0.4 percent) from the same period a year ago. The August 2023 to September 2023 percent change was revised from up 0.7 percent (±0.5 percent) to up 0.9 percent (±0.2 percent).”

Bloomberg explains, “Seven out of 13 categories posted declines, led by furniture and car dealers. Gasoline sales weren’t as big of a drag on the headline number as feared considering how much pump prices fell in the month. Meanwhile, outlays increased at personal-care and grocery stores… so-called core goods prices, which exclude food and energy commodities, fell for a fifth month in October. So the decline in retail sales — which aren’t adjusted for inflation — may reflect lower prices rather than fewer transactions.” (More and more and more)

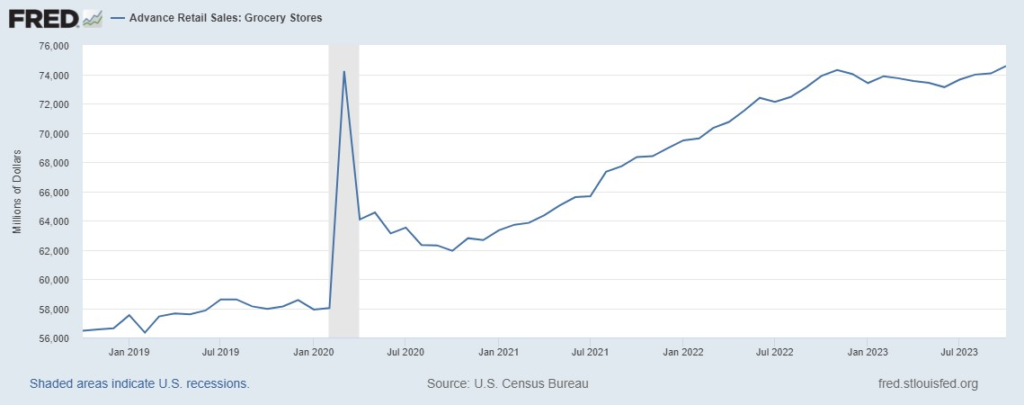

Food-At-Home sales (see first chart below) increased to $73,962 million from $72,726 million in September. Grocery sales are up about 0.9 percent compared to October 2022. Food-Away-From-Home increased from $91,791 million in September to $92,079 million in October. Eating out is up 8.6 percent in compared to October 2022.

Non-store retailers — aka ecommerce — are seeing almost as much Year-Over-Year growth as the restaurant category at 7.6 percent, continuing the power-curve launched early in the pandemic (see second chart below). These non-store retail results motivate consumer-facing supply chains to focus on fulfillment velocity. (Here, the WSJ video emphasizes speed, but please note it is a matter of speedy delivery to particular persons/places.) November 16 Update: There are more than 4600 Walmart stores in the United States, it is not a non-store retailer and, still, for the third quarter just reported online sales increased 24 percent while overall revenue grew 5.2 percent.

Demand is strong while much less volatile than 2020 to mid-2022. In most categories supply is now sufficient to fulfill demand. Prices are moving in a manner coherent with demand patterns, competition, and several months of tighter monetary policy. These are flows well-within the capacity of current US networks.